- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Nordstrom Plunges 12.2% In 3 Months: What's Pulling It Down?

Nordstrom, Inc.’s (NYSE:JWN) growth strategy is on track. However, higher investments toward occupancy, technology, supply chain and marketing expenses are weighing upon its cost and margin performance for quite a while now.

Shares of this Zacks Rank #4 (Sell) declined 12.2% in the past three months, as against the industry’s growth of 5%. Also, it exhibits a Growth Score of F, which further raise concerns.

Why the Decline?

Nordstrom’s higher expenses have been hurting margins for quite some time. In third-quarter fiscal 2017, the company’s merchandise performance was hurt by higher occupancy expenses related to new Rack and Canada stores. This led gross margin contraction of 12 basis points (bps). Further, its accelerated investments toward technology, supply chain and marketing led to 7.5% (or 161 bps) increase in Selling, general and administrative (SG&A) expenses in the quarter.

In the fiscal second quarter, retail gross profit margin contracted 25 bps with SG&A expenses, as a percentage of sales, increasing 46 bps.

Going forward, management anticipates retail gross profit to be impacted by higher new store occupancy expenses and mix impact from off-price growth in fiscal 2017. Furthermore, the company’s projections for SG&A expenses including higher technology and supply chain expenses related to its growth initiatives, offset by progress in productivity improvements are likely to hurt the upcoming results.

Though Nordstrom’s fiscal third-quarter results outpaced the Zacks Consensus Estimate, it was somewhat hurt by adverse impact of hurricanes, along with the aforementioned headwinds.

Also, the total comparable-store sales (comps) fell 0.9% due to declining comps at full-line stores, which were more than offset comps growth at Nordstrom Rack stores. Net sales at Nordstrom full-line stores (including the United States and Canada full-line stores, Nordstrom.com and Trunk Club) decreased 1.2% in the quarter as well.

Consequently, management lowered the higher end of its previously stated earnings guidance for fiscal 2017 while reiterating sales and comps view. The company now envisions earnings per share in the range of $2.85-$2.95 compared with $2.85-$3.00, projected earlier.

Nordstrom also lowered its previously stated Retail EBIT guidance and now expects Retail EBIT in the range of $755-$785 million compared with $790-$840 million, anticipated earlier.

The hurricanes that occurred in the third quarter are expected to impact sales by $26 million, EBIT by $17 million and earnings by 6 cents per share. Also, intense competition along with the challenging trends in the retail industry might dent the company’s future performance.

Estimates Trend

The Zacks Consensus Estimate for fiscal 2017 moved down by 3 cents to $2.90 in the last seven days. For 2018, it has declined by 11 cents to $2.85.

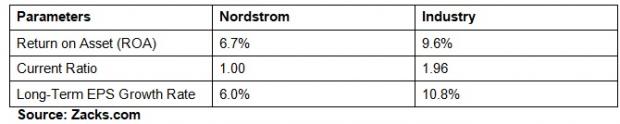

Nordstrom Vs Industry

Growth Strategy Raises Hope

Nordstrom’s growth strategy is boding well for the long term. Additionally, the company is making significant progress with respect to its customer-based strategy and is on track to reach its long-term growth target of $20 billion by 2020.

Management is executing its strategy of enhancing market share through persistent store expansion and strengthening capabilities backed by further investments, particularly in digital growth. With regard to cost savings, the company plans to strike a balance between its sales and expense growth. Evidently, Nordstrom delivered online sales growth of 14% at Nordstrom.com and a 26% increase at Nordstromrack.com/HauteLook in the fiscal third quarter.

Bottom Line

Though the company is facing several difficulties in the near term, we believe Nordstrom will offset these headwinds by its solid strategies and store-expansion endeavors.

Meanwhile, you can count upon some better-ranked stocks in the same industry such as Zumiez Inc. (NASDAQ:ZUMZ) , Boot Barn Holdings, Inc. (NYSE:BOOT) and Canada Goose Holdings Inc. (NYSE:GOOS) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zumiez, with a long-term earnings growth rate of 18% has pulled off an average positive earnings surprise of 27.1% in the last four quarters.

Boot Barn Holdings, with a long-term earnings growth rate of 15.7% has delivered positive earnings surprise of 100% in the last quarter.

Canada Goose Holdings, with a long-term earnings growth rate of 34.6% has come up with positive earnings surprise of 43.8% in the last quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.