- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Major Pairs: Pound Rose For First Time In Four Days Versus Euro

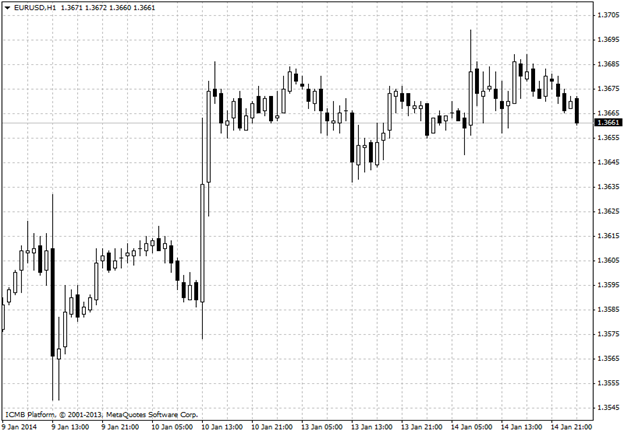

EUR/USD

The euro was little changed against the dollar on Tuesday after data showed that U.S. retail sales rose more strongly than expected in December, bolstering expectations that the economic recovery will continue to strengthen. The Commerce Department said U.S. retail sales rose 0.2% last month, beating expectations for a 0.1% increase. Core retail sales, which exclude automobile sales, climbed 0.7% in December, above forecasts for a 0.4% increase. The euro rose to session highs against the dollar earlier after European Central Bank Governing Council member Ewald Nowotny said the euro zone economy might surprise to the upside this year. The ECB revised its growth forecast for 2014 slightly higher in December, saying it expected growth of 1.1 meanwhile, data released on Tuesday showed that industrial production in the euro zone rose more-than-expected in November, easing concerns over the outlook for growth. Eurostat said industrial production rose 1.8% in November, beating expectations for a 1.4% gain, recovering from a downwardly revised decline of 0.8% in October. On a year-over-year basis, industrial production rose 3%, more than double expectations for a 1.4% increase.

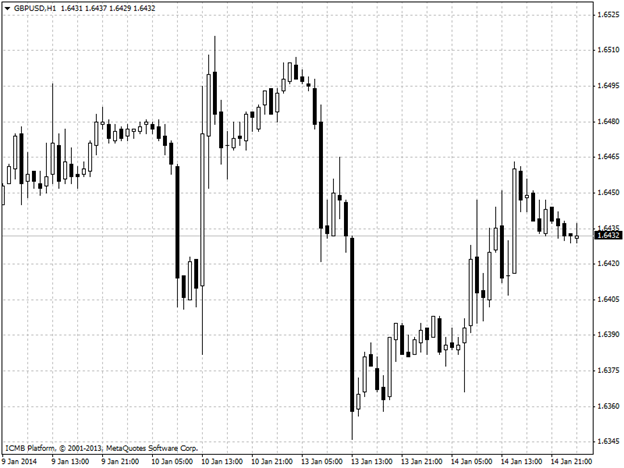

GBP/USD

The pound rose for the first time in four days versus the euro as inflation slowed to the Bank of England’s target for the first time in more than four years, boosting optimism the U.K.’s economic recovery will strengthen. Sterling climbed the most in two weeks versus the dollar as a report showed inflation reached the central bank’s 2 percent threshold last month, helping Governor Mark Carney to keep interest rates at a record low for longer. U.K. government bonds erased gains that had sent 10-year gilt yields to the lowest level in six weeks. “Abating price pressures would continue to support the real purchasing power of U.K. consumers and prop up growth,” said Valentin Marinov, head of European Group-of-10 currency strategy at Citigroup Inc. in London. “The improving macroeconomic background should continue to support sterling and it could be a buy on dips.” The pound appreciated 0.4 percent to 83.14 pence per euro at 4:28 p.m. London time after weakening 1.1 percent in the previous three days. Sterling rose 0.4 percent to $1.6448, the biggest advance since Dec. 27.

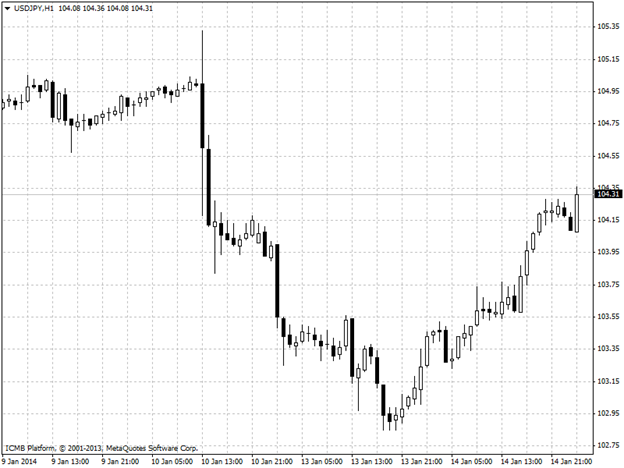

USD/JPY

The yen fell the most in four weeks versus its U.S. peer after a government report showed Japan’s current-account deficit widened to a record in November. The dollar gained for the first time in four days as U.S. retail sales rose more than forecast in December, giving the world’s biggest economy a lift at the end of 2013. The Swedish krona strengthened as a report showed inflation was faster in December than economists forecast. South Africa’s rand slid to a five-year low against the dollar on speculation labor disputes at platinum producers will reduce exports. “Dollar-yen is a bet everyone wants to be long on -- investors are buying on a dip because of the Japanese data,” said Vassili Serebriakov, a foreign-exchange strategist at BNP Paribas SA, by phone from New York. A long position is a bet an asset, in this case the dollar, will appreciate. “The retail sales report makes the payroll numbers look more one-off instead of the economy looking to be on a soft patch..

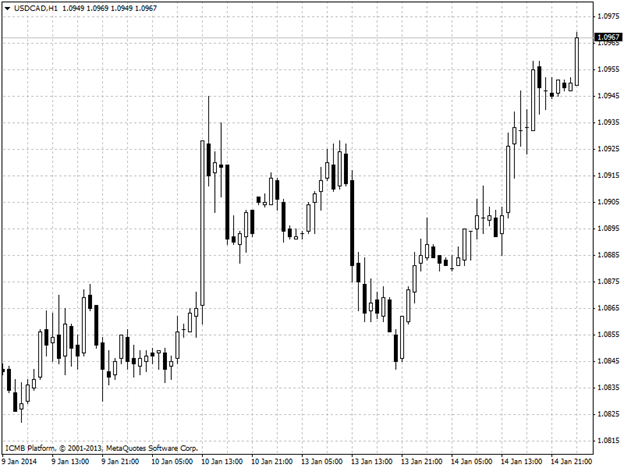

USD/CAD

The U.S. dollar extended gains against the Canadian dollar on Tuesday, re-approaching recent four-year highs after data showed that U.S. retail sales rose more-than-forecast in December. The Commerce Department said U.S. retail sales rose 0.2% last month, beating expectations for a 0.1% increase. Core retail sales, which exclude automobile sales, climbed 0.7% in December, above forecasts for a 0.4% increase. The data helped bolster expectations that the economic recovery will continue to deepen going into this year. The Canadian dollar remained under heavy selling pressure after a recent series of weak economic data undermined the outlook for growth and reinforced expectations that the Bank of Canada will stick to its dovish stance on interest rates.

Related Articles

EUR/USD remains resilient after dipping below 1.05, hinting at a potential breakout. Weak US data and stagflation fears fuel Fed rate cut bets, pressuring the dollar. A break...

USD/CAD lifted by Trump’s tariff push but faces resistance overhead US data missing forecasts at the fastest pace in five months Fed rate cut bets grow, pushing Treasury yields...

The euro has gained ground on Tuesday. In the North American session, EUR/USD is trading at 1.0515, up 0.45%. On Monday, the euro climbed as high as 1.0527, its highest level this...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.