- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

National Vision (EYE) Rides On Robust Growth Across All Lines

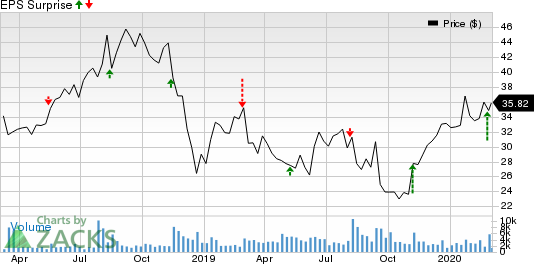

Shares of National Vision Holdings, Inc. (NASDAQ:EYE) rallied nearly 6% since it announced strong fourth-quarter and 2019 earnings results on Feb 26, 2020. The stock reached $35.82 on yesterday’s close.

The company’s fourth-quarter 2019 adjusted earnings per share (EPS) of 11 cents improved stupendously from a penny reported a year ago. The metric also surpassed the Zacks Consensus Estimate of a break-even level. Strong revenues and margin expansion contributed to the company’s bottom line in the quarter.

Full-year adjusted EPS was 81 cents, reflecting a 22.7% rise from the year-ago period. This time too, the metric outpaced the Zacks Consensus Estimate of 54 cents by 50%.

Revenues in Detail

Net revenues in the quarter totaled $401.8 million, beating the Zacks Consensus Estimate by 3.3%. Moreover, revenues rose 12.9% from the year-ago quarter, resulting from comparable store sales and unit growth.

Also, the top line was positively impacted (1.5%) by the timing of unearned revenues, higher eyeglass margin, a higher mix of reimbursed eye exam sales and lower optometrist costs.

Revenues for the year were $1.72 billion, reflecting a 12.2% increase from a year ago. The metric surpassed the Zacks Consensus Estimate by 0.6%.

Strong Segmental Growth

Comparable store sales rose 10.1% in the reported quarter (adjusted comparable store sales growth was 8.1%), primarily led by 9% comparable sales growth in America’s Best and 6.4% improvement in comparable sales in Eyeglass World. Military’s growth was 9.9%, whereas the Legacy segment improved 5.1% in the reported quarter.

Per management, this was the 72nd consecutive quarter of positive comparable store sales growth.

Notably, National Vision opened 8 stores in fourth-quarter 2019 and exited the quarter with 1,151 stores. However, the company closed 2 stores in the reported quarter.

Continued Margin Expansion

Gross profit rose 17.4% to reach $214.2 million. Gross margin expanded 206 basis points (bps) year over year to 53.3% in the quarter under review. Despite escalating operating expenses, adjusted operating margin expanded 442 bps to 9% from the year-ago quarter.

Guidance Issued

For 2020, the company expects net revenues of $1.875-$1.905 billion. The Zacks Consensus Estimate for the same is pegged at $1.89 billion.

Adjusted comparable store sales growth is projected to be 3-5%.

Our Take

Investors seem to be upbeat that National Vision stock will witness an impressive rally in the near term. The company has been witnessing positive comparable growth on increased customer transactions over the past 72 straight quarters. National Vision’s efforts to execute core growth drivers in 2019 buoy optimism. The company is optimistic about maintaining growth momentum at its Legacy segment along with other brands.

In this regard, it reiterated the store count guidance. The company is also steadily progressing with its omni-channel efforts to enhance customer experience and operating efficiency.

However, rising expenses and incremental AC Lens’ contact lens distribution business growth are concerning. The company also anticipates the adverse impacts of inflation.

Zacks Rank and Key Picks

National Vision currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks, which reported solid results this earnings season, Stryker Corporation (NYSE:SYK) , STERIS plc (NYSE:STE) and ResMed Inc. (NYSE:RMD) .

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Its fourth-quarter revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

STERIS reported third-quarter fiscal 2020 adjusted EPS of $1.45, surpassing the Zacks Consensus Estimate by 1.4%. Its net revenues of $774.3 million outpaced the consensus estimate by 3.3%. The company currently carries a Zacks Rank #2.

ResMed, with a Zacks Rank #2 at present, reported second-quarter fiscal 2020 adjusted EPS of $1.21, surpassing the Zacks Consensus Estimate by 19.8%. Its revenues of $736.2 million outpaced the consensus mark by 1.5%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Stryker Corporation (SYK): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

STERIS plc (STE): Free Stock Analysis Report

National Vision Holdings, Inc. (EYE): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.