- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Marriott (MAR) Tops Q3 Earnings Estimates, Revenues Up 10.2%

Marriott International Inc. (NASDAQ:MAR) just released its third quarter fiscal 2016 financial results, posting adjusted diluted earnings of 91 cents per share and revenues of $3.9 billion. MAR is a #3 (Hold), and is down 4% to $68.25 per share in after-hours trading after its earnings report was released.

Beat earnings estimates. The company reported adjusted diluted earnings of 91 cents per share, surpassing the Zacks Consensus Estimate of 90 cents per share and increasing 17% year-over-year. This number excludes 65 cents from non-recurring items.

Matched revenue estimates. The company saw revenue figures of $3.9 billion, matching our estimate of $3.964 billion and growing 10.2% year-over-year. This number includes $168 million related to the eight days of Starwood’s results in the quarter.

Marriott’s acquisition of Starwood Hotels & Resorts Worldwide (NYSE:HOT) closed on September 23, 2016, and at the end of the quarter, Marriott had almost 1.6 million rooms open or in development. During the quarter, Marriott and Starwood together added more than 17,600 rooms, including roughly 1,600 rooms converted from competitor brands and nearly 8,600 rooms in international markets.

Third quarter 2016 adjusted net income totaled $235 million, a 12% increase over 2015 third quarter net income of $210 million.

"Looking forward to 2017, we expect systemwide constant dollar RevPAR for the combined portfolio will be flat to up 2 percent in North America, outside North America and worldwide. Our group booking pace at company-operated North American full-service hotels for 2017 is up 2 percent with about 70 percent of 2017 expected group business volume booked thus far,” said Arne M. Sorenson, president and chief executive officer of Marriott.

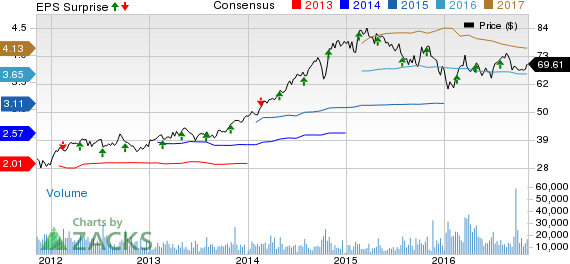

Here’s a graph that looks at Marriott’s price, consensus, and EPS surprise:

Marriott International, Inc. operates and franchises hotels under the Marriott, JW Marriott, The Ritz-Carlton, Renaissance, Residence Inn, Courtyard, TownePlace Suites, Fairfield Inn, SpringHill Suites and Ramada International brand names; develops and operates vacation ownership resorts under the Marriott Vacation Club International, Horizons, The Ritz-Carlton Club and Marriott Grand Residence Club brands; operates Marriott Executive Apartments; provides furnished corporate housing through its Marriott ExecuStay division; and operates conference centers.

Stocks that Aren't in the News…Yet

You are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. Many of these companies are almost unheard of by the general public and just starting to get noticed by Wall Street. They have been pinpointed by the Zacks system that nearly tripled the market from 1988 through 2015, with a stellar average gain of +26% per year. See these high-potential stocks now >>

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.