- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

More U.S. Stock Breakdowns, Panic Out Of Russia

Commentary

If only yesterday’s trading action were reversed.

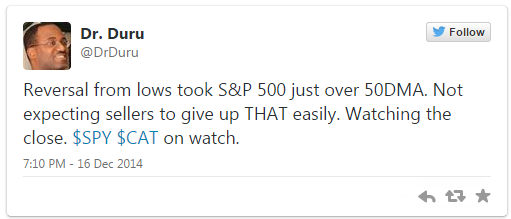

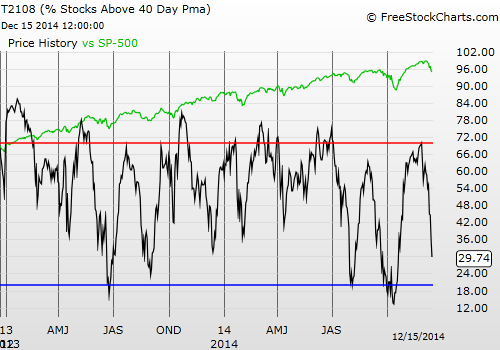

The S&P 500 opened down with the selling lasting only 5 minutes – almost the exact opposite of the previous day where 5 minutes of buying was met by selling until lunchtime on the East Coast. This time around, buyers jumped right into the fray and managed to take the S&P 500 (via SPDR S&P 500 ETF (ARCA:SPY)) above its 50DMA. The peak came right before lunch, and it was all downhill from there. The end result was a -0.9% price performance, an S&P 500 further below its lower-Bollinger® Band and further below the 50DMA, and a T2108 closing at 26.9%…creeping ever closer to oversold conditions.

The S&P 500 goes on a wild ride that ends badly

Without oversold conditions, I still refrained from buying call options on ProShares Ultra S&P500 (ARCA:SSO). The lack of a close above the 50DMA means that I will not buy into any strength today either. Even with a Fed meeting coming in the middle of what is supposed to be a seasonally strong period, the S&P 500 looks all set to retest its 200DMA. At the current rate, such a retest SHOULD occur with oversold conditions. Such a combination would mark a great buying opportunity.

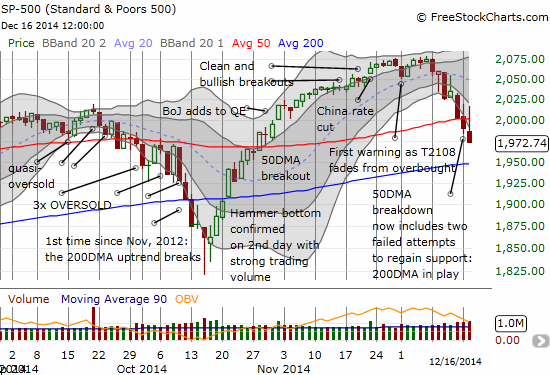

The day's gyrations also meant volatility was all over the place. Given I missed out on buying back into ProShares Short VIX Short-Term Futures (ARCA:SVXY) yesterday, I immediately pounced at the open. The subsequent rise surprised me, and I locked in profits (fortuitously near the peak) – I already have puts options on ProShares Ultra VIX Short-Term Futures (ARCA:UVXY) in play. Just like Monday I set a lower limit order after the sale. This time, it was filled…and eventually I lost two more points on the position. (I had a VERY similar experience trading Apple (NASDAQ:AAPL) options yesterday but I simply do not have time to get into the details!) The volatility index, the CBOE Volatility Index, is now putting on an impressive show of resilience ahead of the Fed meeting.

The VIX is officially surging toward previous glory

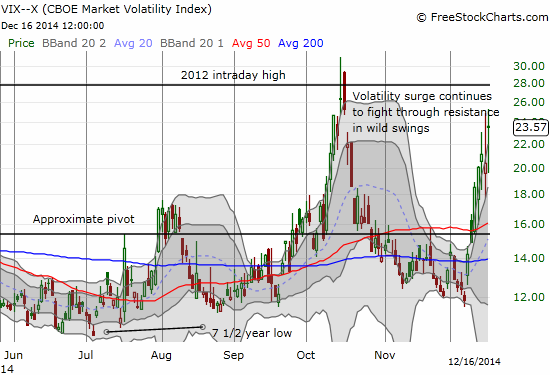

The narrative that has become embedded in media headlines is that the market is now declining because of or along with Crude Oil. Funny thing happened on the way down yesterday…oil made a major reversal and closed UP in a rare display of strength.

A rare display of buying interest in PowerShares DB Oil ETF (PowerShares db Oil Fund (NYSE:DBO)) as oil makes a major reversal on the day

The entire oil patch was hopping with large upward moves…of course just mirror images of prior large DOWNWARD moves. For example, here is Linn Energy, LLC (NASDAQ:LINE), an oil company that I am watching closely only because an author on Seeking Alpha made a spirited defense of the company. Amazing how many articles I have seen throughout this sell-off arguing for bottoms and buys of a lifetime; it has made me think that a bottom is still very far off! For a great example, you can just check out the headlines for LINE articles.

Linn Energy, LLC (LINE) surges 28% off its gut-wrenching lows…and is STILL less than 50% of its value just 2 1/2 months ago!

Nothing says “collapse” better than a chart like this!

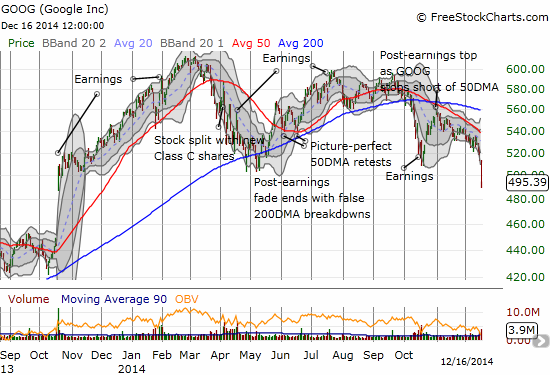

While oil was finally getting some buyer interest, Google (NASDAQ:GOOG) experienced a MAJOR exit. The stock sliced right through $500 and closed with a 3.6% loss…on no fresh headlines I could discern. So not only has GOOG completed a post-earnings round trip but it also is at a fresh 52-week low. The stock even looks ready to fill its major gap up from October, 2013 earnings!!!

GOOG suffers a MAJOR breakdown

Of all the non-commodity related breakdowns I have seen, this one is perhaps one of the most troubling. It will be VERY hard for GOOG to recover from this. I bought some speculative calls just on the likelihood for a dead cat bounce back to the lower-Bollinger® Band.

Amazon.com (NASDAQ:AMZN) also suffered a similar loss that confirms 50DMA resistance with an exclamation mark. Given GOOG’s major breakdown, I am doubting AMZN will find much support at its post-earnings low. Given the bearish outlook I noted last week, I came into this continuation selling prepared with put options.

Rejected from its 50DMA, Amazon.com (AMZN) seems headed for a retest, and eventual violation, of its post-earnings low

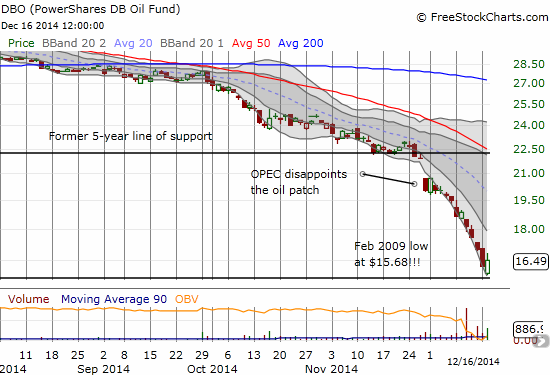

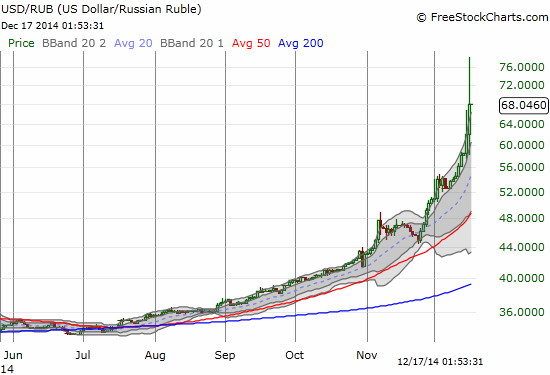

Of any and all charts I saw yesterday, Russia’s drama was the most spectacular. It looks like the country is headed for a second economic collapse in less than 20 years.

The U.S. dollar goes parabolic against the Russian ruble. Wowza!

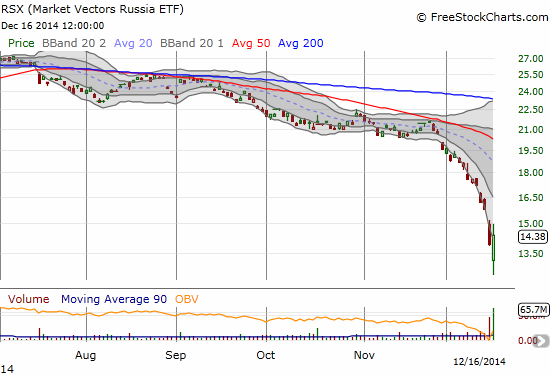

The Russian ruble lost as much as 25% against the dollar from Monday’s close of U.S. trading. This happened in the wake of a second massive rate hike that sent Russian rates to 17% from last week’s hike to 10.5%. The currency did eventually reverse off the extremes. The action was just as dramatic in Russian stock indices with Market Vectors Russia ETF (NYSE:RSX) managing to cling to a rare gain on the day.

Will the major reversal in Market Vectors Russia ETF (RSX) stop the train wreck?

Talk about a panicked stampede from the exits!

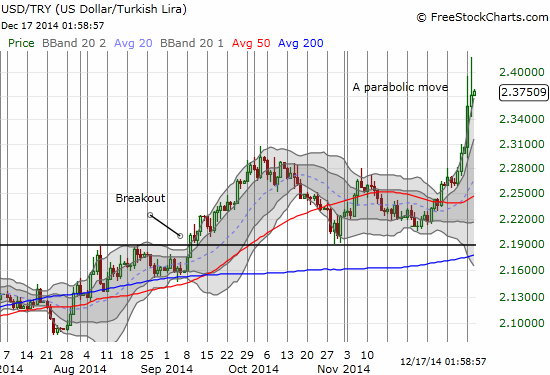

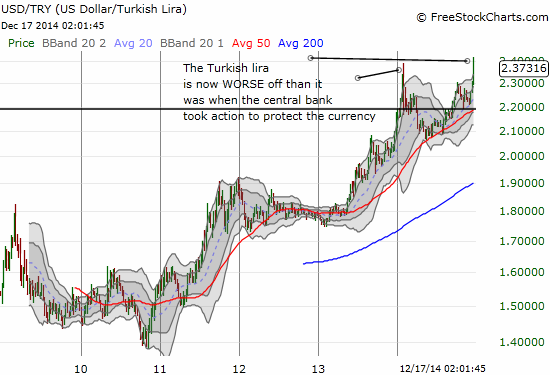

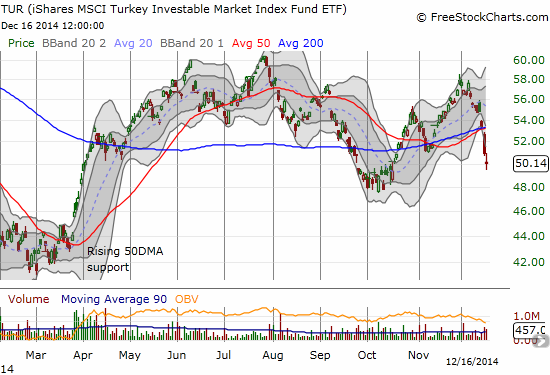

It seems the ruble’s rapid move disrupted currency trading in nearby Turkey as well. In fact, Russia’s desperate attempt to protect the value of its currency reminds me of how we started the year with the Turkish central bank moving aggressively with a rate hike to protect the Turkish lira. The BIG difference is that the rate hike in Turkey immediately sent the currency into recovery. The difference now is that the index of Turkish stocks is not completely collapsing along with the parabolic weakness in the currency.

The U.S. dollar has gone parabolic against the Turkish lira in recent days

It took almost a year but the TUrkish central bank’s attempt to protect the currency has now been completely eroded

Turkish stocks are holding up relatively well given the October lows are still holding

Putting all the pieces together, we should clearly understand that major risks abound, and they are making their voices heard in many places all at once. These kinds of extreme moves usually signal a run is closer to its end than its beginning. However, on the way to the end can still deliver some pain. Major trading models and investing plans are getting disrupted by these wild swings and extreme moves. Forced selling is going on. Stops are getting hit and causing trading whiplash. It is probably like near chaos at many trading desks as operations are holding on for dear life just to get through 2014.

For the little retail investor, you can be thankful that it is easy to simplify your routine and stick strictly to time-tested trading rules. More than ever, an indicator like T2108 is critical for navigating these choppy waters. My bottom-line remains that fresh buys on the S&P 500 should wait until 1) T2108 hits oversold, preferably on a retest of major support (like the 200DMA) and/or a large spike upward in volatility, and/or 2) the S&P 500 shows strength with a confirmed breakout above its 50DMA.

I conclude with the continued breakdown in Netflix (NASDAQ:NFLX). Tuesday’s plunge close to the 2014 low closed out my latest short position on the stock (a put spread).

Netflix continues downward on a well-defined trend. The 2014 low is now in play.

I also closed out of my Herbalife (NYSE:HLF) puts as the stock failed to continue lower on the day.

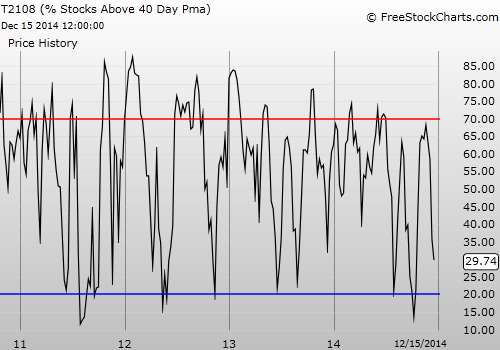

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Disclosure: long UVXY put options, long AAPL call options, long SVXY shares, long GOOG call options, long AMZN put options

Related Articles

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

If the Vanguard S&P 500 Index ETF (VFV) doesn’t give you enough large-cap U.S. equity exposure as a Canadian investor, Invesco NASDAQ 100 Index ETF (QQC) is one of the most...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.