Nucor Corporation (NYSE:) is set to build a full-range merchant bar quality (MBQ) mill at its bar steel mill located in Bourbonnais, IL. The MBQ mill, which is likely to cost $180 million, will have an annual capacity of 500,000 tons. The project is expected to be completed in two years.

The setting up of the latest MBQ mill is in sync with the company’s long-term growth strategy. The move builds on the company’s position as a low-cost producer to displace tons which are being supplied by competitors outside the region. Additionally, it will strengthen Nucor’s product offerings of merchant bar, light shapes and structural angle and channel in markets in the central United States.

With this project, Nucor will be able to fully utilize the company's existing bar mill’s melt capacity and infrastructure. The project will also take advantage of ample scrap supply in the Midwest region and Nucor’s footprint in the central United States.

Nucor’s shares have lost 2.1% over the past six months underperforming the 11% gain of the

industry it belongs to.

Nucor logged a profit of $268.5 million or 83 cents per share for third-quarter 2017, compared with earnings of $305.4 million or 95 cents it registered a year ago. Barring one-time items, earnings per share for the quarter were 79 cents, which surpassed the Zacks Consensus Estimate of 78 cents.

Revenues increased roughly 20.5% year over year to $5,170.1 million in the reported quarter from $4,290.2 million, but missed the Zacks Consensus Estimate of $5,276 million.

The company expects generally stable and improving market conditions for automotive, energy, nonresidential construction, agriculture and heavy equipment. It is also encouraged by the cumulative benefits resulting from successful trade cases of the domestic steel industry. The company expects earnings in fourth-quarter 2017 to be to be similar to slightly lower from the third quarter, excluding tax benefits recognized during the quarter.

Nucor expects improved performance from the raw materials unit on the back of consistent DRI production. Its downstream steel products unit is also expected to benefit from margin improvement whereas the steel mills unit is expected to suffer a decline due to weakness in plate steel and typical seasonality.

Nucor remains committed to expand its production capabilities and grow its business through strategic acquisitions. It is also seeing continued momentum in the automotive market.

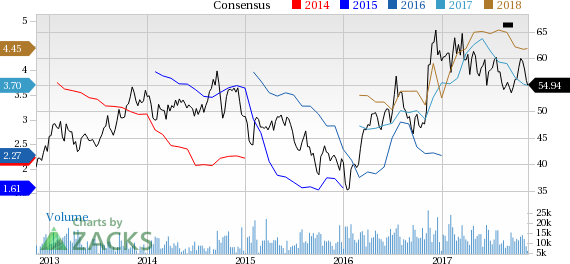

Nucor Corporation Price and Consensus

Nucor Corporation Price and Consensus | Nucor Corporation Quote

Zacks Rank & Stocks to Consider

Nucor currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space are Ingevity Corporation (NYSE:) , ArcelorMittal (NYSE:) and Westlake Chemical Corporation (NYSE:) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has expected long-term earnings growth of 12%. Its shares have gained 33.5% year to date.

ArcelorMittal has expected long-term earnings growth of 11.3%. Its shares have rallied 27.5% year to date.

Westlake Chemical has expected long-term earnings growth of 8.4%. Its shares have moved up 61.8% year to date.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.