- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

NCI Building (NCS) Up 24% In 3 Months: What's Driving It?

Shares of NCI Building Systems Inc. (NYSE:NCS) have gained around 35% in the last three months. The company has also significantly outperformed its industry’s growth of 11%.

NCI Building Systems has a market cap of roughly $1.28 billion. Average volume of shares traded in the last three months is around 612.5K.

The company has an impressive earnings surprise history beating the Zacks Consensus Estimate in three of the trailing four quarters, with an average positive surprise of 9.74%.

Let’s take a look into the factors that are driving this Zacks Rank #3 (Hold) stock.

Driving Factors

NCI Building Systems recently reported adjusted earnings of 32 cents per share for fourth-quarter fiscal 2017 (ended Oct 29, 2017), up 14% from 28 cents recorded in the prior-year quarter. Earnings beat the Zacks Consensus Estimate of 31 cents despite the negative impact of job site disruptions, uneven production flow and increased transportation costs related to the various hurricanes.

For first-quarter fiscal 2018, NCI Building Systems estimates revenues to be in the range of $390-$410 million and adjusted EBITDA to be in the $24-$34 million range. It expects gross margins to improve in fiscal 2018 year due to improvements in cost structure. The company remains confident that fiscal 2018 will be a better year than fiscal 2017. It is poised to gain from success in leveraging IMP (insulated metal panel) product sales to the Components and Building groups. It projects business to improve over the next 12 to 18 months.

NCI Building Systems expects low-rise non-residential construction starts in fiscal 2018 to grow in mid-single digits, with the adjustable markets for legacy businesses projected to be up in the range of 2-4%. The company’s IMP product lines are anticipated to continue growing at a low-double digit rate based on solid underlying demand.

The company is well poised for long-term growth on the back of rising demand for key products and strategic actions. The company is focused on investments in automation and process innovation which will slash operating costs, improve margins, quality and service, and enhance long-term operational flexibility. It will also focus on continued improvement in manufacturing, and delivering cost reductions with the Lean and Six Sigma initiatives across the entire business. The step will reduce excess operational back-office costs and simplify the business. Finally, NCI Building Systems’ focus on growth strategy around IMP and its ability to drive adjacent products across the engines of legacy distribution channels will support the company’s performance.

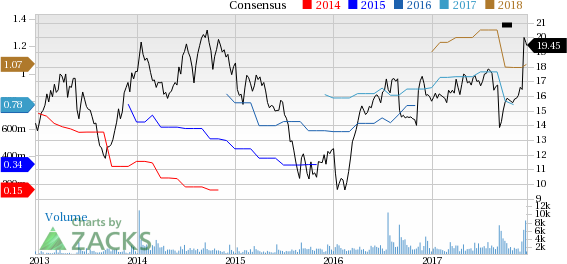

NCI Building Systems, Inc. Price and Consensus

NCI Building Systems, Inc. (NCS): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

Thor Industries, Inc. (THO): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.