- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Long Bonds Enter The Blowoff Stage

Back in late-2014 I first proposed the idea of a blowoff surge higher in the long bond. At the time, many were very negative toward bonds and expected higher interest rates were just around the corner. But after a massive, multi-decade bull market in bonds it was just very hard for me to expect it to come to an end without some sort of euphoric finale. And that’s where I think we find ourselves today – somewhere in that final phase.

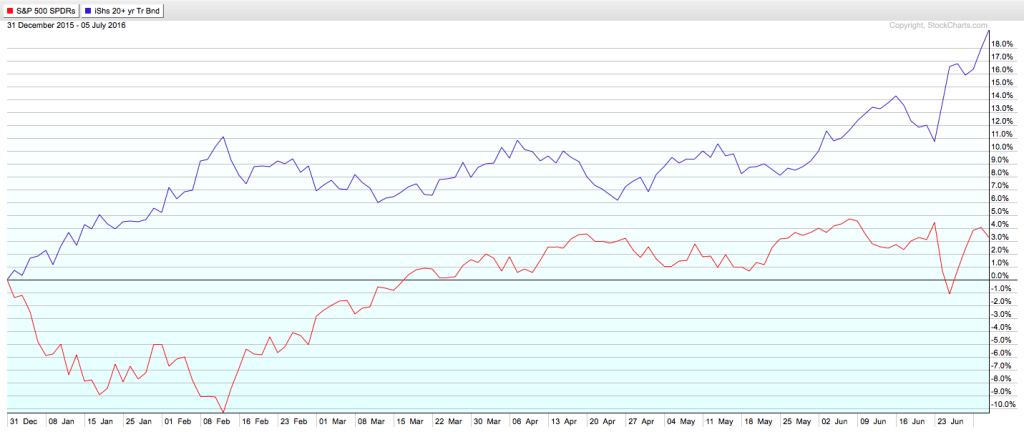

Long-term bonds (via iShares 20+ Year Treasury Bond (NYSE:TLT) in the chart below) have absolutely crushed the performance of stocks (via SPDR S&P 500 (NYSE:SPY)) for quite some time now but it’s the striking outperformance over the past six months that really has investors finally taking notice.

As my friend Helene Meisler likes to say, “nothing like price to change sentiment.”

Now it seems everyone who was calling for higher interest rates a year ago is now calling for lower rates and, perhaps, even negative ones. In other words, “the wall of worry” that bond prices have climbed for the past year or so has vanished as investors finally embrace the bond bull market.

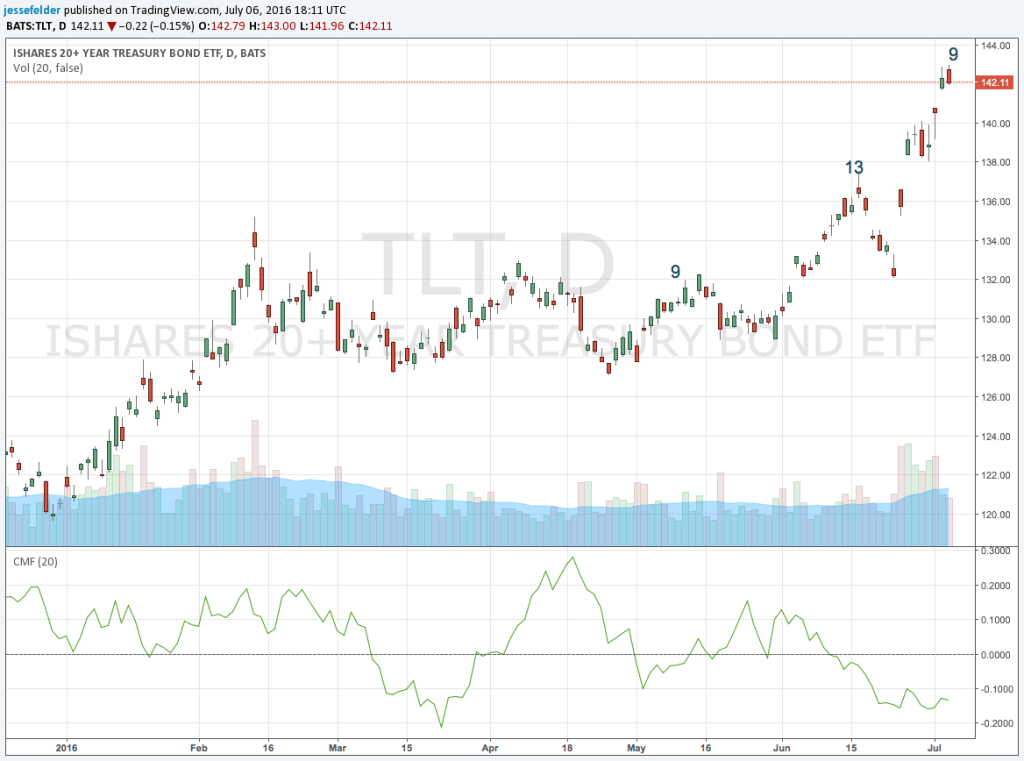

And just as they do, we are starting to see some signs of trend exhaustion. Long-term DeMark sell signals have already triggered in long bonds. Now the daily chart is starting to show some signs that TLT, the long bond ETF, is running out steam.

At today’s open a 9-13-9 sell signal will be completed amid a pretty large negative divergence in money flow. (For more information about DeMark signals, see this post.)

Long bonds have been in a very powerful, long-term uptrend and I have no real idea how much further this sort of blowoff can run. As I wrote over a year ago, I can’t think of any good reason why interest rates here can’t fall as far as they have in Europe or even Japan. And if risk assets falter, as I have suggested recently, Treasuries could easily continue to power higher as investors flee to their relative safety.

All that said, once investors begin to fully embrace the trend—as they are doing today—it usually means we’re getting close to the end. And it’s hard to argue a prudent investor should be comfortable assuming the associated risk (interest rate and opportunity risk, to be specific) in order to earn that 2.15% per year currently offered by the 30-year bond. Especially now that it’s becoming a much more crowded trade.

Related Articles

When it comes to the economy, we’re in a bit of a weird spot: The data tells us that, despite inflation fears, interest rates are likely to fall in the year ahead. Falling rates...

Telegram Group Inc. is a globally recognized messaging service company, offering a cloud-based mobile and desktop messaging application. Known for its strong focus on security,...

Many investors regard passively managed index mutual funds or ETFs as favorable options for stock investing. However, they may also find that actively managed funds offer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.