- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

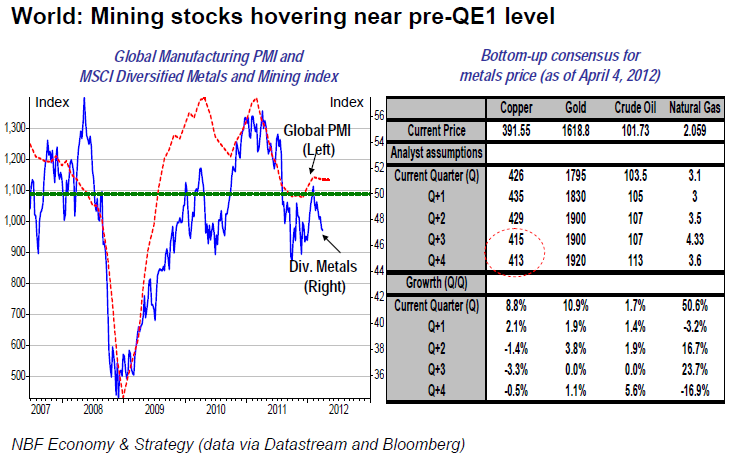

Mining Stocks Hovering Near Pre-QE1 Level: April 8, 2012

Global equities have struggled in recent days with the commodity-related sectors taking the brunt of the decline. Energy, base metals and gold stocks remain more than 20% off their cyclical peaks of a year-ago. In fact, when you look at the level of the respective indexes, we note that all of them are hovering near the levels that prevailed in mid-2010, i.e., before the Fed hinted at QE1 (as today’s Hot chart shows, the Diversified and Mining index of the MSCi AC index is a case in point).

Back then, the global economy was arguably on shakier ground than it is now (as such valuations are much better now). However, we think the USD is currently too weak versus the euro. In our opinion, this remains the main headwind for resource stocks. If the euro weakens – our baseline assumption – then the current commodity price deck that underpins current valuations of resource stocks must be revised down. For example, the current bottom-up consensus of analysts still expects copper prices to be at more than $4/pound by the end of the year.

Related Articles

Treasury Secretary Scott Bessent said no one gave him credit or the administration credit for falling oil prices or lower interest rates. What that means is that Scott Bessent has...

Gold stays near highs with $3K within reach. US inflation data could fuel the next gold rally. Key levels: Support at $2900, resistance at $2950-$3K. Get the AI-powered list of...

Gold faces low volatility around 20-day SMA Short-term bias looks neutral-to-bearish Gold maintained a muted tone around the 2,900 mark as the new week kicked...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.