- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

NIKE (NKE) Hits 52-week High On Its Robust Growth Strategies

NIKE, Inc. (NYSE:NKE) looks good backed by its growth strategies, strength in international business and the global NIKE Direct business, focus on its Consumer Direct Offense plan along with healthy financials. Though the company is witnessing soft sales in North America, we expect this to be offset by its solid strategies.

Notably, shares of this Zacks Rank #3 (Hold) scaled a 52-week high of $65.07 on Dec 15, though it closed a tad lower at $64.79. The probable reasons for this momentum could be analysts’ bullishness on the stock backed by NIKE’s solid financial strength, historical performances and other growth catalysts.

Per the Statista, the worldwide athletic-apparel market is estimated to increase to more than $200 billion by 2022. This, in turn, might positively impact this leading footwear retailer.

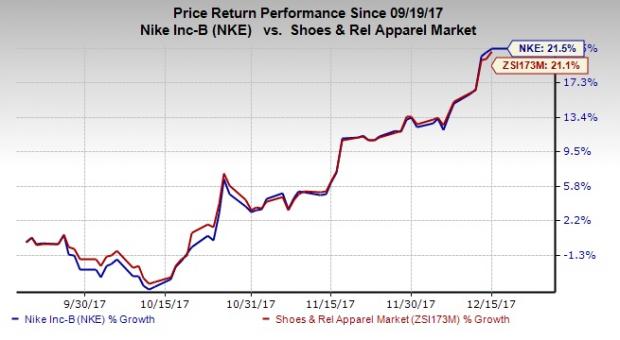

In the past three months, the stock has gained 21.5%, almost in line with the industry’s growth.

Let’s Delve Deep

Growth Drivers

NIKE is a leader in the U.S. footwear and athletic apparel industry. Per the company, it is well positioned to gain from the rise in digital era as it remains focused on strengthening leadership and driving growth through the next phase.

Also, NIKE remains aggressive with focus on its “triple-double” strategy. In this regard, the company has made significant progress on its triple-double strategy focusing on doubling innovation, speed and direct connection with customers.

Meanwhile, the company remains focused on broadening its territory through the growth of e-commerce and NIKE Direct business. Additionally, NIKE is now planning to sell directly to consumers on social media and e-commerce platforms, which is evident from its deal with Amazon.com, Inc. (NASDAQ:AMZN) .

Furthermore, it plans to sell products directly to consumers through Facebook, Inc.’s (NASDAQ:FB) Instagram. We believe these actions will not only broaden the reach but also aid in boosting sales.

In fact, NIKE’s new company alignment — the Consumer Direct Offense plan — focuses on using digital methods for rapid innovation and product development along with strengthening consumer relations by operating through core regions. Through this, the company aims to drive growth by catering to consumers across 12 major cities.

Going forward, the company remains confident of growth drivers like efficient supply chain, enhanced sync between the digital and physical experiences, constant innovations and strategic investments, all of which are likely to bolster long-term shareholder value.

Concerns/ Weaknesses

Lackluster sales trend in the company’s key North American market remains a headwind, owing to the lackluster product assortments, increased promotions due to growth of e-commerce and intensified competition. Moreover, the company’s wholesale business in the region has been negatively impacted by increased focus on online sales. Also, the overall environment is likely to remain promotional in North America, thereby hurting the results.

Additionally, NIKE has been witnessing strained margins for few quarters now. The company anticipates near-term results to be impacted by the tough retail environment, which led to a bleak second-quarter view.

Nevertheless, the Zacks model shows that NIKE is likely to maintain its robust earnings surprise trend when it reports second-quarter fiscal 2018 results on Dec 21. As the company has the right elements for an earnings beat with Earnings ESP of +2.73 and a Zacks Rank #3 (Hold).

Bottom Line

So, let’s wait and see whether NIKE’s solid strategic efforts are likely to counter its near-term headwinds, thereby maintaining its impressive earnings history in the coming quarter.

As of now, you can opt for Deckers Outdoor Corporation (NYSE:DECK) ) which is a better-ranked stock in the same industry. The company has a long-term earnings growth rate of 10.7% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Nike, Inc. (NKE): Free Stock Analysis Report

Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.