- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Mallinckrodt (MNK) Up On Earnings And Revenues Beat In Q4

Following encouraging fourth-quarter 2017 results, shares of Mallinckrodt Public Limited Company (NYSE:MNK) moved up 15.3%.

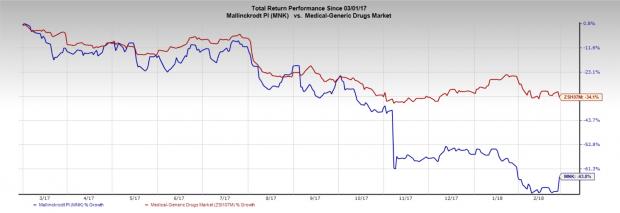

Hit by challenges in 2017, Mallinckrodt’s stock has lost 63.8% over a year compared with the industry’s fall of 34.1%.

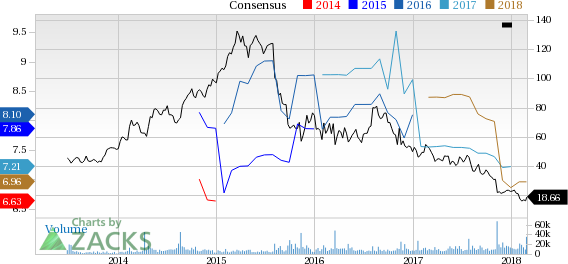

The company reported adjusted earnings of $2.01 per share in the reported quarter, up from the year-ago figure of $1.91, beating the Zacks Consensus Estimate of $1.72.

Net sales in the quarter came in at $792.3 million, down 4.5% year over year, but surpassed the Zacks Consensus Estimate of $765.6 million.

Quarter in Detail

The company reports results under two segments — Specialty Brands and Specialty Generics.

Sales at the Specialty Brands segment were $582.2 million, down 3.5% from the year-ago quarter. Acthar, Mallinckrodt’s largest product, garnered sales of $295.2 million, down 9.3% due to patient withdrawal issues. Mallinckrodt is reeling under an industry wide challenge, wherein an increasing number of written prescriptions are going unfilled.

Inomax, its second-largest product, generated sales of $125.6 million, up 6.2%. Ofirmev sales increased 7.6% year over year to $78 million.

Sales of the Therakos immunology platform were $57.2 million, up 18.4%.

As expected, weakness in the Specialty Generics segment continues due to competitive pressure. The segment recorded sales of $195.8 million, down 8.0%.

Adjusted selling, general and administrative expenses in the quarter decreased 2.1% to $212.6 million. Meanwhile, research and development expenses increased 30.5% to $86.4 million.

Pipeline Update

Earlier in the month, Mallinckrodt acquired erstwhile Sucampo Pharmaceuticals for diversifying and reviving its beleaguered portfolio. The Sucampo acquisition added two approved drugs namely, Amitiza and Rescula to Mallinckrodt’s portfolio.

Last month, Mallinckrodt entered into an agreement with Baxter International (NYSE:BAX) wherein the former will sell certain hemostasis products to the latter for approximately $185 million. The products include Recothrom Thrombin topical (Recombinant) and Preveleak Surgical Sealant. Baxter will assume other expenses, including contingent liabilities associated with Preveleak. The company had acquired these products from The Medicines Co. (NASDAQ:MDCO) .

However, Mallinckrodt will retain Raplixa (Fibrin sealant (human)) for topical use and is evaluating strategic options for this product.

Meanwhile, the FDA accepted Mallinckrodt’s New Drug Application (“NDA”) seeking approval of the recently acquired developmental product stannsoporfin. Under the Prescription Drug User Fee Act, the FDA set its action date to respond to the NDA as Aug 22, 2018. The agency previously granted Fast Track status to stannsoporfin.

2018 Guidance

Due to the recently announced acquisitions and divestitures, Mallinckrodt will prospectively classify the "Specialty Generics Disposal Group" as discontinued operations, which includes the Specialty Generics segment, certain non-promoted branded products within the Specialty Brands segment, and the company's ongoing post-divestiture supply agreement.

Net Sales in 2018 are expected to grow by 3-6% while adjusted EPS is projected to be $6.00- $6.50.

Our Take

The earnings and sales beat in the fourth quarter comes as a silver lining for Mallinckrodt which has been in troubled waters for quite some time now. While Acthar sales continue to decline, Inomax revived a bit.

The company is currently streamlining its business to focus better on its innovative medicines and therapies like terlipressin and StrataGraft, and the recently acquired products stannsoporfin, xenon gas and OCR-002. While the Sucampo buyout to diversify the company’s portfolio considering Amitiza’s potential is commendable, it remains to be seen if it will be enough to bail Mallinckrodt out of its current crisis.

Zacks Rank & Key Pick

Mallinckrodt carries a Zacks Rank #3 (Hold).

A better-ranked stock from the health care space is Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.38 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company delivered a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Baxter International Inc. (BAX): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

The Medicines Company (MDCO): Free Stock Analysis Report

Mallinckrodt PLC (MNK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.