- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

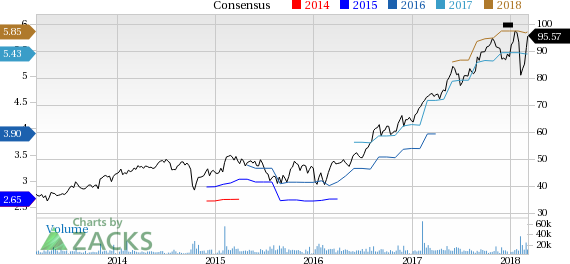

Microchip (MCHP) Up 15.3% Since Earnings Report: Can It Continue?

It has been about a month since the last earnings report for Microchip Technology Incorporated (NASDAQ:MCHP) . Shares have added about 15.3% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is MCHP due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

Microchip reported third-quarter fiscal 2018 non-GAAP earnings of $1.36 per share, surpassing the Zacks Consensus Estimate by a penny. The figure improved 29.5% year over year but declined 3.5% sequentially.

The year-over-year upside was driven by higher net sales, which increased 12.8% from the year-ago quarter to $994.2 million. However, the same declined 1.8% sequentially. The Zacks Consensus Estimate for revenues is pegged at $992 million.

Book-to-bill ratio was approximately 1.00 compared with 1.05 in the previous quarter, reflecting stable lead times. Management expects to achieve normal lead times by June 2018.

Quarter Details

In terms of product line, microcontroller business (66.5% of net sales) increased 18.9% year over driven by robust demand for 8-bit, 16-bit and 32-bit microcontrollers.

Microchip unveiled a single-wire, Electrically Erasable Programmable Read-Only Memory (EEPROM) device, which will help in remote identification of electronic components.

The company also launched Crypto Authentication device, which will allow developers to integrate hardware-based security to their designs. Additionally, it announced a third-party security design partner program.

In the quarter, Microchip announced that it has improved response time for critical system events to help designers create CAN-based applications, without any added complexity.

Additionally, the company expanded collaboration with Amazon (NASDAQ:AMZN) Web services (AWS) to support AWS offerings as well as develop secure cloud systems.

However, analog sales (23.3% of net sales) were down 3.2% on a sequential basis. Revenues were hurt by capacity constraint at Atmel. Moreover, the company’s intent to offer total system solutions that combines microcontroller cores with analog products and connectivity firmware negatively impacted sales. Revenue recognition for these products was shifted from analog business to the microcontroller business.

Still management believes that the higher margin total system solutions will help Microchip retain customers and win new designs in the long haul. According to the company, improving capacity constraints along with design wins will enable the analog business to expand at a higher rate than Microchip.

Memory sales (4.8% of net sales) were down 7.6% on a quarter-over-quarter basis.

Licensing (2.8% of net sales) sales increased 6.8% sequentially and 15.5% on a year-over-year basis.

In the reported quarter, MMO revenues came in at $26 million and accounted for 2.6% of net sales.

Geographically, Asia remained Microchip’s largest market with 60% of net sales coming from the region. Europe and Americas contributed 23% and 17%, respectively.

Operating Details

Microchip posted non-GAAP gross margin of 61.4%, which expanded 360 bps on a year-over-year basis.

Non-GAAP operating expenses, as percentage of revenues, were down 300 bps year over year and 50 bps sequentially to 22%. The decline was primarily due to lower research & development (R&D) expenses and selling, general & administrative (SG&A) expenses, which decreased 170 bps and 130 bps, respectively.

As a result, non-GAAP operating margin expanded 660 bps from the year-ago quarter and 80 bps sequentially to 39.4%.

Balance Sheet

Cash generated in the reported quarter was $365 million compared with $350.1 million in the previous quarter. As of Dec 31, 2017, cash and total investment position was $1.985 billion compared with $1.84 billion in the previous quarter.

Management noted that inventory on Dec 31, 2017, was at 115 days, up by 10 days from the September quarter level.

The company declared a quarterly cash dividend of 36.30 cents per share, which is payable on Mar 6, 2018.

Guidance

Microchip forecasts fourth-quarter fiscal 2018 net sales in the range of $964.4-$1,004.1 million.

Non-GAAP gross margin is anticipated in the range of 61.3-61.7%, which is based on Microchip 2.0 margin drivers. Non-GAAP operating expenses, as percentage of sales, are projected in the 22-22.4% band and operating margin is expected at 38.9-39.7%.

For the fourth quarter, earnings are anticipated in the range of $1.30-$1.39 per share.

Microchip's inventory days in the impending quarter is expected to between 115 and 120 days. Capital expenditures are estimated in the range of $50-$60 million.

For fiscal 2018, capital expenditures are now projected in the range of $200-$210 million, down from $200-$220 million guided previously. This reflects aggressive investment to strengthen and expand production capabilities.

Furthermore, the company plans to bring in-house more of the assembly and test operations that are currently outsourced, which will ultimately improve gross margin.

The heightened capital expenditures also reflect three new buildings that Microchip is constructing in Arizona, India and Germany. These, in turn, will help in reducing cost in the long-haul.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been five revisions lower for the current quarter.

VGM Scores

At this time, MCHP has a strong Growth Score of A, though it is lagging a lot on the momentum front with a D. Charting a somewhat similar path, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, MCHP has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Microchip Technology Incorporated (MCHP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.