- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Music Streaming Stocks To Benefit From Virus-Led Lockdown

Increasing usage of smartphones and Internet has resulted in growth of music streaming services. Additionally, rising proliferation of smart speakers and wearables that enable synchronization with music streaming apps adds to demand for such apps.

Per a Statista report, the music streaming market is expected to generate revenues of $12.4 billion in 2020. The figure is expected to rise to $15.5 billion at a CAGR of 5.7% between 2020 and 2024. Further, user penetration in 2020 is expected to be 14.6% and increase up to 6.5% by 2024.

The massive growth prospects bode well for leading music streaming providers like Spotify (NYSE:SPOT) , Amazon (NASDAQ:AMZN) , Apple (NASDAQ:AAPL) and Alphabet’s (NASDAQ:GOOGL) Google.

Music Streamers to Gain from Coronavirus-Led Lockdown

Fears over the spread of coronavirus led to a record weekly slump in the U.S. market last week. However, the market rebounded on Mar 2, following positive comments from the global central banks and a recovery in tech stocks.

Prolific music streaming service providers including Apple, Amazon, Google and Spotify and Siri increased 9.3%, 3.7%, 3.5% and 1.6%, respectively.

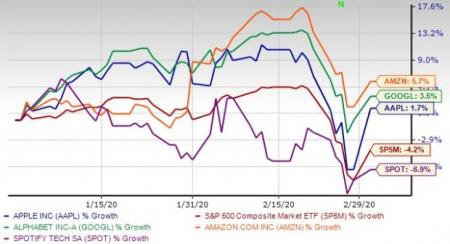

Year-To-Date Performance

Music streamers are expected to benefit from increased usage due to growing speculations of lockdowns in various parts of the world.

Growing Global Penetration: A Key Catalyst

Music streaming service providers are gaining traction worldwide. The United Kingdom has the largest share of music listeners using free and premium streaming services at 83%. The penetration rate in Japan, Canada and Germany is 81%, 79%, and 71%, respectively, according to Nielsen Music’s annual report.

Additionally, the total music streams in the United States spiked 29.3% to 1.15 trillion in 2019 as YouTube and Spotify continued to dominate the industry.

Moreover, in the United States, total revenues from streaming grew 20% to $8.8 billion in 2019, accounting for nearly 80% of all recorded music revenues that increased 13% year over year to $11.1 billion, per RIAA’s 2019 report for U.S. recorded music.

YouTube Dominates Music Streaming Space

Google’s on-demand music streaming service, YouTube Music, is currently available in 77 countries. At the end of fourth-quarter 2019, YouTube achieved $15 billion in ad revenues in 2019, growing 36% year over year, with more than 20 million Music and Premium paid subscribers and over 2 million YouTube TV paid subscribers.

Further, in terms of free music, this Zacks Rank #3 (Hold) company has a free version of its music streaming service in place but is still limited only to Google Home speakers.

Spotify’s Growing Premium Subscribers Poses a Threat

Spotify is benefiting from premium subscriber growth. Its solid focus on the personalization of playlists enhances the music experience for users.

Moreover, robust playlists are helping the company rapidly convert free listeners to paid subscribers. At the end of 2019, the Zacks Rank #3 company reported 271 million monthly active users, with 124 million premium subscribers globally, up 29% year over year.

Notably, Spotify is set to purchase sports and lifestyle company The Ringer, for $200 million upfront with another $50 million later, per a Bloomberg report. The Ringer will bring to Spotify its industry-leading sports and entertainment team, podcast catalog and website, expanding Spotify’s offerings and reach.

Amazon’s Aggressive Stance to Aid Market Position

Amazon’s ad-supported free version of Amazon Music, available on iPhone, Android and Fire TV, is a key differentiator. The offering is expected to help the company reach an audience unwilling to pay a subscription fee to listen to songs.

Moreover, in January 2020, this Zacks Rank #3 company announced that its music streaming service reached more than 55 million customers globally with subscriptions to Amazon Music Unlimited growing by more than 50% last year alone.

Furthermore, solid momentum across Amazon Prime is benefiting the company in music streaming market. Per CNBC, Prime members have access to over 2 million ad-free songs.

Apple’s Position

Apple has been gaining steam in the market with expanding Apple Music subscriber base. Apple currently has more than 60 million paid subscribers.

Further, its availability on Google Play is a major positive. Apple Music’s availability on Amazon Echo devices is expected to expand the iPhone maker’s footprint further in the music streaming space. Additionally, the iPhone maker is gaining from its tie-up with Verizon (NYSE:VZ).

However, Amazon’s free music service poses a significant threat to this Zacks Rank #2 (Buy) company’s market share. It has no free version of Apple Music. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Spotify Technology SA (SPOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.