- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

No Exit For Now

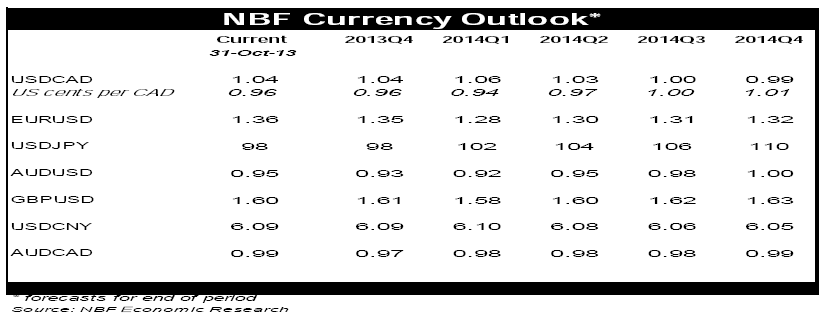

With economic data continuing to disappoint, central banks in the developed world are finding it difficult to exit or even pare back stimulative monetary policies. The tapering of the Fed’s asset purchase program, which until very recently was viewed as imminent, now seems to have been delayed to next year thanks to weak US growth and a deceleration in employment creation. And with economic slack opening up rather than narrowing down in the last couple of quarters, the Bank of Canada finally threw in the towel and abandoned its tightening bias, a feature in its statements for over a year. On the other side of the Atlantic, with credit contraction threatening to derail the recovery, the European Central Bank looks poised to add stimulus rather than withdraw it, more so with inflation continuing to drop. Ditto for the Bank of Japan which has yet to meet its inflation target. We expect Fed tapering to start only in Q1 of next year, something that should allow the US dollar to regain some strength relative to most majors. We have adjusted our near term yuan forecasts to reflect October’s ascent, but have left our other targets largely unchanged.

The Canadian dollar took it on the chin when the Bank of Canada abandoned its tightening bias in October. While the currency should continue to slide towards our end-of-Q1 USDCAD target of 1.06, we remain upbeat about the loonie’s longer term outlook, expecting it to return to stronger than parity with the greenback by the end of 2014.

To Read the Entire Report Please Click on the pdf File Below.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.