- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Nordstrom (JWN) Falls On Q4 Earnings Miss, Issues '18 View

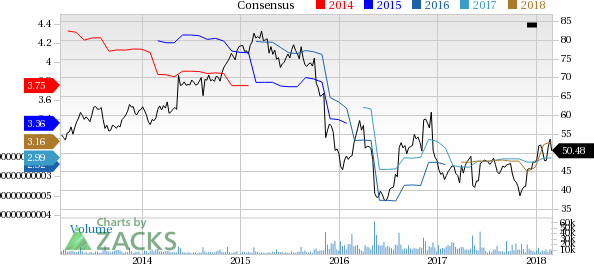

Nordstrom Inc. (NYSE:JWN) reported mixed financial numbers for fourth-quarter fiscal 2017. While the company’s earnings missed the Zacks Consensus Estimate after six straight quarters of beat, revenues surpassed the same for the third consecutive quarter. Also, management provided guidance for fiscal 2018.

Shares of this leading fashion specialty retailer were down nearly 3.6% in the after-hours trading on earnings miss. However, the stock has rallied 6.9% in the last three months outperforming the industry’s gain of 1.3%.

(1).jpg)

Nordstrom’s quarterly adjusted earnings of $1.20 per share missed the Zacks Consensus Estimate of $1.24.

On a GAAP basis, earnings came in at 89 cents per share compared with $1.15 earned in the year-ago quarter.

Revenues

Total revenues advanced 8.9% to $4,702 million, outpacing the Zacks Consensus Estimate of $4,611 million.

While the company’s net Retail sales increased 8.4% to $4,600 million, Credit Card revenues surged 39.7% to $102 million. Furthermore, total comparable-store sales (comps) rose 2.6%. Moreover, the company’s results reflected significant progress on its digital strategy.

Net sales at Nordstrom full-line stores (including the U.S. and Canada full-line stores, and Nordstrom.com and Trunk Club) were up 6.4%, with comps rising 2.4%. Notably, the best-performing merchandising categories were Men's and Kids' Apparel.

Coming to Nordstrom Rack (that includes Nordstrom Rack stores and Nordstromrack.com/HauteLook) net sales advanced 15% while comps increased 3.7%

Operational Update

Nordstrom's Retail gross profit margin contracted 42 bps to 35.6% mainly on account of increased occupancy expenses related to new store expansion for Nordstrom Rack, and in Canada and the New York City Men’s flagship. Further, inventory rose 6.9% while merchandise margin met the company's expectations reflecting persistent momentum in regular price selling trends.

Selling, general and administrative (SG&A) expenses, as a percentage of sales, improved 243 bps to 30.1% mainly driven by increased marketing, technology and supply chain costs related to the company's growth efforts.

Store Update

As of Feb 3, 2018, Nordstrom operated 366 stores in 40 states. These include 122 full-line stores in the United States, Canada and Puerto Rico, 232 Rack outlets, two Jeffrey boutiques, two clearance stores, seven Trunk Club clubhouses as well as Nordstrom Local service concept.

In fiscal 2018, management intends to inaugurate 12 Nordstrom Racks and one full-line store, with plans to relocate one Rack store.

Financials

Nordstrom ended the quarter with cash and cash equivalents of $1,181 million, long-term debt net of current liabilities of $2,681 million and total shareholders’ equity of $977 million.

In fiscal 2017, management bought back 4.6 million shares worth $206 million. Following this, nearly $414 million remained under the current buyback authorization. Further, it does not intend to buy back any shares owing to the possibility of going private deal.

Nordstrom generated $1400 million in cash from operating activities and free cash flow of $383 million in fiscal 2017. Capital expenditures in the year were $670 million. For fiscal 2018, the same is projected to be roughly $740 million.

Guidance

Management issued guidance for fiscal 2018. Net sales are projected in the band of $15.2-$15.4 billion, with comps growth in the 0.5-1.5% range.

Further, this Zacks Rank #2 (Buy) company expects EBIT to lie between $885 million and $940 million, which is likely to be reduced by roughly $30 million due to the revenue recognition accounting changes.

Based on the above iterations, the company now envisions fiscal 2018 earnings per share in the range of $3.30-$3.55, excluding the impact of share repurchases. The Zacks Consensus Estimate for the year is currently pegged at $3.16.

Not Done Yet? Check These Solid Retail Picks

The Buckle, Inc. (NYSE:BKE) has delivered an average positive earnings surprise of 3.8% in the trailing four quarters. Also, the stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Children's Place, Inc. (NASDAQ:PLCE) with a long-term earnings growth rate of 9% has pulled off an average positive earnings surprise of 14% in the last four quarters. Also, the stock carries a Zacks Rank of 2.

American Eagle Outfitters, Inc. (NYSE:AEO) , also a Zacks Rank #2 stock, has a long-term earnings growth rate of 5.5%. Further, it has pulled off an average positive earnings surprise of 2.6% in the last four quarters.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Buckle, Inc. (The) (BKE): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.