- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Magna (MGA) Q3 Earnings & Revenues Beat Estimates, Up Y/Y

Magna International Inc. (NYSE:MGA) reported third-quarter 2017 earnings per share of $1.36, surpassing the Zacks Consensus Estimate by a couple of cents. The bottom line also improved 5.4% from $1.29 recorded in the same period of 2016.

Revenues increased 7.4% year over year to $9.5 billion. The top line also surpassed the Zacks Consensus Estimate of $9.05 billion. The quarter witnessed a 55% increase in complete vehicle assembly sales, reflecting the launch of BMW 5-Series at its assembly facility in Graz, Austria.

However, the company reported a decrease of 3% in adjusted EBIT to $692 million from the year-ago figure of $715 million.

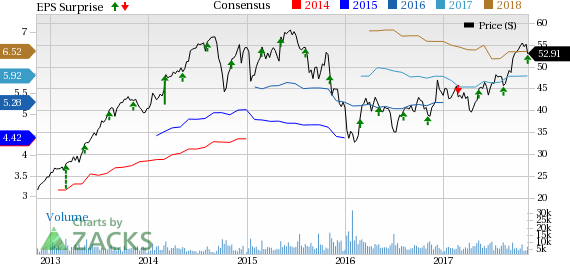

Magna International, Inc. Price, Consensus and EPS Surprise

Segment Details

Revenues at the External Production segment (comprising North America, Europe, Asia and Rest of World or ROW units) rose 7% year over year to $9.5 billion in the reported quarter.

However, revenues in North America declined 5% to $4.6 billion. While revenues from Europe gained 14% year over year to $2.5 billion, the same from Asia climbed 5% to $576 million. The metric from ROW surged 31% to $156 million.

Revenues at the Complete Vehicle Assembly segment totaled $781 million, soaring 55% from $503 million a year ago.

Revenues from the Tooling, Engineering & Other segment increased 35% to $890 million in the quarter under review.

Financials

Magna International had $783 million of cash and cash equivalents as of Sep 30, 2017 compared with $974 million as of Dec 31, 2016. The company had a long-term debt of $3.2 billion as of Sep 30, 2017, up from the Dec 31, 2016 figure of $2.4 billion.

In third-quarter 2017, Magna International’s cash flow from operations was $881 million.

Capital Deployment

The company’s board of directors announced a quarterly dividend of 27.5 cents per share for the third quarter. This dividend is payable on Dec 8, 2017 to shareholders of record as of Nov 24, 2017.

During the quarter, Magna International repurchased 8.7 million shares for $422 million and paid a dividend of $99 million.

Outlook

For 2017, Magna International projects revenues from the total production sales in the range of $31.9-$32.8 billion, slightly up from the prior guidance of $31.5-$32.8 billion. Complete Vehicle Assembly sales are estimated in the band of $3-$3.2 billion, up from the previous guidance of $2.8-$3.1 billion.

Thus, for 2017, the company expects total revenues within $38.3-$39.5 billion, higher than the prior view of $37.7-$39.4 billion. Income tax rate is expected around 25%. Capital expenditures are anticipated to be approximately $1.9 billion, down from the previous expectation of $1.9-$2 billion.

Zacks Rank & Key Picks

Magna International carries a Zacks Rank #3 (Hold). Some better-ranked auto stocks are PACCAR Inc. (NASDAQ:PCAR) , Allison Transmission Holdings, Inc. (NYSE:ALSN) and BorgWarner Inc. (NYSE:BWA) . While PACCAR and Allison Transmission sport a Zacks Rank#1 (Strong Buy), BorgWarner carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PACCAR has an expected long-term growth rate of 10%.

Allison Transmission has an expected long-term growth rate of 10%.

BorgWarner has an expected long-term growth rate of 9.1%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

PACCAR Inc. (PCAR): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Magna International, Inc. (MGA): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.