- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Low & Bonar: Estimates Unchanged

In-line update, estimates unchanged

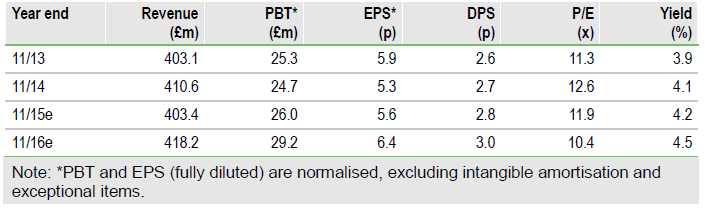

As it approaches the end of FY15, Low & Bonar (L:LWB) has confirmed that it is trading in line with existing market guidance and, consequently, our estimates are unchanged. We believe that the benefits of organisational change and investment will become increasingly apparent in FY16 and be attractive to growth-oriented investors.

Divisional and group trading patterns unchanged

In a short IMS covering H215 performance to date, Low & Bonar confirmed that trading is in line with existing market expectations for FY15. With minor exceptions, divisional performance is also consistent with H115 results. Coated Technical Textiles (CTT) has traded strongly in Europe throughout the year (although projectbased architectural membranes and specialist container sales have been low) and Interiors & Transport has experienced high demand and plant utilisation levels in all regions served. Civils activity levels have remained ‘muted’, although a combination of management change and cost reduction is likely to be improving returns here. Building & Industrial has experienced some sector strength and no further softness in Europe in H2. Lastly, Sports & Leisure is understood to have seen a good peak selling season. We believe that the key FX cross rates (ie £/€ and £/US$) for the year to date are closely in line with those seen at the H115 stage.

To Read the Entire Report Please Click on the pdf File Below

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.