- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lumber Liquidators (LL) Q4 Earnings Top, Sales Miss Estimates

Lumber Liquidators Holdings, Inc. (NYSE:LL) reported mixed results in the fourth quarter of 2017. Although the company’s earnings surpassed the Zacks Consensus Estimate, revenues missed the same.

Following the quarterly results, shares of Lumber Liquidators declined 9.3% on Feb 27 primarily due to lower-than-expected top line and soft first-quarter 2018 comparable sales projection.

In the past six months, the company’s shares have plunged 42.4% against the industry’s gain of 26.5%.

Per management, first-quarter comparable store sales (comps) are likely to be impacted by soft January sales as promotion toward the end of 2017 was less effective than the year-ago period. Further, weakness in the company’s Northern division sales is expected to negatively impact first-quarter results.

For 2018, the company projects total revenues to increase by mid-to-upper single digits. Comps are expected to rise in the mid-single digits. However, for the first quarter it expects comps to increase by low-single digit. The company is likely to open 20 to 25 new stores in 2018. Capital spending for the year is projected to be in the range of $15 to $20 million.

Q4 Results in Detail

In the fourth quarter, the company posted earnings per share of 10 cents versus year-ago quarter’s loss of 20 cents. The reported figure surpassed the Zacks Consensus Estimate by a penny. Higher sales and lower adjusted SG&A expenses supported the bottom line.

Net sales rose 6.1% to $259.9 million but lagged the Zacks Consensus Estimate of $264.2 million for the second straight quarter. Comparable-store net sales increased 4.5% primarily owing to a 3.4% rise in average sales and a 1.1% gain in customers invoiced. Moreover, non-comparable store sales were up $4.1 million in the prior-year quarter. While adjusted SG&A expenses declined 3.1% to $86.4 million in the quarter, SG&A expenses — as a percentage of sales — decreased to 33.3% from 36.4% in the year ago period.

Gross margin came in at 35.4% compared with 32.9% in the prior-year quarter. Sharp increase in gross margin can chiefly be attributed to healthy performance of vinyl and engineered products and decline in transportation costs.

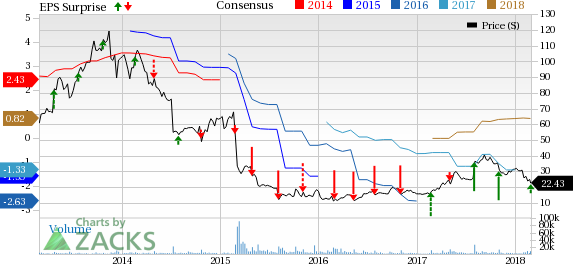

Lumber Liquidators Holdings, Inc Price, Consensus and EPS Surprise

Balance Sheet and Cash Flow

Lumber Liquidators ended the quarter with cash and cash equivalents of $19.9 million compared with $10.3 million in the year-ago quarter. Merchandise inventories at the end of period amounted to $262.3 million compared with $301.9 million at the end of the year-ago quarter.

Zacks Rank & Key Picks

Lumber Liquidators has a Zacks Rank #3 (Hold). Better-ranked stocks from the same space are Builders FirstSource, Inc. (NASDAQ:BLDR) , Fastenal Company (NASDAQ:FAST) and Lowe's Companies, Inc. (NYSE:LOW) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Builders FirstSource’s earnings have surpassed the Zacks Consensus Estimate in the trailing four quarter, with an average beat of 58.6%.

Fastenal has an impressive long-term earnings growth rate of 14%.

Lowe's has a long-term earnings growth rate of 18.4%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Fastenal Company (FAST): Free Stock Analysis Report

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR): Free Stock Analysis Report

Lumber Liquidators Holdings, Inc (LL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.