- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Northrop Grumman (NOC) Wins $86M Deal To Support Triton UAS

Northrop Grumman Corp.’s (NYSE:NOC) business unit, Northrop Grumman Systems recently secured a modification contract to offer sustainment, engineering, logistics and test support for MQ-4C Triton aircraft mission control and operator training systems. The deal has been awarded by the Naval Air Systems Command, Patuxent River, MD

Valued at $86.2 million, the contract is scheduled to be completed by March 2021. The majority of the task will be carried out in Patuxent River, MD and Jacksonville, FL.

Advantages of Triton UAS Air Vehicles

Northrop Grumman’s MQ-4C Triton UAS is equipped to provide real-time intelligence, surveillance and reconnaissance (ISR) over vast ocean and coastal regions. The system is also equipped with a robust mission sensor suite that provides 360-degree coverage on all sensors, ensuring unprecedented maritime domain awareness for the U.S. Navy.

Triton UAS supports a wide range of missions including maritime ISR patrol, signals intelligence, search and rescue, and communications relay.

Northrop Grumman’s Prospects

Cost-effectiveness compared with manned aircraft and zero mortality, which UAS offers, has been bolstering demand for military drones. This, in turn, has been driving demand for Triton, a next-generation UAS.

During the 2019-2025 period, the global unmanned aerial vehicle (UAV) market is anticipated to see CAGR of 15.5% to $45.8 billion (per a report by Markets and Markets research firm). Notably, rise in the procurement of military UAVs by defense forces worldwide is one of the most significant factors, which might provide a boost to the UAV market.

To date, North America remains the largest market for UAV, driven by increasing use for border and maritime surveillance activities, particularly in the United States and Canada.

With Northrop Grumman being a prominent defense major in the United States and an expert UAV manufacturer, the aforementioned projections for the market should boost this defense prime’s growth substantially.

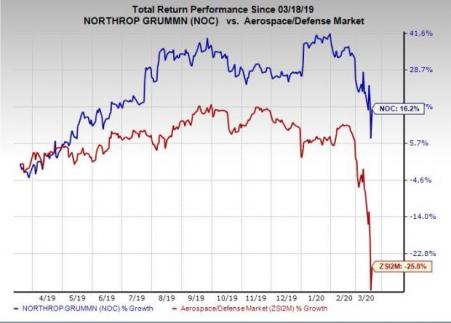

Price Performance

In a year’s time, shares of Northrop Grumman have rallied about 16.2% against the industry’s 25.8% decline.

Zacks Rank & Other Stocks to Consider

Northrop Grumman has a Zacks Rank #2 (Buy). A few other top-ranked stocks in the same sector are L3Harris Technology Inc (NYSE:LHX) , Leidos Holdings, Inc. (NYSE:LDOS) and AeroVironment, Inc. (NASDAQ:AVAV) , each of which carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

L3Harris’ earnings estimate for 2020 indicates an annual improvement of 15.2%. The company surpassed the Zacks Consensus Estimate for earnings in the last four quarters, the average beat being 5.28%.

Leidos’ earnings estimate for 2020 indicates an annual improvement of 8.7%. The company surpassed the Zacks Consensus Estimate for earnings in the last four quarters, the average beat being 11.19%.

AeroVironment’s earnings estimate for fiscal 2020 indicates an annual improvement of 1.7%. The company surpassed the Zacks Consensus Estimate for earnings in the last four quarters, the average beat being 5.72%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

AeroVironment, Inc. (AVAV): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

L3Harris Technologies Inc (LHX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.