- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Non Ferrous Metal Mining Industry Near-Term Outlook Bright

The Zacks Mining - Non Ferrous industry comprises companies that produce non-ferrous metals, including copper, gold, silver, cobalt, molybdenum, zinc, aluminum and uranium. These metals are utilized by a wide array of industries that include aerospace, automotive, packaging, construction, industrial machinery, electronics, transportation, jewelry, chemical, and nuclear energy.

Let us take a look at the three major themes in the industry:

- The Mining - Non Ferrous industry is subject to fluctuations based on changes in global economic conditions and end-use markets. Given that China is a major consumer of metals, the coronavirus outbreak has dealt a severe blow to commodity prices. The only exception being gold that gained on the back of its safe-haven demand. In fact, with the coronavirus pandemic showing no signs of letting up, mining companies are suspending production, slowing project construction or curbing their operations to critical activities as governments are imposing restrictions to contain the outbreak. These production cutbacks will lead to a supply crunch, which will drive metal prices when demand picks up eventually. Stimulus measures from governments will also help lift the industry.

- Mining companies are major consumers of energy with around 50% of their production costs closely linked to energy prices. Thus, lower oil prices currently will drive margins. Meanwhile, the industry has been facing a shortage of skilled workforce that has led to a spike in wages. Moreover, labor-related disputes can be damaging to production and revenues. Since the industry cannot control the prices of its products, it focuses on improving sales volume, operating cash flow and lowering unit net cash costs. The industry participants are also opting for alternate energy sources in order to minimize fuel-price volatility and secure supply. Miners are now committed cost-reduction strategies and digital innovation to drive operating efficiencies.

- The industry players are currently dealing with depleting resources, declining supply in old mines and lack of new mines. Development projects are inherently risky and capital intensive. Demand for non-ferrous metals will remain high in the future given their wide usage in primary sectors, such as transportation, electricity, construction, telecommunication, energy, information technology and materials. Further, demand is on the rise due to requirement from emerging markets, and economic activity in the United States and other industrialized countries. So, there will be an eventual deficit in metal supply that is likely to bolster metal prices, which bodes well for the industry in the long haul.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Mining - Non Ferrous Industry is a 10-stock group within the broader Zacks Basic Materials Sector. The industry currently carries a Zacks Industry Rank #102, which places it at the top 40% of more than 250 Zacks industries.

The group's Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright prospects in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few Mining – Non Ferrous stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

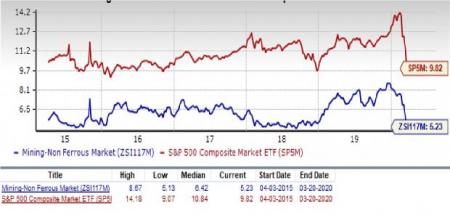

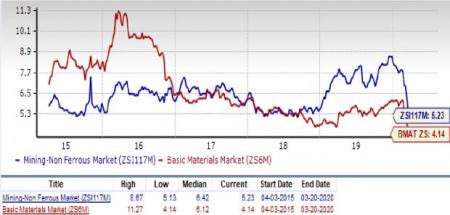

Industry Lags S&P 500&Sector

The Mining- Non Ferrous Industry has underperformed the Zacks S&P 500 composite and its own sector over the past year. The stocks in this industry have collectively declined 45.2% in the past year, while the Basic Materials Sector declined 42.3%. Meanwhile, the Zacks S&P 500 has plunged 20.5% in the same timeframe.

One-Year Price Performance

Mining- Non Ferrous Industry’s Valuation

On the basis of forward 12-month EV/EBITDA ratio, which is a commonly used multiple for valuing Mining- Non Ferrous stocks, we see that the industry is currently trading at 5.23X compared with the S&P 500’s 9.82X. The Basic Materials sector’s forward 12-month EV/EBITDA is at 4.14X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Enterprise Value/EBITDA (EV/EBITDA) Ratio (F12M)

Over the last five years, the industry has traded as high as 8.67X and as low as 5.13X, with the median being at 6.42X.

Bottom Line

While the coronavirus-induced crisis is far from being over, the long-term prospects for non-ferrous metals remain solid. Robust demand from end-use sectors like automotive, aerospace, construction and packaging, among others, bodes well for metals. Additionally, gold and silver have long been considered a hedge against financial or political uncertainty. Overall, the long-term fundamentals of metals remain positive, supported by their crucial role in the global economic development and a challenging supply environment.

We are presenting one stock with a Zacks Rank #2 (Buy) and three stocks with a Zacks Rank #3 (Hold) that are well poised to grow. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

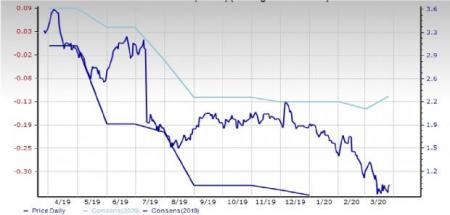

Energy Fuels Inc. (UUUU): This Lakewood, CO-based company carries a Zacks Rank #2. The Zacks Consensus Estimate for the current year earnings indicates year-over-year growth of 70%.

Price and Consensus: UUUU

Arconic Inc. (ARNC): This Pittsburgh, PA-based company carries a Zacks Rank #3. The company has a trailing four-quarter positive earnings surprise of 7.8%, on average.

Price and Consensus: ARNC

Freeport-McMoRan Inc. (FCX): This Phoenix, AZ-based company carries a Zacks Rank #3. The Zacks Consensus Estimate for fiscal 2020 currently indicates year-over-year growth of 600%. The company has a trailing four-quarter positive earnings surprise of 20.6%, on average.

Price and Consensus: FCX

Coeur Mining, Inc. (CDE): The Zacks Consensus Estimate for this Chicago, IL-based company projects year-over-year growth of 108%. The company carries a Zacks Rank #3.

Price and Consensus: CDE

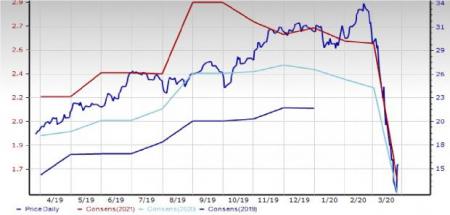

Southern (NYSE:SO) Copper Corporation (SCCO): This Phoenix, AZ-based company has a Zacks Rank #3 and a long-term estimated earnings growth rate of 14%. The Zacks Consensus Estimate for fiscal 2020 earnings has moved up 4% over the past 60 days, indicating year-over-year growth of 10%.

Price and Consensus: SCCO

Southern Copper Corporation (SCCO): Free Stock Analysis Report

Freeport-McMoRan Inc. (FCX): Free Stock Analysis Report

Coeur Mining, Inc. (CDE): Free Stock Analysis Report

Arconic Inc. (ARNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.