- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Micron (MU) Posts Massive Q1 Earnings Beat, Strong Q2 Guidance

Micron Technology, Inc. ( (NASDAQ:MU) ) just released its first-quarter fiscal 2018 financial results, posting non-GAAP earnings of $2.45 per share and revenues of $6.8 billion.

Currently, MU is a Zacks Rank #2 (Buy) and is up 3.77% to $45.64 per share in after-hours trading shortly after its earnings report was released.

Micron:

Beat earnings estimates. The company posted non-GAAP earnings of $2.45 per share, beating the Zacks Consensus Estimate of $2.20. Micron said GAAP earnings came in at $2.19 per share.

Beat revenue estimates. The company saw revenue figures of $6.80 billion, beating our consensus estimate of $6.39 billion.

Total revenues were up about 11% sequentially and 71% year-over-year. Overall consolidated gross margin was 55.1%, up from 25.5% in the year-ago quarter. Micron cited increased demand for its mobile, server, and SSD products as a catalyst for its sales growth, while margin expansion for both DRAM and Trade NAND products lifted gross margin.

“We are making solid progress on our strategic priorities to drive cost competitiveness, deploy high value solutions and strengthen our balance sheet. We believe these actions will position Micron to benefit from the broad demand trends ahead of us,” said CEO Sanjay Mehrotra.

Management expects second-quarter earnings in the range of $2.51 per share to $2.65 per share. Revenues are expected to be between $6.80 billion and $7.20 billion. Our current consensus estimates are calling for earnings of $1.95 and revenues of $6.08 billion, so today’s guidance is quite strong.

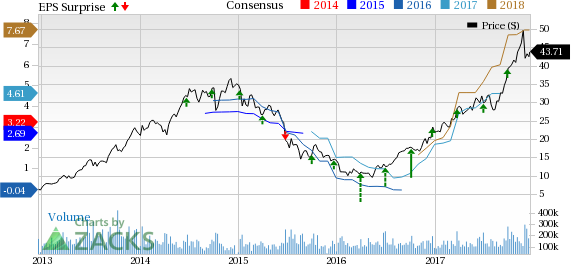

Here’s a graph that looks at Micron’s earnings surprise history:

Micron Technology, Inc., is one of the world's leading providers of advanced semiconductor solutions. Through its worldwide operations, Micron manufactures and markets DRAMs, NAND flash memory, CMOS image sensors, other semiconductor components, and memory modules for use in leading-edge computing, consumer, networking, and mobile products.

Check back later for our full analysis on Micron’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.