- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

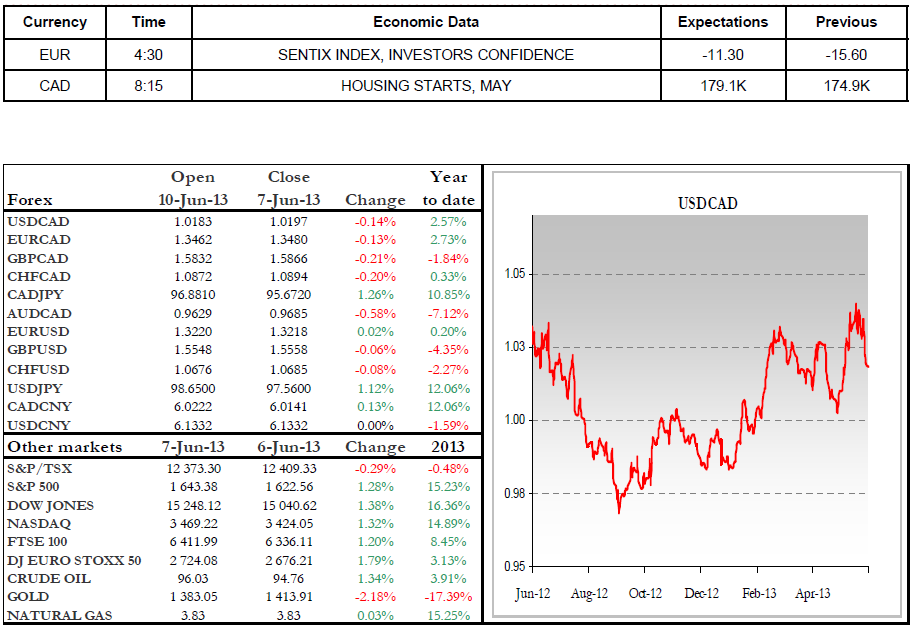

NBC Daily Forex: June 10, 2013

Chinese Inflation and Industrial Production figures for May were announced Monday night, and proved slightly disappointing. In contrast, Japan saw a leap of 4.1% in its annualized GDP for the first quarter of the year. The Bank of Japan's strategy of printing money appears to be hitting the mark. Very early Tuesday, BoJ Governor Haruhiko Kuroda will announce his key rate decision, which could trigger volatility.

Closer to home, Fed officials are pondering a gradual pullback from quantitative easing measures. Many have denounced the program as disrupting markets, and certain indicators seem to bear this out. By purchasing massive quantities of securities, the Fed has driven yields to rock-bottom levels, driving away other buyers. Last week, the repo rate at which banks borrow dipped into negative territory (which had also occurred in the thick of the financial crisis). Essentially, this means that private money market funds must pay interest to banks to lend them money. Needless to say, an excellent reason to invest elsewhere. These distortions are proving troublesome to markets, and may be depriving the economy of precious capital. Should a pullback from quantitative easing measures begin, the greenback would likely take off, making this an area that bears watching closely.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.