- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Macy's (M) And Emerson Electric (EMR): Growth & Income Stocks

Macy’s (NYSE:M) is one of the nation's premier retailers, operating about 885 stores in 45 states, the District of Columbia, Guam and Puerto Rico, under the names of Macy's, Bloomingdale's, Bloomingdale's Outlet and Bluemercury, as well as the macys.com, bloomingdales.com and bluemercury.com websites.

The company recently reported Q4 17 results where they beat the Zacks consensus earnings estimate for the third consecutive quarter, but came in just short of the revenue estimate. But overall, the year over year data was better than expected with sales rising by +1.8%, comparable sales improving by +1.3%, and adjusted diluted EPS (taking out deductions from the tax reform law) growing by +39.6%. Also, on a fiscal year basis, operating income jumped up by +48.8%, and net cash flows rose by +7.9%. To add to the positive quarterly results, management noted that these positive trends carried into January (Q1 18) as comps, gross margins, and merchandise margins seeing year over year strength.

As part of the company’s cost cutting plans, the company has been focused on several key components; the opening of new stores, the closures of less profitable stores, and its real estate portfolio. In 2017, they opened 36 Bluemercury stores, 2 Macy’s stores, and one Bloomingdale store. At the same time the company has closed 83 out of the 100 stores that they had earmarked in late 2016. As for its real estate portfolio, Macy’s gained $411 million in cash proceeds from sales of assets, these sales included warehouses, parking garages, and outparcels. Going into FY 2018 management remains focused on evaluating its real estate portfolio for new opportunities, and the departure of non-strategic locations.

Due to these positive data points, management guided FY 19 EPS, revenue, and comparable store sales above consensus. EPS is now expected to be between $3.55-3.75, above the previous expectation of $3.03, Revenues between $24.34-24.71 billion verses $24.34 billion, and comparable store sales to be between 0-1% well above the previous expectation of a decline of -1.3%.

This news caused analyst estimates for Q1 18, Q2 18, FY 18, and FY 19 to all see positive estimate revisions over the past 30 days; Q1 18 improved from $0.23 to $0.38, Q2 18 grew from $$0.40 to $0.53, FY 18 rose from $2.80 to $3.63, and FY 19 jumped from $1.67 to $3.17.

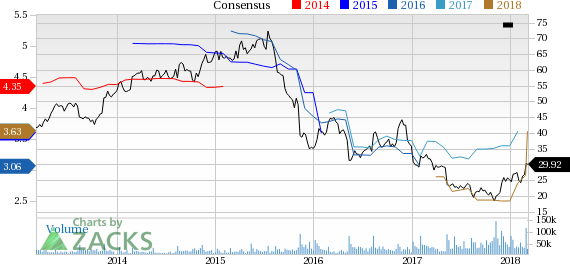

The big turnaround at Macy’s can be seen in the Price and Earnings Consensus Graph below.

Emerson Electric Company (EMR): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.