- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is Square (SQ) A Great Growth Stock?

Growth stocks can be some of the most exciting picks in the market. Not only do these types of stocks captivate investors’ attention, but they’re known for producing big gains as well. However, growth stocks can also lose momentum when a growth story ends, so it’s vital to find companies still experiencing strong growth prospects in their business.

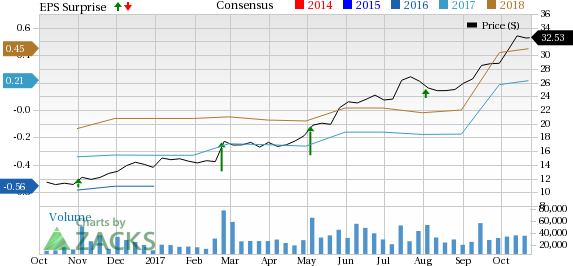

One company that might be well-positioned for future earnings growth is Square Inc. (NYSE:SQ) , a leading mobile-payments company founded by Twitter (NYSE:TWTR) CEO Jack Dorsey. This firm, which is in the Internet-Software industry, reported EPS growth of over 71% last year, and is looking great for this year, too.

In fact, current growth estimates for fiscal 2017 call for roughly 161% EPS growth. And, Square anticipates growth rates for the long-term to come in at 25%, suggesting impressive prospects going forward.

Shares of SQ have actually seen estimates rise over the past month for the current fiscal year by 1.14%; two analysts have revised their estimates upwards during this time frame compared to none lower. Thanks to this rise in estimates, Square is a Zacks Rank #2 (Buy), further underscoring the company’s potential.

Investors looking for a fast-growing stock that still has plenty of opportunities on the horizon, make sure to consider SQ. With double-digit earnings growth in its near future and an impressive Zacks Rank, this combination suggests that analysts believe even better days are ahead for the booming mobile payments company.

Square is set to report its third quarter fiscal 2017 results on November 8 after the bell. Current estimates sit at revenues of $573.81 million on earnings of six cents per share.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Square, Inc. (SQ): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.