- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Natural Resource (NRP) Q4 Earnings & Revenues Beat Estimates

Natural Resource Partners LP (NYSE:NRP) reported fourth-quarter 2017 adjusted earnings of $1.31 per unit, beating the Zacks Consensus Estimate of 99 cents by 32.3%.

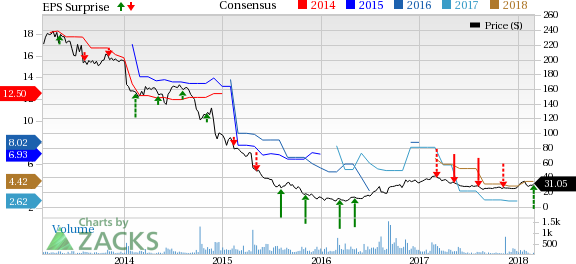

Natural Resource Partners LP Price, Consensus and EPS Surprise

Total Revenues

In the quarter under review, Natural Resource Partners’ total revenues of $101.1 million surpassed the Zacks Consensus Estimate of $90 million by 12.3% and the year-ago revenues by 14.7%.

Segment Details

The Coal Royalty and Other segment’s revenues and other income (excluding gains on asset sales) in the fourth quarter increased 16.6% year over year to $47.5 million.

The Construction Aggregates segment’s revenues in the fourth quarter were $30.6 million, up nearly 10.8% from the prior-year quarter.

Highlights of the Release

In the fourth quarter, coal royalty from Appalachia increased $2.9 million year over year primarily as a result of increased metallurgical coal prices and production. Higher prices and production in this region led to $1.5 million increase from the year-ago quarter in coal royalty revenues in the Northern Powder River Basin. In the Illinois Basin, lower production led to $4.1 million decrease in coal royalty revenues.

Total operating expenses in the reported quarter were down 16.2% to $51.1 million from $61 million in the prior-year quarter.

Interest expenses dropped 17.2% to $19.3 million from $23.3 million in the year-ago quarter.

Financial Condition

Natural Resource Partners had cash and cash equivalents of $29.8 million as of Dec 31, 2017, down from $40.4 million as of Dec 31, 2016.

The partnership continues to lower outstanding debt levels. Long-term debt was $729.6 million as of Dec 31, 2017, down from $987.4 million as of Dec 31, 2016.

In 2017, cash from operating activities was $127.8 million, up 18.4% from $107.9 million in the prior-year.

Zacks Rank

Natural Resource Partners carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of the Peers

Other operators in the Zacks Coal industry are Arch Coal (NYSE:ARCH) , Peabody Coal Corporation (NYSE:BTU) ) and SunCoke Energy (NYSE:SXC) , which surpassed their respective Zacks Consensus Estimate in fourth-quarter earnings.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Peabody Energy Corporation (BTU): Free Stock Analysis Report

Natural Resource Partners LP (NRP): Free Stock Analysis Report

SunCoke Energy, Inc. (SXC): Free Stock Analysis Report

Arch Coal Inc. (ARCH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.