- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

MMM, HON, LUK: Which Conglomerate To Bet On Post-Q3 Earnings?

As the third-quarter earnings season heads to its last lap, various analysis and comparisons are being done by industry peers to gauge the underlying metrics and relative performance. Let us perform a similar comparative analysis among leading players in the Diversified Conglomerates sector to pick the best investment option based on third-quarter earnings scorecard.

Third-Quarter Earnings

3M Company (NYSE:MMM) reported strong third-quarter 2017 results with healthy year-over-year increase in earnings and revenues. GAAP earnings for the reported quarter were $1,429 million or $2.33 per share compared with $1,329 million or $2.15 per share in the year-earlier quarter. The year-over-year improvement in earnings was largely due to higher sales.

The reported earnings for the stock comfortably beat the Zacks Consensus Estimate of $2.21. Net sales were record high for the third quarter at $8,172 million, up from $7,709 million in the year-ago quarter and exceeded the Zacks Consensus Estimate of $7,908 million.

Foreign currency translation impact increased sales by 0.6% while organic local-currency sales improved 6.6%. 3M carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Honeywell International Inc. (NYSE:HON) reported adjusted earnings of $1.75 a share in the third quarter, beating the Zacks Consensus Estimate of $1.74 by 0.6%. Notably, adjusted earnings increased 4.8% on a year-over-year basis.

Third-quarter revenues for this Zacks Rank #2 stock inched up 3.2% year over year to $10,121 million and exceeded the Zacks Consensus Estimate of $10,056 million with solid performance in all segments except Performance Materials and Technologies.

Leucadia National Corporation (NYSE:LUK) reported relatively healthy third-quarter results with net income of $99.4 million or 27 cents per share compared with $154.4 million or 41 cents per share in the year-ago quarter. The year-over-year decrease in earnings was due to unrealized pre-tax mark-to-market gain of $91.8 million in the third quarter of 2016.

However, earnings comfortably beat the Zacks Consensus Estimate of 17 cents. Total revenues for the reported quarter increased to $2,896.5 million from $2,676.4 million in the prior-year period due to solid organic growth. Revenues for this Zacks Rank #2 stock also exceeded the Zacks Consensus Estimate of $2,655 million.

Guidance

Buoyed by strong quarterly results and favorable growth dynamics, 3M raised its earlier guidance for 2017. The company anticipates 2017 GAAP earnings in the range of $9.00 to $9.10 per share, up from prior projection of $8.80-$9.05. This represents year-over-year growth of 10-12%, up from 8-11% expected earlier. Organic local-currency sales are expected to be 4-5%, up from 3-5% expected earlier.

Incorporating its improved expectations for organic sales in Aerospace and Performance Materials and Technologies segments, Honeywell raised its 2017 sales guidance to a range of $40.2 billion to $40.4 billion (up 3-4% organic and up 2-3% on a reported basis). The company also reaffirmed its full-year earnings guidance of $7.05 to $7.10 per share, up 9-10% year over year.

Leucadia did not offer any guidance for 2017.

Price Performance

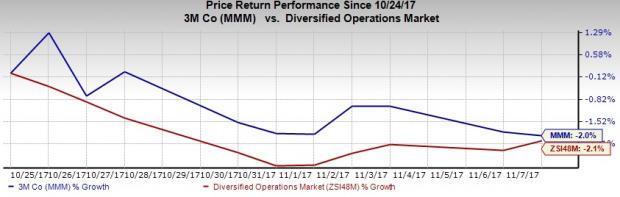

From earnings release to date, 3M has outperformed the industry with an average loss of 2% compared with 2.1% decline for the latter. Honeywell has also outperformed the industry since third-quarter earnings release with an average return of 1.2% as against a decline of 3.4% for the latter. Leucadia has outperformed the industry post its earnings release, with an average gain of 0.5% as against a loss of 0.7% for the latter.

Estimate Revisions

Over the last month, 3M’s current-quarter estimates remained stable at $2.01 per share while that for the current year increased from $8.64 to $8.91.

Honeywell’s current-quarter estimates decreased a penny to $1.85 during the last month while current-year estimates increased a penny to $7.10 per share. Leucadia’s current-quarter estimates decreased a penny to 27 cents during the last month while current-year estimates increased to $1.39 per share from $1.31. With positive estimate revisions, investor sentiments clearly appear to be bullish on 3M compared to Honeywell and Leucadia.

To Sum Up

Based on the current scenario, although there is not much difference among the industry peers, 3M seems to have trumped Honeywell and Leucadia on most fronts and stands out as a better investment proposition.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

3M Company (MMM): Free Stock Analysis Report

Honeywell International Inc. (HON): Free Stock Analysis Report

Leucadia National Corporation (LUK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.