- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Medtronic Stock Dips On Preliminary Sales Drag, CRHF To Grow

On Nov 17, 2017, we issued an updated research report on medical device major, Medtronic plc (NYSE:MDT) . The stock carries a Zacks Rank #4 (Sell).

As we wait for the company to release second-quarter fiscal 2018 earnings results on Nov 21 2017, the market depicts a bearish picture per the latest preliminary sales update by Medtronic.

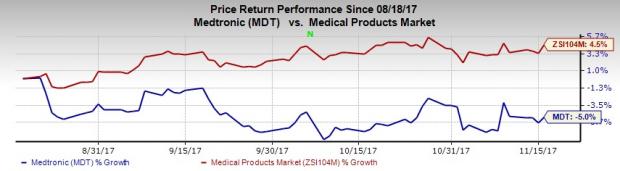

Over the past three months, shares of the company have significantly underperformed the broader industry. The stock has declined 5% versus the broader industry’s gain of 4.5%.

Per the preliminary results, worldwide revenues for the quarter are expected to dip 4% year over year to $7.05 billion. This dull revenue estimate for the quarter to be reported is mainly due to the company’s divestiture of its Patient Care, Deep Vein Thrombosis (Compression) and Nutritional Insufficiency businesses to Cardinal Health (NYSE:CAH) at the beginning of the quarter.

Also, per the preliminary report, the impact from Hurricane Maria was approximately $55-$65 million on the company’s second-quarter top line. Besides, the hurricane left an adverse impact of roughly 3 cents on its second-quarter non-GAAP earnings per share (EPS).

However, despite this year-over-year drag in preliminary sales, it is encouraging to note that the latest projection is actually an improvement from the company’s earlier anticipation of Maria’s impact on its financial standing, provided a month back. That time, Medtronic had projected both fiscal second-quarter 2018 revenues and adjusted net earnings to the extent of $250 million.

Also we believe that the aforementioned divestitures align with the company’s disciplined portfolio management strategy. Per the company, the above businesses do not fall under Medtronic’s core product line and hence remain deprived of the required investment and focus at present.

Divestment of these non-core non-profitable businesses will help Medtronic focus more on core products. This in turn will also enable the company to invest in long-term, high-return, internal and external opportunities that are more directly aligned with the company’s growth strategies of therapy innovation, globalization and economic value.

The stabilizing trend in the global Cardiac Rhythm & Heart Failure (CRHF) market is another upside. We are optimistic about this solid growth trend continuing in the United States as well as the healthy global acceptance of its advanced therapies.

Key Picks

A few better-ranked medical stocks are PetMed Express, Inc. (NASDAQ:PETS) , Align Technology, Inc. (NASDAQ:ALGN) and Myriad Genetics, Inc. (NASDAQ:MYGN) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10%. The stock has surged roughly 77.9% over a year.

Align Technology has a long-term expected earnings growth rate of 28.9%. The stock has skyrocketed 156.3% last year.

Myriad Genetics has a long-term expected earnings growth rate of 15%. The stock has soared 82.1% last year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Medtronic PLC (MDT): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.