- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Micron's (MU) Q1 Earnings And Revenues Beat, View Strong

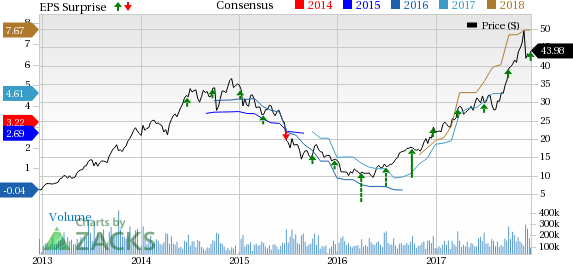

Micron Technology, Inc. (NASDAQ:MU) started fiscal 2018 on a strong note, reporting outstanding results for the first quarter. The memory-chip maker’s quarterly earnings and revenues not only marked significant year-over-year growth but also came ahead of its guidance range and the Zacks Consensus Estimate.

Apart from this, the company’s gross margin, operating income and free cash flow reached a record level during the fiscal first quarter. President and CEO of Micron — Sanjay Mehrotra — noted that the overwhelming quarterly results were mainly “driven by double-digit sequential revenue growth in mobile, server and SSD applications, with expanded gross margins and improved profitability.”

Micron’s shares rallied approximately 5.4% in the extended trading hours yesterday. Notably, the stock has appreciated 110.3% in the year-to-date (YTD) period, significantly outperforming the S&P 500 return of just 20.6%.

Let’s now discuss fiscal first quarter in detail.

Revenues

Micron’s revenues in the reported quarter surged more than 71% on a year-over-year basis to $6.803 billion. Also, reported revenues were up on a quarter-over-quarter basis (up 11%). The upsurge was primarily driven by improved pricing and strong demand environment for DRAM chips. Solid unit shipments of NAND chips also contributed to revenue growth but were partially offset by decline in prices.

Quarterly revenues also came ahead of the company’s guidance range of $6.1-$6.5 billion and surpassed the Zacks Consensus Estimate of $6.387 billion as well.

Sales from DRAM products, which accounted for 67% of total revenues during the quarter, soared a whopping 88% on a year-over-year basis and 13% on a sequential basis. The company recorded upper single-digit and mid-single-digit rise in bit shipments and average selling price (ASP), respectively, on quarter-on-quarter basis. Strong demand from PC, server and smartphone makers drove demand and pricing for DRAM chips.

On the other hand, sales from NAND products, which accounted for 27% of total revenues, marked 47% growth on year-over-year basis and 2% on quarter-on-quarter basis. The company witnessed a mid-single-digit rise in bit shipments, while ASP declined in the low single-digit range. Market share gain in SSD space, along with solid demand from the mobile and embedded markets, benefited Micron’s NAND shipment year-over-year performance.

Business unit wise, revenues of computing and networking business (CNBU) unit more than doubled from the year-ago quarter and reached $3.2 billion. Apart from a healthy pricing environment, senior vice president and CFO, Ernie Maddock, stated that this growth was led by “increasing server memory content, which drove higher sales to enterprise customers together with strong demand for graphics processing.”

Revenues from the Mobile Business Unit (MBU) reached its highest level at $1.4, registering year-over-year jump of 32%. Maddock noted that strong revenue growth at MBU was “strong acceptance of our LPDRAM products and continue to enhance our portfolio of managed NAND offerings.”

Storage Business Unit (SBU) revenues came in at $1.4 billion, up 61% year over year and 7% sequentially, mainly due to elevated demand for the company’s SSD products. In fact, Maddock said that “sales of SSDs reached record levels in the quarter, with double-digit sequential growth across Consumer, Client and Enterprise and Cloud markets.”

The Embedded business unit delivered record performance with revenues reaching $830 million, in line with the last quarter, but up 44% from the year-ago quarter, primarily due to strong bit demand from the consumer applications and automotive customers.

Income and Margins

Micron’s non-GAAP gross profit registered more than three-fold jump on a year-over-year basis to $3.769 billion, while margin advanced to 55.4% from 26% reported in the year-earlier quarter. Non-GAAP gross margin also came ahead of management’s guidance range of 50-54%. The impressive year-over-year improvement in gross margin was chiefly driven by sound industry pricing environment and heightened adoption of the company’s advanced technology-based products.

Non-GAAP operating expenses flared up nearly 3% year over year to $612 million, but came within the company’s guidance range of $575-$625 million. Operating expenses, as a percentage of revenues, contracted 600 basis points year over year to 9%.

Micron’s non-GAAP operating income came in at $3.157 billion compared with just $438 million reported in the prior-year quarter and came well ahead of the company’s guidance range of $2.65-$2.85 billion. Non-GAAP operating margin improved to 46.4% from 11% reported in first–quarter fiscal 2017. Higher gross margin and reduced operating expenses as a percentage of revenues resulted in this tremendous growth.

On a non-GAAP basis, the company reported net income of $2.994 billion compared with $335 million witnessed in the comparable quarter last fiscal. Non-GAAP earnings per share came in at $2.45, beating the Zacks Consensus Estimate of $2.20, as well as management’s guidance range of $2.09–$2.23 per share. Earnings were also higher than the year-ago quarter’s figure of 32 cents.

Balance Sheet and Cash Flow

The company exited the fiscal first quarter with cash and short-term investments of $6.174 billion compared with $5.428 billion at the end of fourth-quarter fiscal 2018. Receivables were $3.876 billion compared with $3.759 billion recorded in the previous quarter. Micron’s long-term debt decreased to $7.644 billion from $9.872 billion in the previous quarter.

The company generated operating cash flow of $3.6 billion and free cash flow of $1.7 billion during the reported quarter. Capital expenditure was $1.9 billion in the fiscal first quarter.

Outlook

The company provided outlook for second-quarter fiscal 2018. For the quarter, Micron expects revenues in the range of $6.8-$7.2 billion. The Zacks Consensus Estimate is pegged at $6.08 billion.

Non-GAAP gross margin is projected to be between 54% and 58%. Operating expenses on non-GAAP basis are likely to be in the range of $625-$675 million and operating income is anticipated to come in the band of $3.25-$3.45 billion.

The company expects non-GAAP earnings per share in the range of $2.51-$2.65 per share. The Zacks Consensus Estimate is pegged at $1.95.

Furthermore, Micron has capital expenditure plans worth $7.5 billion for fiscal 2018. During the fourth-quarter fiscal 2017 earnings conference call, Maddock had noted that CapEx “will be focused on technology transition and product enablement.” He had also mentioned that the company has no plans for wafer capacity additions in fiscal 2018.

Our Take

Micron’s impressive fiscal first-quarter results and an upbeat second-quarter outlook downplay all speculations that memory-chip makers’ super cycle is nearing its end. The mess started on Nov 27, after analyst Shawn Kim of Morgan Stanley (NYSE:MS) noted that NAND flash memory-chip prices are at peak levels, but may start declining from the beginning of 2018 due to a supply glut.

This created panic among investors who preferred to pull out their investments from this space, leading to a massive sell-off seen in memory chip makers’ shares.

However, Micron’s fiscal second-quarter outlook reflects that the entire industry will continue its outperformance as long as demand for memory chips remains ahead of supply.

Currently, Micron carries a Zacks Rank #2 (Buy).

Some other top-ranked semiconductor stocks are NVIDIA Corporation (NASDAQ:NVDA) , Intel Corporation (NASDAQ:INTC) , and STMicroelectronics N.V. (NYSE:STM) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA, Intel and STMicroelectronics have long term-expected EPS growth rates of 10.3%, 8.4% and 5%, respectively.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

STMicroelectronics N.V. (STM): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.