- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Model N (MODN) Reports Narrower-Than-Expected Loss In Q4

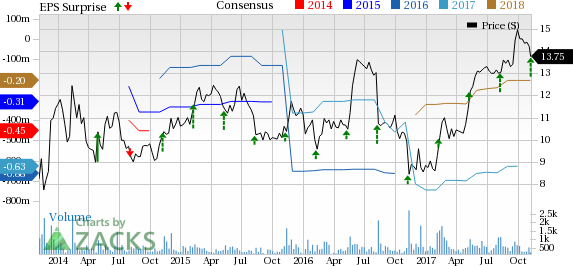

Model N, Inc. (NYSE:MODN) reported fiscal fourth-quarter 2017 adjusted loss of 6 cents per share, narrower than the year-ago quarter loss of 28 cents per share. The figure was also narrower than the Zacks Consensus Estimate of a loss of 9 cents per share.

Revenues of $35.6 million increased 25% year over year and beat the Zacks Consensus Estimate of $35 million. The figure also surpassed the guided range of $34.6 million to $35.1 million.

For fiscal 2017, total revenues increased 23% year over year to $131.2 million after the $5.2 million deferred revenue adjustment related to purchase accounting for the Revitas acquisition. Non-GAAP net loss per share was 59 cents for fiscal 2017.

Management noted that the integration of Revitas was completed successfully during fiscal 2017. The company has also made steady progress in its transformation to a 100% Software-as-a-Service (SaaS) based model.

Model N stock has rallied 55.4% year to date, substantially outperforming the 29.7% gain of the industry it belongs to.

Quarter in Detail

Model N has two reportable segments namely License & Implementation and SaaS & Maintenance.

SaaS & Maintenance revenues of $29.6 million grew 32% year over year. Model N is on track to shift its business to a 100% SaaS and Maintenance revenue model.

License & Implementation revenues of $6 million declined 2% on a year-over-year basis. The company no longer sells on-premise perpetual licenses. Management expects this revenue line to continue to decline through fiscal 2018 due to backlog burn off and transition of customers to cloud.

Revitas contributed approximately $3.6 million to SaaS and Maintenance revenues and approximately $1.6 million to the company’s license and implementation revenues.

Management is optimistic about the company’s Revenue Cloud offering for med-tech, pharma and high tech companies. The improvisations made to its Rebate Management offering are positives for the company.

During the quarter, the company added Nexperia, a semiconductor manufacturer to its client base. The company will use Revenue Cloud for the management of direct and channel revenues. Additionally, Seagate Technology PLC (NASDAQ:STX) , a prominent data storage provider, rolled out the Phase 1 Revenue Cloud for high tech.

Adjusted gross profit increased to $22.7 million from $15.8 million recorded in the year-ago quarter.

Adjusted EBITDA was $1 million compared with ($1.7) million in the year-ago quarter. Adjusted operating profit was $144,000 against the year-ago loss of $2.9 million. The improved results reflect strong synergies from the Revitas acquisition.

Balance Sheet

Model N exited the quarter with cash and cash equivalent balance of $57.6 million, up from $51.8 million at the end of third-quarter fiscal 2017.

Cash flow from operations was $4.3 million.

Guidance

Model N expects fiscal first-quarter 2018 GAAP revenues to come in the range of $37 million to $37.5 million.

Non-GAAP net loss is likely to be between 5 cents and 7 cents per share for the first quarter.

For fiscal 2018, GAAP revenues, after deferred revenue adjustment, are expected to be in the range of $147-$150 million. SaaS and maintenance revenues are anticipated to grow 15% organically driven by cloud subscription and professional services growth.

Non-GAAP loss per share is expected to be in the range of 23 cents to 13 cents for fiscal 2018.

Zacks Rank and Stocks to Consider

Currently, Model N has Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader technology sector include Adobe Systems Incorporated (NASDAQ:ADBE) and Fair Isaac Corporation (NYSE:FICO) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Adobe and Fair Isaac is projected to be 17% and 10%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Seagate Technology PLC (STX): Free Stock Analysis Report

Model N, Inc. (MODN): Free Stock Analysis Report

Fair Isaac Corporation (FICO): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.