- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Macy's (M) Q3 Earnings Beat, Sales Miss, View Reiterated

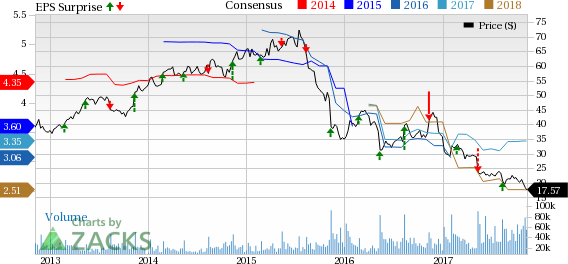

Macy’s, Inc. (NYSE:M) posted second straight quarter of positive earnings surprise, when it reported third-quarter fiscal 2017 results. However, total sales fell short of the consensus mark after surpassing the same in the preceding quarter. Nevertheless, management retained its fiscal 2017 view.

Let’s Delve Deep

Macy’s posted adjusted earnings of 23 cents a share that beat the Zacks Consensus Estimate of 19 cents and surged 35.3% from 17 cents reported in the year-ago period. Despite decline in the top line, bottom line increased on account of lower cost of sales and reduced SG&A expenses.

This Cincinnati, OH-based company generated net sales of $5,281 million that came below the Zacks Consensus Estimate of $5,307.6 million and declined 6.1% year over year. Comparable sales (comps) on an owned plus licensed basis dipped 3.6%, while on an owned basis comps fell 4%.

For quite some time now, the company has been grappling with waning comps and dwindling top line. The reflection of the same is quite visible from the stock’s performance. So far in the year, Macy’s shares have plunged 50.9% wider than the industry’s decline of 39.9%. Analysts pointed that the overall industry is grappling with waning mall traffic and increased online competition.

In an attempt to augment sales, profitability and cash flows, the company has been taking steps such as cost cutting, integration of operations as well as developing its e-commerce business and Macy’s Backstage off-price business, along with the expansion of Bluemercury and online order fulfillment centers. Moreover, as a part of store rationalization program, the company plans to shut down underperforming stores. These are seen as a part of the company’s endeavors to better withstand competitive pressure from both brick-and-mortar discount stores and online retailers, such as Amazon.com, Inc. (NASDAQ:AMZN) .

.jpg)

Coming back to results, gross profit in the quarter declined 6% year over year to $2,106 million, however, gross margin expanded 10 basis points to 39.9%. On the other hand, adjusted operating income jumped 4.1% to $176 million, whereas adjusted operating margin increased 30 basis points to 3.3%.

Store Update

During the quarter under review, the company opened eight new freestanding Bluemercury beauty specialty stores and seven new Macy’s Backstage off-price stores within existing Macy’s stores. Early 2018, the company plans to shutter stores in Laguna Hills Mall in Laguna Hills, CA; Stonestown Galleria in San Francisco, CA; and Westside Pavilion in Los Angeles, CA.

Other Financial Aspects

Macy’s, which carries a Zacks Rank #4 (Sell), ended the quarter with cash and cash equivalents of $534 million, long-term debt of $6,297 million, and shareholders’ equity of $4,231 million, excluding non-controlling interest of $7 million.

Guidance

Management reiterated its fiscal 2017 guidance. Macy’s continues to project comps on an owned plus licensed basis to decrease in the band of 2-3%. On an owned basis, comps are expected to decline between 2.2% and 3.3%. Management envisions total sales to decline in the range of 3.2-4.3% in the fiscal year. The company projects adjusted earnings in the band of $2.91-$3.16 per share for fiscal 2017.

Still Interested in Retail? Check these 3 Trending Picks

Zumiez Inc. (NASDAQ:ZUMZ) delivered an average positive earnings surprise of 27.1% in the trailing four quarters. The company has a long-term earnings growth rate of 18% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Home Depot, Inc. (NYSE:HD) delivered an average positive earnings surprise of 3.8% in the trailing four quarters. It has a long-term earnings growth rate of 13.5% and carries a Zacks Rank #2.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Oracle (NYSE:ORCL) reports after the closing bell Monday, March 10th, 2025, with street consensus expecting $1.49 in earnings per share on $14.39 billion in revenue, for expected...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.