- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Marvell (MRVL) Q4 Earnings & Revenues Beat Estimates, Up Y/Y

Keeping its earnings streak alive, Marvell Technology Group Ltd. (NASDAQ:MRVL) reported better-than-expected fourth-quarter fiscal 2018 results. Quarterly revenues and earnings not only came ahead of the mid-point of the company’s guided ranges but also beat the respective Zacks Consensus Estimate.

Additionally, the top and bottom lines marked a significant year-over-year improvement. Per the company, this growth stemmed from better sales execution and efficient cost management.

Marvell president and CEO Matt Murphy stated in a press release that "Our strong fourth quarter and fiscal year results continue to demonstrate that Marvell's strategy is working and that our team is executing it very well.”

Quarter Details

Marvell’s revenues increased 8.7% year over year to $615.4 million surpassing the Zacks Consensus Estimate of $611.6 million. Moreover, reported revenues came ahead of the mid-point of management’s guided range of $595-$625 million (mid-point $610 million).

In the end markets, storage revenues (53% of total revenues) grew 4% year over year and 3% sequentially on better-than-expected demand at the SSD (Solid-State Drive) segments, along with elevated demand from enterprise and data-center operators.

The networking business (25%) increased 5% year over year and 3% sequentially mainly due to increase in the network of processor product line, i.e. switch, PHY and embedded.

Revenues from connectivity (14%) climbed 31% year over year, primarily driven by solid demand for “high-end voice-enabled” and home media streaming applications. However, sequentially, the segment’s revenues slipped 16%. Other product (8%) revenues during the quarter grew 20% year over year and 5% sequentially.

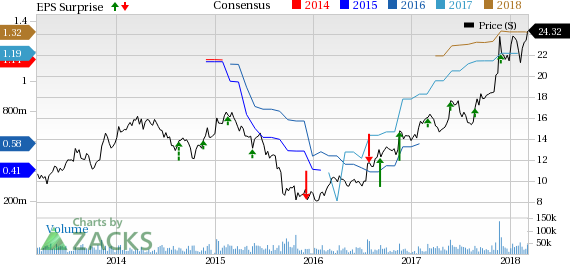

Marvell Technology Group Ltd. Price, Consensus and EPS Surprise

Marvell’s non-GAAP gross profit came in at $383.1 million, up 17% on a year-over-year basis. Gross margin also increased from 57.8% to 62.3% on a year-over-year basis, primarily buoyed by a favorable product mix and higher revenue base. Gross margin also came in marginally higher than management’s expectation of 62%.

Non-GAAP operating expenses rose 2.4% year over year to $217.6 million and were within the company’s expectations of $215-$220 million. As a percentage of revenues, operating expenses contracted 210 basis points to 35.4%. Marvell’s non-GAAP operating margins came in at 26.9% compared with 20.3% reported in the year-ago quarter. The results were positively influenced by higher gross margin and lower operating expenses as a percentage of revenues.

The company reported non-GAAP net income of approximately $164.8 million during the quarter as compared with $118.4 million reported in the prior-year quarter. On per-share basis, non-GAAP earnings came in at 32 cents, up 45.5% from the year-earlier quarter’s earnings of 22 cents. Quarterly non-GAAP earnings also came ahead of the mid-point of management guided range of 29-33 cents (mid-point 31 cents) as well as beat the Zacks Consensus Estimate by a penny.

Balance Sheet

Marvell exited the quarter with cash, cash equivalents and short-term investments of $1.841 billion as compared with $1.732 billion in the previous quarter. The company carries no long-term debt. Cash from operating activities during the fiscal amounted to $571.1 million.

During the fiscal, Marvell repurchased stocks worth $527.6 million and paid dividend of $119.3 million to its shareholders.

Outlook

Marvell projects first-quarter fiscal 2019 revenues in the range of $585-$615 million (mid-point $600 million). The Zacks Consensus Estimate is pegged at $595 million.

Management expects GAAP and non-GAAP gross margin to be approximately 62% and 63%, respectively. GAAP operating expenses are expected to lie between $250 million and $260 million, while non-GAAP operating expenses are estimated to be approximately $215 million.

The company anticipates non-GAAP earnings per share in the band of 29-33 cents (mid-point 31 cents), while the Zacks Consensus Estimate is pegged at 29 cents. On GAAP basis, earnings are projected to come between 22 cents and 26 cents per share.

Our Take

Marvell ended fiscal 2018 on an impressive note, reporting better-than-expected results for the fourth quarter. Furthermore, the company provided encouraging fiscal first-quarter earnings guidance.

Though macro headwinds and stringent regulations might put its financials under pressure in the near term, we believe strong demand for Marvell’s 4G LTE products will act as a catalyst. This will be supported by growth from the company’s wide range of the recently-launched Internet of Things (IoT) solutions.

In an effort to expand offerings beyond hard disk drives to high growth areas such as data centers and wireless communications, Marvell entered into an agreement to acquire Cavium in the last quarter. This buyout will provide the company an opportunity to expand its offerings and access newer markets.

The company’s current restructuring initiative will help Marvell improve cloud infrastructure and applications, which are projected to drive the top line. The latest buyback scheme also reflects sound financial position and favorable prospects.

Nonetheless, intensifying competition in the High Definition (HD) storage drive market makes us increasingly cautious about the stock’s prospects. In the HD storage drive market, Broadcom (NASDAQ:AVGO) is Marvell’s main competitor as these two are the primary SoC (system on a chip) suppliers. Also, NXP Semiconductors, QUALCOMM (NASDAQ:QCOM) and Texas Instruments (NASDAQ:TXN) offer various components to the market.

Given the fact that Broadcom has been trying to acquire Qualcomm, while the latter is already in process to buy NXP Semiconductor, the former will become a bigger entity, along with enhanced capabilities, which can supply SoCs as well as components. This might dampen Marvell’s long-term prospects.

Therefore, despite the company’s strong quarterly results, Marvell’s shares declined roughly 3% during yesterday’s after-hour trade. The stock has unperformed the industry to which it belongs to in the year-to-date period. Marvell has gained 12%, while the industry recorded growth of 12.7%.

Currently, Marvell has a Zacks Rank #4 (Sell).

A better-ranked stock in the semiconductor space is NVIDIA Corporation (NASDAQ:NVDA) which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA has a long-term expected earnings per share growth rate of 10.3%.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Marvell Technology Group Ltd. (MRVL): Free Stock Analysis Report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.