- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

New Year, Fresh Start For Markets

So, as we say goodbye to 2020—and hello to 2021—we have a new year to consider and hopefully one where COVID-19 becomes a less of news item as the year progresses. But for now, COVID-19 (and the consequences of Brexit for those in the UK), is all we have to work with.

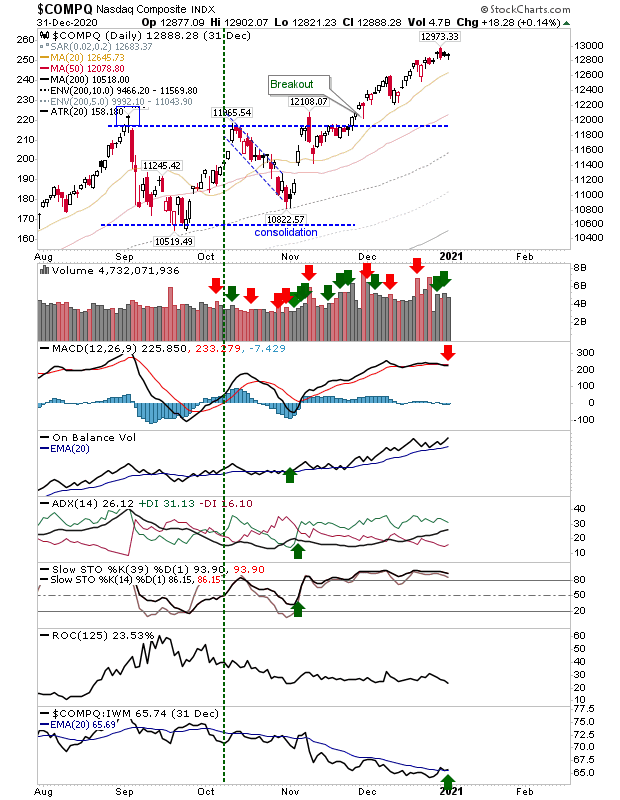

The NASDAQ finished near its highs but did edge a 'sell' trigger in the MACD. Other technicals are net positive with the index improving in relative performance against the Russell 2000.

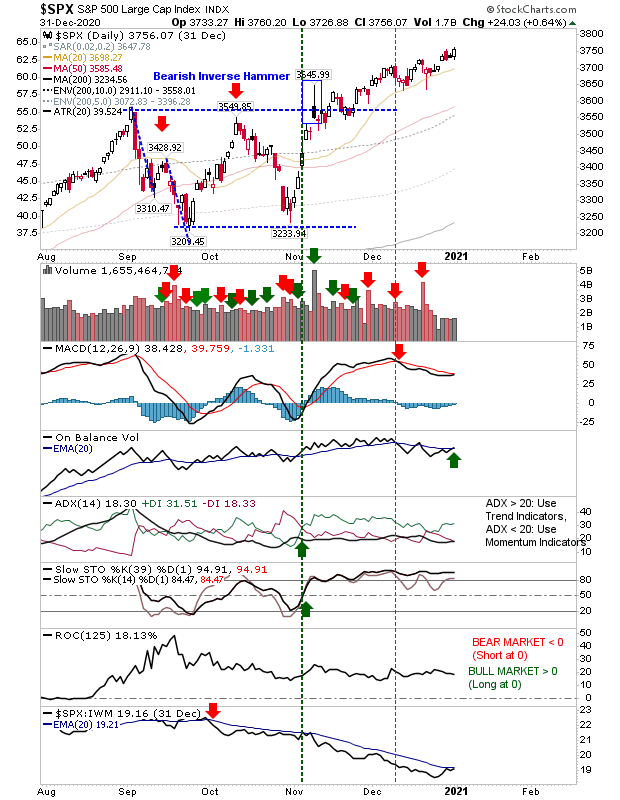

The S&P made one last flourish to close at a new high as On-Balance-Volume enjoyed a 'buy' trigger. It also made inroads against the Russell 2000, but it didn't trigger a new 'buy'.

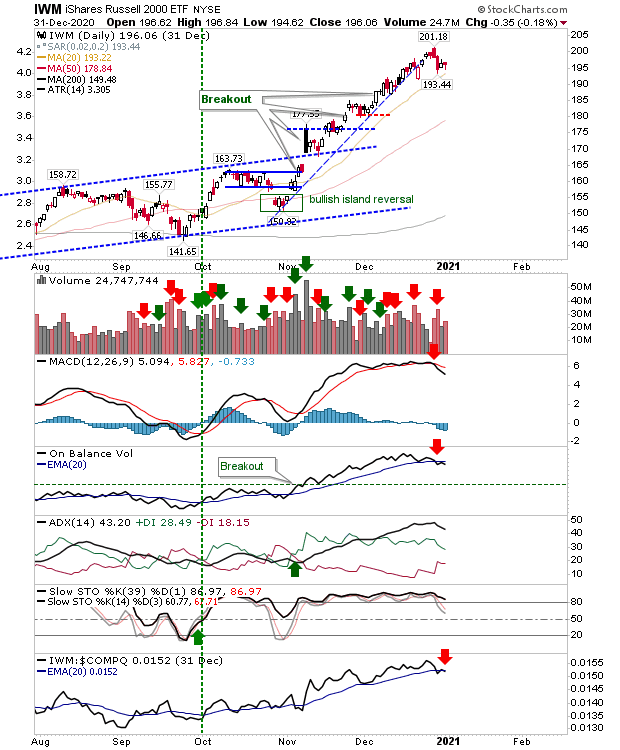

Speaking of the Russell 2000 (via IWM), it had started to crack before the year was out. Some higher volume distribution days came with 'sell' triggers for the MACD and On-Balance-Volume. It's still very close to its highs, and the decline looks more of a pullback from end-of-year profit taking than any panic selling. However, we don't want to see any acceleration to the downside as traders return from their vacations.

Not surprisingly, with trading volume light over the past week, we won't know what the true intentions of traders will be until Monday rolls in. I wouldn't expect too much in the coming week but let's see.

All indices ended the month in the 95% zone of historic price extremes relative to their 200-day MA; often a ripe ground for a swing high top.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.