- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

McKesson (MCK) Hits 52-Week High: What's Aiding the Stock?

Shares of McKesson Corporation (NYSE:MCK) MCK scaled a new 52-week high of $258.28 on Jan 28, before closing the session marginally lower at $258.21.

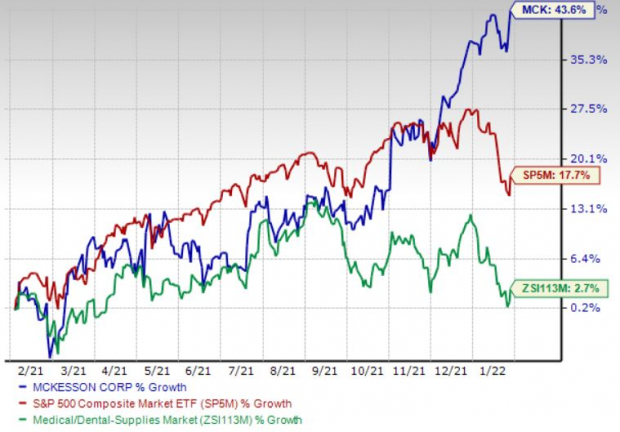

Over the past year, this Zacks Rank #3 (Hold) stock has gained 43.7% compared with 2.7% growth of the industry and 17.7% rise of the S&P 500 composite.

McKesson is witnessing an upward trend in its stock price, prompted by its robust Biologics business. A solid second-quarter fiscal 2022 performance, along with its strategic deals, is expected to contribute further. However, stiff competition and weaker generic pharmaceutical pricing trends persist.

Let’s delve deeper.

Key Growth Drivers

Strength in Biologics: Investors are optimistic about McKesson’s robust Biologics business. Independent specialty pharmacy, Biologics by McKesson, has been making impressive progress of late. In December 2021, the pharmacy was selected by Calliditas Therapeutics as the exclusive specialty pharmacy provider for TARPEYOTM (budesonide) delayed release capsules to reduce proteinuria in adults with primary immunoglobulin A nephropathy (IgAN) at risk of rapid disease progression.

The same month, the pharmacy was selected by PharmaEssentia USA Corporation as a specialty pharmacy provider of BESREMi (ropeginterferon alfa-2b-njft) for the treatment of adults with polycythemia vera.

Strategic Deals: McKesson has inked a few strategic deals over the past few months, raising investors’ optimism on the stock. The company, in December, entered into an agreement to sell its Austrian business to Quadrifolia Management GmbH. The transaction includes the sale of McKesson Austria’s Herba Chemosan Apotheker-AG, together with Sanova Pharma GesmbH.

In November, McKesson inked an agreement to sell off its U.K. businesses to the pan-European asset management group, AURELIUS. The agreement is an important step in advancing McKesson’s efforts to streamline its business and fully exit the European region.

Strong Q2 Results: McKesson’s robust second-quarter fiscal 2022 results buoy optimism. The company recorded strong segmental performances by three of its four segments. Raised earnings outlook for fiscal 2022 instills confidence in the stock. Double-digit adjusted operating profit growth across all segments is encouraging. The company’s crucial role in COVID-19 response efforts in the United States and abroad through the distribution of COVID-19 vaccines, ancillary supply kits and COVID-19 tests is impressive.

Downsides

Weak Trends: McKesson distributes generic pharmaceuticals, which are subject to price fluctuation. The Distribution Solutions segment continue to experience weaker generic pharmaceutical pricing trends. Continued volatility, unfavorable pricing trends, reimbursement of generic drugs, and significant fluctuations in the nature, frequency and magnitude of generic pharmaceutical launches could have a material adverse impact on McKesson.

Stiff Competition: Distribution Solutions faces stiff competition both in terms of price and service from various full-line, short-line and specialty wholesalers, service merchandisers, self-warehousing chains, manufacturers engaged in direct distribution, third-party logistics companies and large-payer organizations. Moreover, the company depends on fewer suppliers for its products. As a result, it is not in a position to negotiate pricing.

Key Picks

A few stocks from the broader medical space that investors can consider are AMN Healthcare Services (NYSE:AMN), Inc. AMN, Cerner Corporation (NASDAQ:CERN) CERN and Catalent (NYSE:CTLT), Inc. CTLT.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 19.51%. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 33.8% against the industry’s 60.1% fall over the past year.

Cerner, carrying a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 12.8%. CERN’s earnings surpassed estimates in three of the trailing four quarters, the average surprise being 3.21%.

Cerner has gained 14.1% against the industry’s 56.5% fall over the past year.

Catalent has an estimated long-term growth rate of 16.9%. CTLT’s earnings surpassed estimates in the trailing four quarters, the average surprise being 9.88%. It currently carries a Zacks Rank #2.

Catalent has lost 14.9% compared with the industry’s 31.9% fall over the past year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

As one investor put it, “curing and preventing hundreds of diseases…what should that market be worth?” This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer (NYSE:SAM) Company which shot up +143.0% in little more than 9 months and NVIDIA (NASDAQ:NVDA) which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cerner Corporation (CERN): Free Stock Analysis Report

McKesson Corporation (MCK): Free Stock Analysis Report

AMN Healthcare Services (NASDAQ:HCSG) Inc (AMN): Free Stock Analysis Report

Catalent, Inc. (CTLT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Oracle (NYSE:ORCL) reports after the closing bell Monday, March 10th, 2025, with street consensus expecting $1.49 in earnings per share on $14.39 billion in revenue, for expected...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.