- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Middleby's Deutsche Beverage Buyout To Aid Beverage Business

The Middleby Corporation (NASDAQ:MIDD) , on Mar 2, announced that it acquired Charlotte, N.C.-based Deutsche Beverage Technology. The financial terms of the transactions have been kept under wraps.

It is worth mentioning here that this is the second acquisition by Middleby so far in 2020. The company’s shares gained 0.2% yesterday, closing the trading session at $111.99.

Inside the Headlines

Deutsche Beverage is engaged in the designing and manufacturing of systems related to beverage brewing and processing. Solutions offered can be used for kombucha, beer, cold brew coffee and other liquid extractions purposes.

Product offerings of Deutsche Beverage include piping, milling systems, custom metal fabrications and boiler for stream systems. The firm generates $40 million in revenues annually.

The Deutsche Beverage buyout is expected to strengthen Middleby’s product offering in the beverage platform. Notably, the company believes that the buyout will complement its June 2019 acquisition of Ss Brewtech — one of the leading beverage equipment makers and the finest player in the craft brewing industry.

Middleby’s Inorganic Initiatives

We believe that the above-mentioned transaction is consistent with the company’s policy of acquiring businesses for attracting customers, and gaining access to various regions and product lines.

In January 2020, it acquired RAM Fry Dispensers. The latter is engaged in the manufacturing of automated frozen fry dispensing equipment. The buyout is expected to strengthen Middleby’s product offering in the restaurant automation platform. In November 2019, Middleby acquired Redwood City, CA-based Brava Home Inc. — a specialist in providing advanced technology for residential cooking.

In July 2019, Middleby acquired Packaging Progressions, Inc. The buyout has been strengthening Middleby’s product offering related to processing technologies, with the addition of two products — ProLeaver and ProStax. Further, it bought Cooking Solutions Group of Standex International Corporation (NYSE:SXI) and Newton, MA-based Powerhouse Dynamics, Inc. in April 2019.

Notably, buyouts drove Middleby’s sales by 5.1% in the fourth quarter of 2019.

Zacks Rank, Earnings Estimates and Price Performance

Middleby, with a market capitalization of $6.3 billion, currently carries a Zacks Rank #3 (Hold).

The company anticipates gaining from product innovation, improving selling techniques, solid customer offerings, focus on growth markets and strengthening Viking business. It also expects to benefit from acquired assets. However, weak spending by restaurant chains and adverse impacts of coronavirus on Commercial Foodservice Equipment Group in the first half of 2020 might play spoilsport.

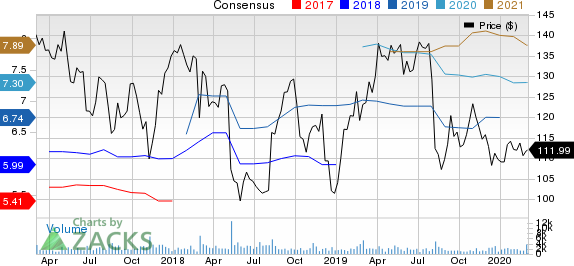

The Zacks Consensus Estimate for Middleby’s earnings is pegged at $7.30 for 2020 and $7.89 for 2021, reflecting growth of 0.8% and a decline of 1.7% from the respective 30-day-ago figures.

The Middleby Corporation Price and Consensus

Dover Corporation (DOV): Free Stock Analysis Report

The Middleby Corporation (MIDD): Free Stock Analysis Report

Standex International Corporation (SXI): Free Stock Analysis Report

Tennant Company (TNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.