- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Lockheed Martin Arm Wins Satellite Communication Security Deal

Defense major Lockheed Martin Corp.’s (NYSE:LMT) Space Systems business unit secured a modification contract for providing engineering and interim logistics services as well as delivering spares and associated material, related to Mobile User Objective System (MUOS). Work related to the deal is expected to be over by November 2020.

Details of the Deal

Valued at $92.9 million, the contract was awarded by the Space and Naval Warfare Systems Command, San Diego, CA. Majority of the work will be carried out in Scottsdale, AZ.

Fiscal 2018 weapons procurement (Navy); fiscal 2018 research, development, test and evaluation (Navy); and fiscal 2018 operations and maintenance (Navy) funds will be utilized incrementally to finance this deal.

A Brief Note on MUOS

MUOS is a narrowband military satellite communications system. It not only enables modern net centric communications capabilities but also supports legacy terminals for global customers. It has been developed for the U.S. Navy by Lockheed Martin.

MUOS satellites are equipped with a Wideband Code Division Multiple Access payload that provides more than 10 times the communications capacity over the current Ultra High Frequency (UHF) satellite system. Each MUOS satellite includes a legacy UHF payload which is fully compatible with the current UHF Follow-on system and legacy terminals. Once operational, MUOS will provide 16 times the capacity of the legacy system it will eventually replace.

Our View

Lockheed Martin’s Space Systems segment designs and develops satellites, strategic and defensive missile systems and space transportation systems like the Trident II D5 Fleet Ballistic Missile, Space Based Infrared System, GPS-III, Geostationary Operational Environmental Satellite R-Series and more. Space Systems is responsible for various classified systems and services required for national security.

With a rapid increase in militant activism, geo-spatial intelligence is the need of the hour. Lockheed Martin’s extensive systems help the Intelligence Community transform raw imagery and sensor data into layered, detailed maps. This helps troops, intelligence agents and emergency responders to address terrorism.

In line with this, Global Military Satellite market, valued at $7.9 billion in 2017, is projected to grow at a CAGR of 2.50%, to value $10.1 billion by 2027 (per a Reportbuyer report).This indicates the solid growth prospects of this market in days ahead.

Notably, geopolitical tension, all over the globe, is on the rise at present and is unlikely to subside any time soon. Thus prominent defense contractors like Lockheed Martin are expected to win more defense deals in relation to satellite communication securities from the government in coming days. A look at the company’s latest quarterly numbers also reflects the same. In particular, Lockheed Martin’s Space Systems segment generated revenues of $2.3 billion in the third quarter of 2017, reflecting 18.5% of the total revenue.

We expect solid inflow of contracts from Pentagon like the latest one will aid Lockheed Martin in maintaining the trend of putting up a solid performance in the upcoming quarters as well.

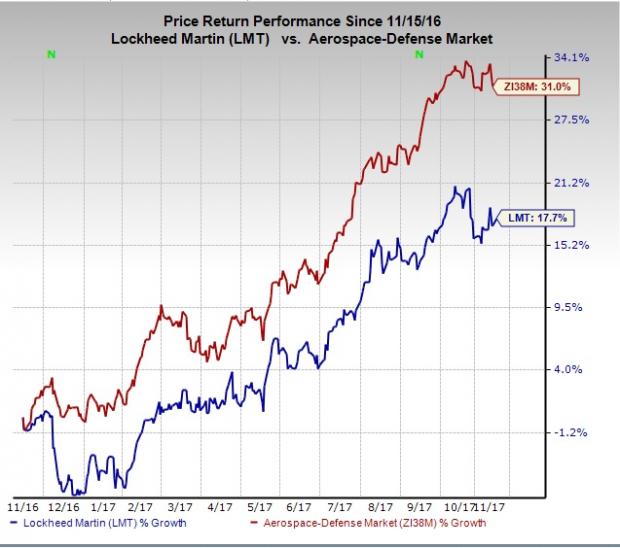

Price Performance

Shares of Lockheed Martin have rallied 17.5% over a year, underperforming the industry’s 30.6% gain. This could be because the earlier budget cuts have put pressure on the top line although the present defense budget is more in favor of the sector. Moreover, Lockheed Martin's performance lagged the likes of Huntington Ingalls Industries, Inc. (NYSE:HII) and The Boeing Co. (NYSE:BA) that have outperformed the industry.

Zacks Rank & Key Pick

Lockheed Martin currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the same space is Leidos Holdings, Inc. (NYSE:LDOS) with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Leidos Holdings surpassed the Zacks Consensus Estimate in the past four quarters with a positive average surprise of 14.81%. The company also has a solid long-term earnings growth rate of 10%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Boeing Company (The) (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.