- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Liquefied Natural Gas: Improving Macro Environment

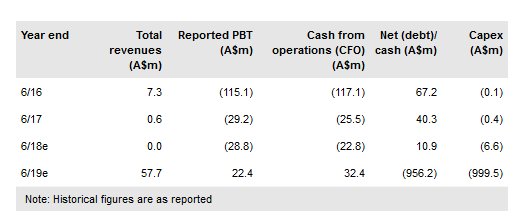

The Magnolia development remains one of the most competitive Liquefied Natural Gas Ltd (AX:LNG) development projects (greenfield or brownfield) globally. Industry is starting to recognise that the current LNG oversupply will move towards undersupply within five years and there are few projects on track to fill the resulting gap. This should put Magnolia increasingly in the spotlight for buyers looking to fulfil demand in 2023 onwards. LNGL management has indicated it is in discussions with many companies across a diverse set of geographies and interests. We have adjusted our valuation to account for a delayed expectation of project FID, reducing it slightly to $A1.25/share (US$3.8/ADR).

Market sentiment has improved

LNGL has suffered over the recent few years as a glut of spot LNG supply (and low spot crude prices) have cast shade on LNG markets. However, with spot prices (oil and LNG) improving and a consensus building that the oversupply will end in the early 2020s, we see much to be optimistic about. The Magnolia project is shovel ready (well ahead of many of its US peers) and continues to offer buyers a fast and cheaper alternative to other projects. The management continues to stress its marketing efforts and is discussing the project with many buyers including major oil companies and traders.

To read the entire report Please click on the pdf File Below:

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.