- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

First Data Buys CardConnect, Boosts Distribution Footprint

First Data Corporation (NYSE:FDC) has completed the acquisition of peer payment processor and its longtime distribution partner CardConnect Corp CCN in an all-cash transaction.

The company yesterday announced that it will buy all the outstanding shares of CardConnect for $15 per share. The collective transaction amount is about $750 million, encompassing repayment of CardConnect’s outstanding debt and the redemption of CardConnect’s preferred stock.

The announcement of the merger was first made on May 29. The company stated that it will be funding the purchase through a combination of its own funds and existing credit facilities.

The acquisition is anticipated to make a modest contribution to First Data’s adjusted earnings per share (EPS) in the first full year post closing. Better synergies are expected after that.

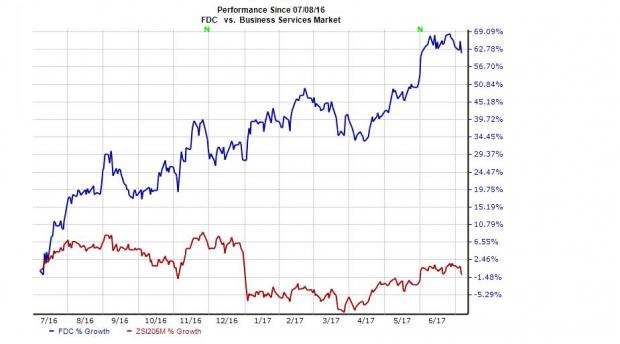

Investors will surely keep an eye on this new deal and its impact post closure to see if it could further boost the ongoing momentum in First Data’s shares. The stock has appreciated a huge 61.4% over the last one year against the Zacks Business Services industry’s loss of 1%.

Focus on JVs, ERP and Integrated Solutions

According to First Data Chairman and CEO, Frank Bisignano, “This acquisition allows us to improve our service offerings for our JVs and other distribution partners, accelerate our integrated solutions strategy, and enter the ERP integration business.”

It appears that with the transaction, First Data is focusing on a three-tier strategy. Through the acquisition, First Data gets access to CardConnect’s $26 billion worth of payments a year from 67,000 merchant customers. This is likely to boost its financial technology capacities.

Moreover, the addition of CardConnect’s invoice-to-cash processing capabilities will open up vast opportunities for First Data in the ERP space and help it better manage cash and other services for clients.

In addition, CardConnect’s Application Programming Interface (API) will offer First Data tools to connect with enterprise clients and their vendor ecosystems.

We expect minimal integration risk given First Data’s successful partnership with CardConnect.

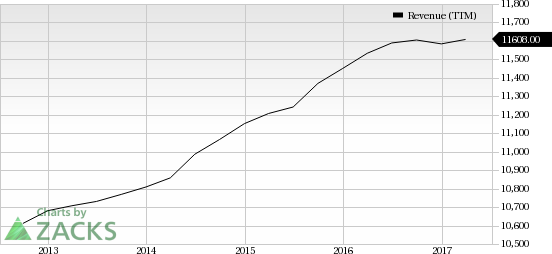

First Data Corporation Revenue (TTM)

CardConnect Eyes Upselling and Cross-selling

Founded in 2006, CardConnect provides payment processing and technology solutions primarily in the United States. The company serves small-to-midsize businesses, related mobile app as well as enterprise-level organizations.

A merger with FirstData will give CardConnect access to its huge customer base and boost up-selling and cross selling. The company will get a considerably larger distribution network.

To Conclude

Bisignano has stressed on collaborating innovative technologies across First Data’s distribution footprint through the acquisition. He expects this integration to enhance service to partners and clients.

We believe that the CardConnect acquisition will help First Data better focus on globalizing its offerings and strategic partnerships along with boosting its business around enterprise clients.

Zacks Rank and Stocks to Consider

First Data currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the broader technology sector include Alibaba (NYSE:BABA) and PetMed Express (NASDAQ:PETS) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings per share growth rates for Alibaba and PetMed Express are projected to be 30.4% and 10%, respectively.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

First Data Corporation (FDC): Free Stock Analysis Report

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

CardConnect Corp. (CCN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.