- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Natural Gas: Is La Niña Priced In?

Natural Gas has been bumping along the bottom of its long-term range for most of 2016. Indeed in March of this year, Natural Gas hit record lows of around $1.6 MMBTU’s.(that’s 1.6 million British Thermal Units to us humans. We’ll use BTU’s going forward.) The main reasons were twofold, record high inventories still in storage after the drawdown winter season and the general sell-off in risk that was occurring in markets at the time.

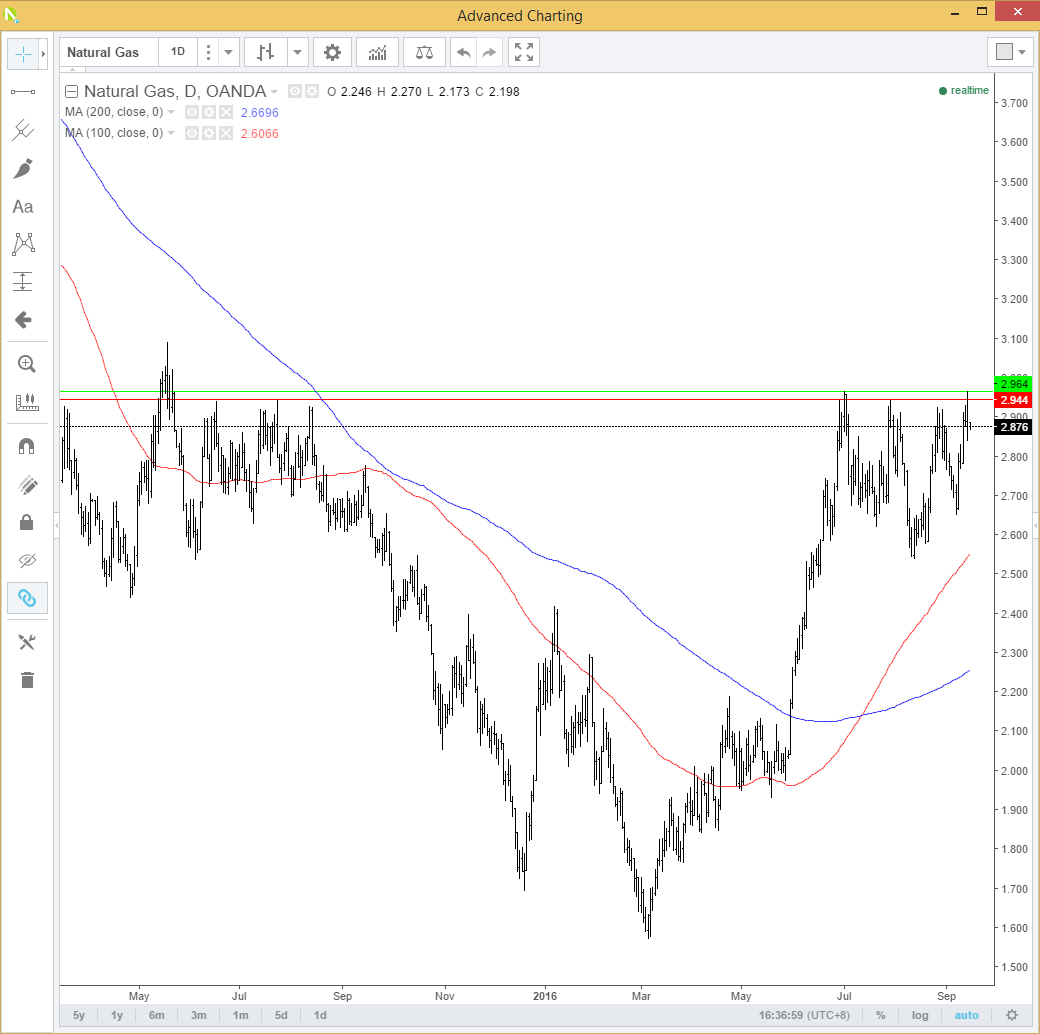

Since then natural gas has climbed steadily throughout the year even as inventories are ramped up again for winter. The chart below shows the daily prices. From a technical perspective, we appear to be marking time before a break higher. Natural Gas is testing a year-long resistance zone between $2.944 and $2.964 BTU’s (denoted by the red and the green lines), with a break opening a move to the $3.1000 initially and then the $3.350 BTU region.

It is important to note though that this is very substantial resistance before everyone hits the buy button on their computers. Additionally, there are other dynamics at work outside the pure world of charting. For example, the main reason for the 3.5% rally in gas sine the lows of March has been El Nino driven warm weather driving up the use of air conditioning. Living in Singapore I empathise, I don’t know what we would do without air conditioning here! America’s need to stay cool has required power generators to generate more electricity meaning they have has to buy a lot more gas than expected.

The world hasn’t suddenly fallen in love with natural gas; it is simply that at record lows, it is cheaper to use by power generators than Coal or Oil. Another thing to note is that natural gas in America is almost entirely and proudly made in America, to paraphrase Donald Trump. Thus, from both the supply and demand side of the equation, it is a closed ecosystem so to speak.

Factors influencing natural gas prices could be listed as,

1. Domestic Supply (i.e., how much has been produced and is in storage)

2. Weather Disruption, e.g., hurricanes. More on this later.

3. Strength of the economy

4. Winter Weather.

5. Summer Weather. America uses more air conditioning.

6. Natural Gas held in storage.

7. Competition with other fuels. i.e., can large-scale users use cheaper alternatives?

Source EIA. Get the full list here. EIA

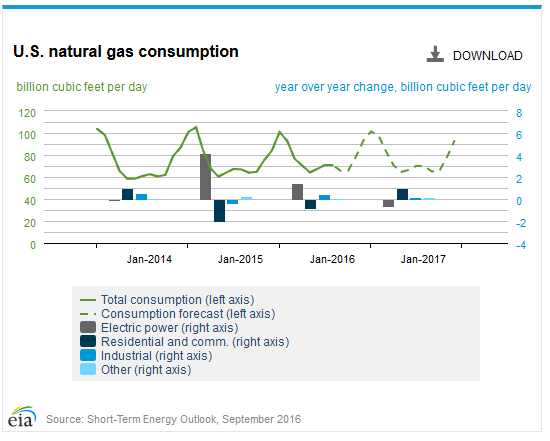

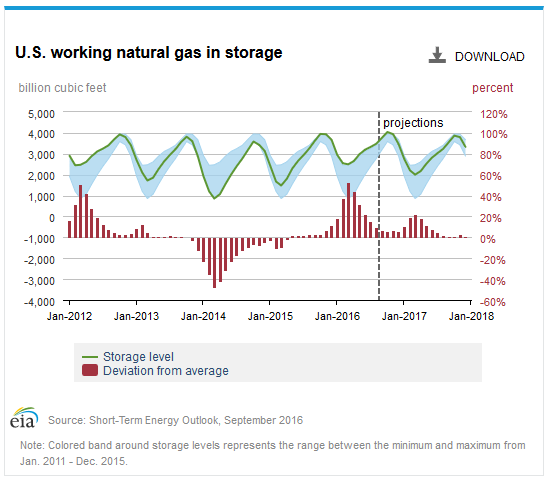

Looking at data from the EIA Short-Term Energy Outlook Report we see that regarding gas stored ahead of winter volumes are increasing in anticipation of the growth in demand on the 2nd chart through the winter months.

Source EIA Short-Term Energy Outlook

This brings us to La Niña. La Niña is in effect El Niño’s little sister. Occurring after the former and bringing the opposite effects weather wise. I won’t go into a lot of detail, needless to say, it tends to make Northern USA winters a lot colder and also increase hurricane activity substantially. (the hurricane season runs from June to November by the way)

Most importantly, going back to points 2 above, it, therefore, can disrupt production via increased cold temperatures in producing areas, hurricanes in others or interfere with the distribution network. It goes without saying that much colder winters in the Northern USA will mean extra more power and heating requirements. One or any or all of the combinations can put upward pressure on gas prices.

Interestingly 5 of the last 7 hurricanes causing over $USD 1 Billion in damages in the USA came in 2008 and 2011. La Nina years. (Source: CNN) However, La Nina does not occur in the same strength each Nino/Nina cycle. The chances of a strong La Nina were 75% in June and have dropped steadily since. Last night the US Climate Prediction Centre announced they had ceased the La Nina watch for this year as their predicted odds of it occurring had dropped to 40% .

This will no doubt disappoint those bullish on gas and be eyeing a break of the technical level noted above. A milder winter with fewer hurricanes most likely places you in a minority, though! Meteorology is an inexact science, though. And the model still suggests a 40% probability.

Summary

Natural Gas has recovered from the record lows in March with a steady 3.5% climb in prices since. We are now abutting a strong technical resistance region at 2.944/2.964 BTU’s with a break implying higher levels. However, other climatic factors induced by La Nina may or may not play their part. A drop in La Nina expectations will make this technical level hard to break for now. But climatic complacency has the potential to prove the doubters wrong. Traders should monitor La Nina developments carefully in case the meteorologists have got it wrong!

by Jeffrey Halley

Related Articles

Brent crude prices continue to face downside pressure as technical indicators and fundamentals hint at further downside. Markets are digesting a host of factors at present and...

Gold Gold (XAU/USD) continues to hit heavy selling pressure on every rally, as we established a week ago. Yesterday we collapsed to support at 2904/00 but longs were stopped...

Energy prices are under pressure amid demand concerns and improving prospects for a Russia-Ukraine peace deal. But tariff risks continue to hit metal markets Energy-WTI Below...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.