- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lowe's (LOW) Q3 Earnings & Sales Top Estimates, View Intact

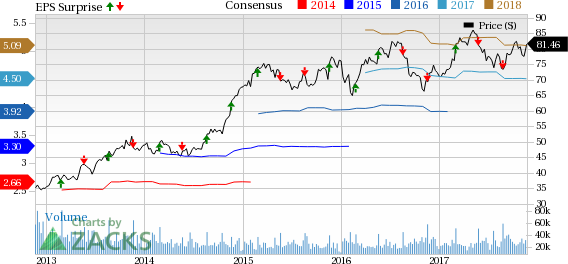

Lowe’s Companies, Inc. (NYSE:LOW) posted better-than-expected third-quarter fiscal 2017 results, after reporting negative surprises in both the top and bottom lines during the preceding two quarters. As a result, shares of this North Carolina-based company are up roughly 1.9% during pre-market trading hours. In the past three months, the stock has increased 7.5% compared with the industry’s growth of 12.3%.

The home improvement retailer posted quarterly earnings of $1.05 per share that beat the Zacks Consensus Estimate of $1.02. Bottom line improved 19.3% from 88 cents delivered in the year-ago quarter – following an increase of 14.6% and 18.4% registered in the second and first quarter, respectively. Higher net sales and lower SG&A expenses aided the bottom line.

.jpg)

Net sales of $16,770 million also came ahead of the Zacks Consensus Estimate of $16,568 million. Top line jumped 6.5% year over year after increasing 6.8% and 10.7% in the second and first quarter, respectively. Hurricane-related sales stood at approximately $200 million.

The company’s sales increase can be attributed to its efforts to provide a better omni-channel customer experience and an improvement in the housing market. Rise in demand for building materials post hurricanes also supported the top line.

Comparable sales (comps) rose 5.7% during the quarter under review, following an increase of 4.5% and 1.9% recorded in the second and first quarter, respectively. Comps for the U.S. business climbed 5.1%, after increasing 4.6% and 2% in the respective quarters.

Gross profit increased 5.7% year over year to $5,713 million, however, gross profit margin contracted roughly 28 basis points to 34.1%.

Other Financial Aspects

Lowe’s, which competes with The Home Depot, Inc. (NYSE:HD) , ended the quarter with cash and cash equivalents of $743 million, long-term debt (excluding current maturities) of $15,570 million and shareholders’ equity of $5,742 million.

During the quarter, the company kept its promise of returning surplus cash to stockholders as it repurchased shares worth $500 million and distributed $344 million as dividends.

Outlook

Management continues to project total sales growth of approximately 5% with comps increase of about 3.5% during fiscal 2017. Lowe’s envisions operating margin to increase approximately 80 to 100 basis points in the fiscal year. This Zacks Rank #3 (Hold) company continues to envision earnings in the band of $4.20-$4.30 per share.

Moreover, the company intends to open 25 home improvement and hardware stores during fiscal 2017. As of Nov 3, 2017, the company operated 2,144 stores in the United States, Canada and Mexico.

Like to Know Hot Stocks in the Retail Space, Check These

Dollar Tree, Inc. (NASDAQ:DLTR) has a long-term earnings growth rate of 13.2% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ross Stores, Inc. (NASDAQ:ROST) pulled off an average positive earnings surprise of 5.5% in the trailing four quarters. It has a long-term earnings growth rate of 10% and a Zacks Rank #2.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.