- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

New Mountain Finance (NMFC) Extends Share Buyback, Stock Up

New Mountain Finance (NASDAQ:NMFC) Corporation NMFC recently authorized an extension of a share-repurchase plan worth $50 million of its common stock. The program will be effective until the earlier of Dec 31, 2022 or until $50 million of outstanding common shares are repurchased.

Shares of New Mountain Finance inched up 1.3% in after-hours trading following the announcement of its extended share buyback activity.

On Feb 4, 2016, New Mountain Finance had authorized a share repurchase of up to $50,000 of its stock. On Dec 31, 2020, NMFC stretched that program until the earlier of Dec 31, 2021 or $50,000 of its outstanding common shares were bought back. The current repurchase scheme is another extension of the same program.

As of Sep 30, 2021, nearly $2.9 million worth of repurchases have been made by the company under its repurchase program. Share buybacks aside, New Mountain Finance is regularly paying out dividends to enhance shareholder value. On Oct 27, NMFC announced the fourth-quarter 2021 common stock dividend of 30 cents per share. The dividend will be paid out on Dec 30 to its shareholders of record as of Dec 16, 2021.

As of Sep 30, 2021, New Mountain Finance had net borrowings of $1.8 billion, significantly higher than the cash and cash equivalents balance of $83.4 million. Moreover, NMFC has a debt/equity ratio of 1.39, higher than the industry average of 0.62. Thus, the sustainability of its capital deployments seems unlikely.

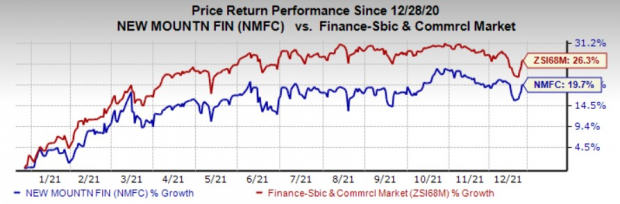

Over the past year, shares of New Mountain Finance have gained 19.7%, underperforming 26.3% growth of the industry it belongs to.

Currently, New Mountain Finance carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Banks Stocks That Took Similar Action

Over the past month, several banks have rewarded shareholders with new share-repurchase programs. A few of these are United Community Banks (NASDAQ:UCBI), Inc. UCBI, Columbia Financial (NASDAQ:CLBK), Inc. CLBK and Cadence Bank CADE.

United Community Banks’ board of directors approved a repurchase of up to $50 million of UCBI’s outstanding shares. The plan will expire on Dec 31, 2022.

The new repurchase plan replaces the previous one, which authorized United Community Banks to buy back up to $50 million shares until Dec 31, 2021.

This plan was announced in November 2020. As of Sep 30, 2021, authorization to repurchase shares worth $34.9 million was intact.

Columbia Financial announced that its board of directors approved the repurchase of up to 5 million shares or 4.6% of its outstanding shares. The plan has no expiry date.

CLBK’s new share repurchase plan was adopted after receiving the no-objection from the Federal Reserve Bank of Philadelphia. The new repurchase plan will be effective following the completion of Columbia Financial’s previous buyback program, which was announced in February 2021.

Cadence Bank announced that its board of directors authorized a share repurchase program for 2022. The board of directors has approved the buyback of up to 10 million shares of CADE.

The new share repurchase program is subject to the approval of the Federal Deposit Insurance Corporation and will be effective Jan 3, 2022. CADE’s buyback plan will expire on Dec 30, 2022.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Community Banks, Inc. (UCBI): Free Stock Analysis Report

New Mountain Finance Corporation (NMFC): Free Stock Analysis Report

Cadence Bank (CADE): Free Stock Analysis Report

Columbia Financial (CLBK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.