- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

MongoDB (MDB) To Report Q4 Earnings: What's In The Offing?

MongoDB (NASDAQ:MDB) is set to report fourth-quarter fiscal 2020 results on Mar 17.

For the quarter, the company expects revenues between $109 million and $111 million. Non-GAAP loss is anticipated between 27 cents and 29 cents per share.

The Zacks Consensus Estimate is currently pegged at a loss of 28 cents, unchanged over the past 30 days. The consensus mark for revenues currently stands at $110.4 million, indicating growth of 29.1% from the year-ago reported figure.

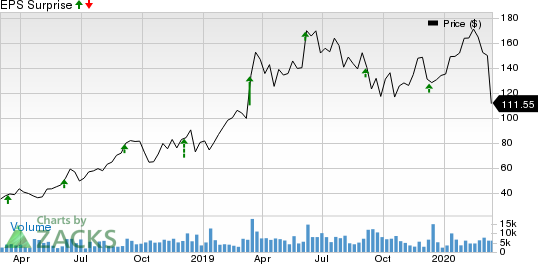

Notably, the company’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average being 19.5%.

Let’s see how things are shaping up for this announcement.

Factors to Watch

MongoDB’s fourth-quarter fiscal 2020 results are likely to benefit from robust subscription revenues, driven by a solid customer adoption of Atlas.

Notably, in the last reported quarter, Atlas revenues skyrocketed more than 185% year over year, accounting for 40% of revenues. Atlas had more than 14,200 customers at the end of the fiscal third quarter.

Moreover, partnerships with the likes of Alphabet’s (NASDAQ:GOOGL) Google Cloud Platform (GCP) division, Alibaba’s (NYSE:BABA) data intelligence platform, Alibaba Cloud, and Microsoft (NASDAQ:MSFT) are likely to have enhanced the platform’s growth opportunities.

However, MongoDB’s top-line result for the fiscal fourth quarter is expected to reflect stiff year-over-year comparison for Atlas revenues.

Moreover, a higher percentage of Atlas in the revenue mix is expected to have been an overhang on gross margins. Additionally, the bottom-line number is expected to reflect on hefty investments in sales & marketing and research & development.

Key Q4 Developments

On Dec 3, 2019, MongoDB announced several new features for Atlas, making it a seamless affair for users who deploy and run the service on Amazon (NASDAQ:AMZN) Web Services (AWS). These include addition of security features to Atlas. Moreover, new integrations with popular AWS tools, such as AWS CloudFormation and Amazon EventBridge make Atlas user-friendly for customers.

Zacks Rank

MongoDB currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

MongoDB, Inc. (MDB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.