- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Macy's (M) Q4 Earnings Beat, Issues Upbeat View, Stock Up

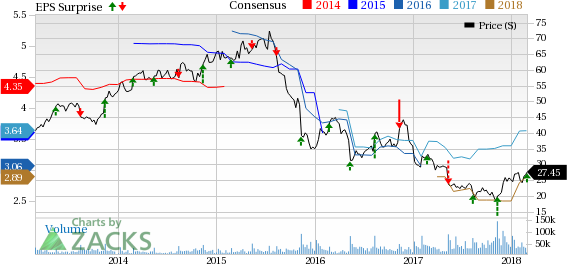

Macy’s, Inc. (NYSE:M) posted the third straight quarter of positive earnings surprise, when it reported fourth-quarter fiscal 2017 results. However, total sales fell short of the consensus mark for the second quarter in a row. Nevertheless, management hinted that strategic investments across stores, technology and merchandising are likely to help the company to see comparable sales growth in fiscal 2018.

Impressive bottom-line performance and an upbeat view sent the shares up more than 8% during pre-market trading hours. In the past three months, the stock has rallied 23.8% compared with the industry's gain of 33.1%.

Let’s Delve Deep

Macy’s posted adjusted earnings of $2.82 per share that beat the Zacks Consensus Estimate of $2.69 and surged 39.6% from $2.02 reported in the year-ago period. Higher sales and lower SG&A expenses aided the bottom line.

This Cincinnati, OH-based company generated net sales of $8,666 million that came below the Zacks Consensus Estimate of $8,724 million but increased 1.8% year over year. Comparable sales (comps) on an owned plus licensed basis jumped 1.4%, while on an owned basis comps rose 1.3%.

In an attempt to augment sales, profitability and cash flows, this Zacks Rank #2 (Buy) company has been taking steps such as cost cutting, integration of operations as well as developing its e-commerce business. The company registered double-digit growth in digital business for the 34th successive quarter.

Moreover, as part of the store rationalization program, the company plans to shut down underperforming stores. These are seen as part of the company’s endeavors to better withstand competitive pressure from both brick-and-mortar discount stores and online retailers, such as Amazon (NASDAQ:AMZN) .

In the recent past, Macy's also announced a few more measures to support growth plan. Under this plan, the company will shut down 11 stores in the early part of 2018 and will not only hire employees but also retrench at some stores. Further, the company will streamline some of the non-functional stores. These efforts will result in annual cost savings of $300 million beginning 2018.

Coming back to the results, gross profit in the quarter grew 1.3% year over year to $3,308 million, however, gross margin contracted 10 basis points to 38.2%. On the contrary, adjusted operating income surged 31.5% to $1,397 million, while adjusted operating margin increased 360 basis points to 16.1%.

Store Update

During the quarter, the company opened two new freestanding Bluemercury beauty specialty outlets. In fiscal 2017, the company opened 36 Bluemercury stores, two Macy's stores, 30 Backstage off-price stores within current Macy’s stores and one Bloomingdale’s licensed location in Kuwait. The company shuttered 16 Macy's stores. This February, the company announced that it will pull shutters on Redmond Town Center main store in Redmond, WA, by early 2019.

Other Financial Aspects

Macy’s ended the quarter with cash and cash equivalents of $1,455 million, long-term debt of $5,861 million, and shareholders’ equity of $5,673 million, excluding non-controlling interest of $12 million. The company lowered its debt load by $950 million during the fiscal year.

Guidance

Macy’s now projects comps on both an owned and an owned plus licensed basis to be flat to up 1% for fiscal 2018. However, it envisions total sales to decline in the band of 0.5-2%.

Management now expects adjusted earnings in the range of $3.55-$3.75 per share for fiscal 2018. The current Zacks Consensus Estimate for the fiscal year is pegged at $2.89.

Still Interested in Retail? Check these 2 Trending Picks

Zumiez (NASDAQ:ZUMZ) delivered an average positive earnings surprise of 22.2% in the trailing four quarters. The company has a long-term earnings growth rate of 18% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

G-III Apparel (NASDAQ:GIII) delivered an average positive earnings surprise of 6.1% in the trailing four quarters. It has a long-term earnings growth rate of 15% and carries a Zacks Rank #2.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.