- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

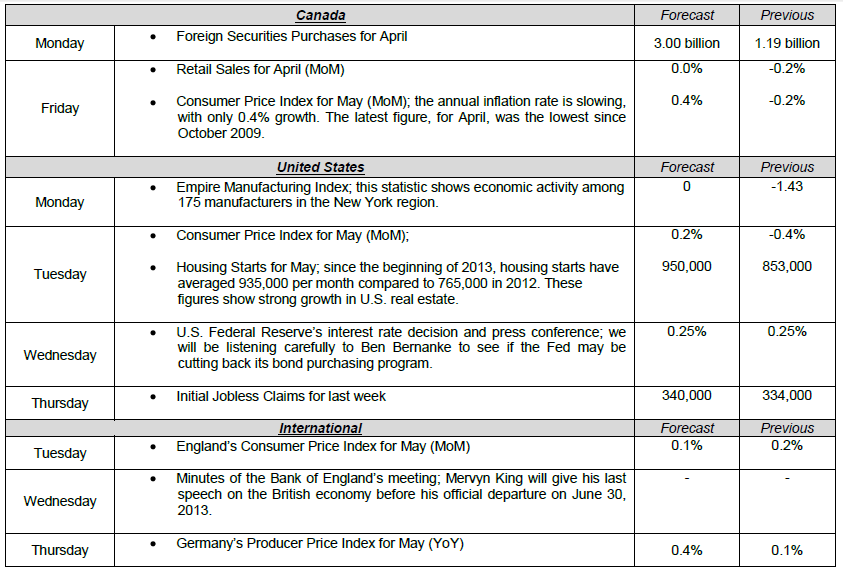

Major News This Week: June 17, 2013

On Friday, the International Monetary Fund lowered its forecast for growth in the U.S. in 2014 from 3% to 2.7%. The stated reason was that the Federal Reserve should be able to better control communications on its strategy to end its current monetary easing policy. Over the last few weeks there has been considerable volatility in the U.S. interest rate curve stemming from a series of rumours about monetary policy. For example, 5-year bond rates in the U.S. increased from 0.65% to 1.10% in one month. In Japan, the yen continues to surge, up 3% over last week. The main reason was the failure by Haruhiko Kuroda, Governor of the Bank of Japan, to announce additional bond purchases on Tuesday. Have a great week! Philippe Shebib

The Loonie

“A man who wants to lead the orchestra must turn his back on the crowd.” - Max Lucado

Since the 2008 financial crisis, the central banks have, whether they like it or not, become very sophisticated market manipulators. This is a far cry from the days when currency values were driven solely by economic forces in each country. The importance of fundamental analysis, which is based on historical economic data and data released on a pre-set schedule has been completed supplanted by geopolitics. A series of massive, repeated interventions by central banks to stimulate their economies have made financial markets exceptionally sluggish. Whether these actions were motivated by fears of inflation, such as in Japan; by a desire to remain competitive to support exports and currencies, such as in Poland, Turkey and Brazil; or even to promote employment, such as in the U.S., clearly the actors have tempered at least some of the volatility. We are constantly hearing in the news about investor uncertainty, which we believe refers to a certain restiveness caused by a high dependence on central bank decisions – the new miracle drug. In addition, the actions taken by the high-performance economic drivers (i.e., governments and central banks working together in this way) are very difficult to predict, so economic forecasts need to be revised more frequently. The forecasters change keys and do their best to follow the conductors!

Withdrawal from the broad form of control is certainly not going to be easy. The market has been reacting to the slightest sign from the Fed that it may stop or slow current asset purchases. Investors are even giving serious thought to the effects of these shocks in the medium term. Will we return to things as they were before? If so, we will finally be able to count on our benchmarks again and make informed decisions about future commitments.

To Read the Entire Report Please Click on the pdf File Below.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.