- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Marriott (MAR) Tops On Q3 Earnings & Revenues, Updates View

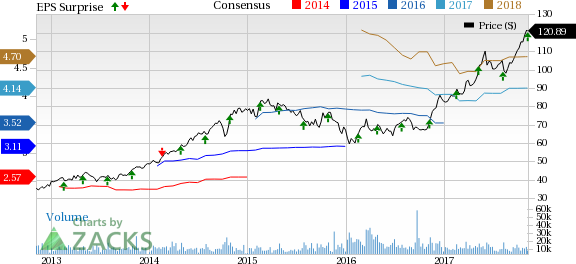

Marriott International Inc. (NASDAQ:MAR) posted better-than-expected third-quarter 2017 results wherein both the bottom and top lines outpaced the Zacks Consensus Estimate. Following the earnings release, the company’s shares gained 0.5% in after-hours trading on Nov 7.

Also, Marriott became the world's largest hotel company after it completed the acquisition of Starwood Hotels & Resorts Worldwide (NYSE:HOT) Inc. on Sep 23, 2016.

Earnings and Revenue Discussion

Adjusted earnings per share (EPS) of $1.10 surpassed the Zacks Consensus Estimate of 98 cents by 12.2%. Also, the figure improved 26.4% from combined adjusted EPS of 87 cents in the year-ago quarter. In fact, the bottom line came above management’s guided range of 96 cents to 99 cents.

Notably, combined third-quarter 2016 results assume Marriott's acquisition of Starwood and Starwood's sale of its timeshare business that completed on Jan 1, 2015.

Adjusted total revenues rose slightly year over year to $5.66 billion and also surpassed the Zacks Consensus Estimate of $5 billion by 13.8%.

Excluding the impact of Marriott's acquisition of Starwood and Starwood's sale of its timeshare business on third-quarter 2016 results, the top line in the reported quarter improved a significant 43.7% year over year. This, in turn, reflects the positive impact of Starwood acquisition on third-quarter 2017 revenues.

RevPAR & Margins

In the quarter under review, revenue per available room (RevPAR) for worldwide comparable system-wide properties increased 2.1% in constant dollar (up 2.4% in actual dollars), driven by 1.1% growth in occupancy and a 0.7% rise in average daily rate (ADR). In fact, the reported figure came above management’s guided range of an increase of 1% to 2% on a constant dollar basis.

Comparable system-wide RevPAR in North America grew 0.4% in constant dollars (up 0.6% in actual dollars). Though occupancy rate remained flat, ADR witnessed an increase of 0.4%. Management had expected the same to be flat on a constant dollar basis. .

In constant dollar, international comparable system-wide RevPAR rose 6.7% (up 7.8% in actual dollars) in the third quarter. Both occupancy rate and ADR witnessed a rise of 3.6% and 1.5%, respectively. Also, the figure came above management’s guided range of a rise of 3% to 5% on a constant dollar basis.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $831 million, up 7% year over year, from combined adjusted EBITDA in the year-ago quarter.

Also, worldwide comparable company-operated house profit margin increased 40 basis points (bps). The uptick was owing to higher RevPAR, solid cost controls and synergies from the Starwood acquisition. However, North American comparable company-operated house profit margins decreased 20 bps. Meanwhile, house profit margins for comparable company-operated properties outside North America rose 130 bps.

Total adjusted expenses decreased 1.6% year over year to $5 billion mainly due to lower general, administrative and other expenses.

General, administrative and other expenses were $201 million, down 15.2% from the year-ago quarter, primarily due to general and administrative cost savings. The figure was also below management’s projected range of $215 million to $220 million.

Fourth-Quarter 2017 Outlook Revised

Marriott's outlook for fourth-quarter and full-year 2017 is for the combined company and does not include merger-related costs.

For the fourth quarter, earnings per share are now estimated between 98 cents and $1 (earlier 96 cents to $1.05). The Zacks Consensus Estimate of $1.02 is pegged higher than the guided range.

Marriott expects comparable system-wide RevPAR to increase in the range of 2% to 3% on a constant dollar basis in North America and worldwide (earlier 1% to 3% rise). The guidance for fourth-quarter RevPAR growth in North America reflects the shift of the Jewish holidays in the reported quarter compared with the fourth quarter of 2016. Outside North America, the company expects the same to rise in the range of 3% to 5% (earlier increase in the 2–4% band).

Adjusted EBITDA is likely to be in the range of $762 million to $777 million, reflecting the negative impact of hotels previously sold.

Moreover, the company anticipates fee revenues between $825 million and $835 million (earlier $804-$849 million). Operating income is projected in the range of $600 to $615 million (earlier $594-$644 million). Meanwhile, general, administrative and other expenses are expected between $240 million and $245 million (earlier $229-$234 million) due to expenses delayed from the third quarter.

2017 View Updated

For 2017, Marriott now anticipates earnings in the band of $4.22 to $4.24 per share, up from the earlier guided range of $4.06 to $4.18. The Zacks Consensus Estimate for the year is pegged at $4.14.

Comparable system-wide RevPAR is expected to rise 1-2% in North America (same as earlier), increase nearly 5% outside North America (earlier 3-5% increase) and improve 2-3% worldwide (earlier 1-3% rise), on a constant dollar basis.

Additionally, Marriott projects fee revenues between $3,287 million and $3,297 million (earlier $3,245-$3,305 million). Compared to the guidance projected earlier, these fee revenue estimates reflect the outperformance in the third quarter, higher worldwide RevPAR guidance and elevated branding and relicensing fees.

While operating income is anticipated in the range of $2,485 million to $2,500 million (earlier $2,420-$2,490 million), general, administrative and other expenses are expected to be in the band of $877 million to $882 million (earlier $880-$890 million).

Adjusted EBITDA is projected to be between $3,177 million and $3,192 million (earlier $3,131-$3,201 million). This estimate reflects the negative impact of hotels previously sold.

The company anticipates gross room additions of roughly 7% while room deletions are expected to be between 1% and 1.5% for 2017.

2018 View

For 2018, Marriott projects comparable system-wide RevPAR to be flat to up 2% in North America on a constant dollar basis. Meanwhile, RevPAR for worldwide comparable system-wide properties is anticipated to rise in the range of 1% to 3%. Outside North America, the company expects the same to increase in the 3% to 5% band.

Furthermore, the company expects gross room additions of roughly 7% while room deletions are projected to be between 1% and 1.5%.

Marriott carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Wyndham Worldwide Corporation (NYSE:WYN) reported third-quarter adjusted earnings per share of $2.03, beating the Zacks Consensus Estimate of $2 by 2%. Also, the bottom line was up 7.4% year over year on the back of higher revenues as well as the company’s share repurchase program. However, the same was negatively impacted by higher expenses along with the effect of the hurricanes Irma and Maria.

In third-quarter 2017, Hilton Worldwide Holdings Inc. (NYSE:H) posted adjusted earnings of 56 cents per share that outpaced the Zacks Consensus Estimate of 50 cents by 12%. Moreover, the bottom line soared 37% year over year, primarily owing to higher revenues. Also, the same came above management’s guided range of 47 cents to 51 cents.

Hyatt Hotels Corporation’s (NYSE:H) third-quarter 2017 adjusted earnings of 26 cents per share outpaced the Zacks Consensus Estimate of 17 cents by 52.9%. However, earnings were down 44.7% year over year from 47 cents due to the impact of natural disasters and the Jewish Holiday timing.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Wyndham Worldwide Corp (WYN): Free Stock Analysis Report

Marriott International (MAR): Free Stock Analysis Report

Hyatt Hotels Corporation (H): Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT): Get Free Report

Original post

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.