- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Masimo Products To Boost India-Based NU Hospitals' Systems

Masimo Corporation (NASDAQ:MASI) recently announced that its technologies will be integrated in NU Hospitals, a Bangalore-based nephrology care center in India. This development is in line with the company’s focus on expanding in India.

Per the deal, NU Hospitals is going to incorporate a number of Masimo technologies in its operating rooms (OR), intensive care units (ICUs), dialysis beds and general wards.

NU Hospitals’ ORs will be equipped with Masimo Root Patient Monitoring and Connectivity Hubs and Radical-7 Pulse CO-Oximeters. These monitors will include noninvasive, continuous hemoglobin monitoring (SpHb), a Masimo rainbow parameter, Masimo Open Connect (MOC-9) technology and SedLine brain function monitoring.

Patients at NU Hospitals will be constantly monitored using a variety of bedside devices like Root with Noninvasive Blood Pressure and Temperature and Rad-97 Pulse CO-Oximeters. Measurements will include SpHb, SET Measure-through Motion and Low Perfusion pulse oximetry. Furthermore, Pleth variability index (PVi) monitoring has been adopted for dialysis patients to help in optimizing fluid management.

Developments in India & Emerging Economies

In recent times, Masimo has made several developments in India.

Last December, Artemis Hospital, a Gurgaon-based multi-specialty hospital in Delhi, India, adopted Masimo’s flagship Patient SafetyNet across all its patient care areas.

In 2017, Masimo had announced the launch and availability of the Rad-97 Pulse-CO-Oximeter and Next generation SedLine Brain Function Monitoring in India.

Apart from India, the company’s other major emerging market developments include the implementation of Masimo SafetyNet in two hospitals in Dubai under the governance of the Dubai Health Authority (DHA).

Evidently, expanding operations to highly populated economies is a strategic move by Masimo and is likely to fortify the company’s global foothold in the MedTech space.

Promising Market Trends

Per Emergo, the medical devices market in India was worth $3.5 billion in 2015 and is expected to grow to $4.8 billion by 2019. With the evolution of India’s economic, healthcare and social landscapes, the country’s medical devices market is a promising opportunity for foreign manufacturers.

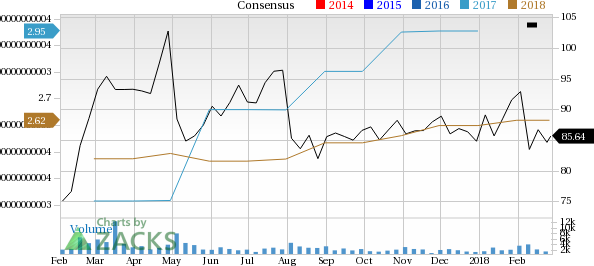

Price Performance

Masimo has underperformed the industry in terms of price. The stock has lost 5.2% against the industry’s rally of 25.6%.

However, positive developments are likely to drive the share price in the quarters ahead.

Zacks Ranks & Key Picks

Masimo carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are athenahealth, Inc. (NASDAQ:ATHN) , Centene Corporation (NYSE:CNC) and Mednax, Inc. (NYSE:MD) . Each of these stocks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

athenahealth has a projected long-term growth rate of 20.7%. The stock has returned 10% in the past three months.

Centene has a long-term growth rate of 14.4%. The stock has gained 18.9% in the last six months.

Mednax has an expected long-term growth rate of 10%. In the last six months, the stock has gained 26%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

athenahealth, Inc. (ATHN): Free Stock Analysis Report

Masimo Corporation (MASI): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Mednax, Inc (MD): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.