- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lululemon's (LULU) Raised FY17 View Spurs Holiday Spirit

Lululemon Athletica Inc. (NASDAQ:LULU) has been lately building a reputation in the market with a solid base of loyal customers. The company has left behind a controversial past that almost led to its doom. In recent years, the company has effectively turned around what it had lost and is set to scale further highs.

This was clearly reflected in its recently reported third-quarter fiscal 2017 results, with both sales and earnings surpassing estimates and also improving year over year. While this marked the company’s third consecutive earnings beat, sales topped estimates for the eighth straight quarter. (Read More: Lululemon Jumps on Q3 Earnings & Sales Beat, Ups View)

Much of this improvement can be attributed to the consumers’ favorable response to Lululemon’s product innovations, solid direct-to-consumer (“DTC”) sales, focus on supply chain initiatives and the company’s commitment to its long-term strategy. Further, the company is on track with the remodeling of its ivivva business into an online brand, as announced in June 2017.

What is In Store for Lululemon?

Looking ahead, Lululemon remains on track with efforts to build upon its supply chain network and e-commerce business. With regard to e-commerce, the company is progressing by further developing the processes put in place in the first and second quarters, including improved photography, more spontaneous merchandising and disciplined planning. These efforts helped the company receive favorable response from shoppers, without having to proceed with the previously planned launch of a new website. Moreover, the company anticipates these process improvements to aid double-digit growth for digital business in the fourth quarter, and into 2018 and beyond.

Further, the company remains hopeful about the coming quarters. It expects the momentum across business channels since the start of the fourth quarter to continue through the holiday season. Driven by these factors and a favorable third-quarter, the company provided an encouraging view for the fourth quarter and raised guidance for fiscal 2017.

Q4 Forecasts Indicate a Solid Holiday Season

Driven by the incredible enthusiasm for the holiday season, the company witnessed an improvement in store traffic in both the United States and Canada through the first five weeks of the fiscal fourth quarter. To gain from the increased traffic and satisfy holiday shoppers, the company has opened 22 pop-up seasonal stores in the high traffic areas and malls. This will help in capturing really good business during the holiday season.

For fourth-quarter fiscal 2017, Lululemon anticipates revenues in the range of $870-$885 million, with constant dollar comps expected to increase in mid-single digits range. The company projects normalized gross margin to improve 100 basis points (bps) compared with the year-ago quarter. Management anticipates SG&A expense leverage of about 50-100 bps as it has nearly completed the expansion of digital business.

Lululemon envisions normalized earnings (excluding the impact from ivivva’s restructuring) for the fourth quarter to lie in a band of $1.19-$1.22 per share. On a GAAP basis, earnings are anticipated to be in the range of $1.18-$1.21 per share.

Holiday Quarter Expectations Boost FY17 View

For fiscal 2017, Lululemon now projects sales to range from $2.590-$2.605 billion, up from the previous forecast of $2.545-$2.595 billion. The guidance is based on mid-single digits comps growth on a constant dollar basis, compared with the previous forecast of low-single digits comps growth. The company’s guidance includes the planned closure of ivivva stores and the related reduction in revenues.

The company projects normalized gross margin expansion of 100-150 bps year over year in fiscal 2017, up from the old forecast of 100 bps increase. This will be backed by product margin enhancements and benefit of mix.

The company anticipates SG&A expense to deleverage 100 bps compared with the previous forecast of 50-100 bps increase. This primarily includes digital investments made during the year, accounting for nearly 50 bps increase. Normalized earnings for the fiscal year are now projected in a band of $2.45-$2.48 per share, up from the previous range of $2.35-$2.42. GAAP earnings are likely to come in the range of $2.20-$2.23 per share.

Capital expenditures for fiscal 2017 are now estimated to be nearly $170 million, compared with the prior guidance of $175-$180 million. Capital expenditures mainly include new store openings, renovation, and relocation capital, along with strategic IT investments.

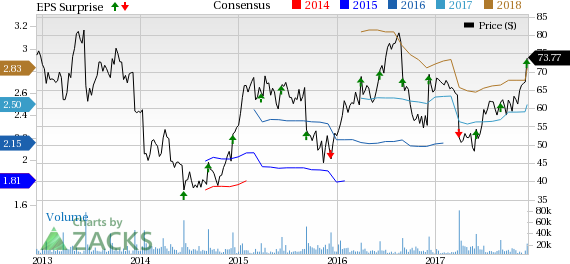

Stock Performance

The investor community is impressed with Lululemon’s superb feat in the recent quarter. Consequently, the stock has displayed solid growth of 9% since reporting third-quarter fiscal 2017 results on Dec 6. Moreover, the shares have gained 19.4% in the last three months, outperforming the industry’s 6.2% growth.

Rightly, the stock currently carries a Zacks Rank #2 (Buy). Furthermore, a Momentum Score of A highlights its growth prospects.

Looking for More? Check these 3 Trending Retail Stocks

Other top-ranked stocks in the same industry are Ralph Lauren Corp. (NYSE:RL) , sporting a Zacks Rank #1 (Strong Buy), Michael Kors Holdings Limited (NYSE:KORS) and Guess? Inc. (NYSE:GES) , both carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ralph Lauren has gained 12% in the last three months. Moreover, it has a long-term earnings growth rate of 15%.

Michael Kors has a long-term EPS growth rate of 7.5%. Further, the stock has returned 45.2% in three months.

Guess? has grown nearly 38.1% year to date. Moreover, it has a long-term earnings growth rate of 17.5%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

lululemon athletica inc. (LULU): Free Stock Analysis Report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Guess?, Inc. (GES): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.