- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

LATAM Airlines' (LTM) Q4 Earnings Beat, Revenues Miss Mark

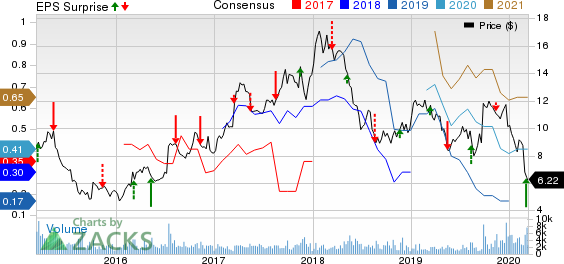

LATAM Airlines Group’ (NYSE:LTM) fourth-quarter 2019 earnings of 37 cents per share surpassed the Zacks Consensus Estimate of 24 cents. In fourth-quarter 2018, the company reported earnings of 25 cents. The year-over-year improvement was partly due to the 10.6% decrease in average fuel price per gallon.

Total revenues increased year over year but missed the Zacks Consensus Estimate by 2.1%. The year-over-year improvement was owing to a 6.5% rise in passenger revenues, which accounted for 86.3% of the top line. During the quarter, LATAM Airlines carried 19.95 million passengers, up 9.4% year over year. The uptick was mainly due to strong performances at the carrier’s domestic markets. Cargo revenues, however, declined 10.3% in the quarter partly due to the sale of MasAir in the second half of 2018.

Operating expenses increased 3.1% year over year. However, fuel costs decreased 10.6% despite a 3.2% rise in fuel consumption. Excluding fuel costs, cost per available seat mile (CASK) increased 6.7% due to higher maintenance and depreciation expenses, capacity adjustments in international routes and a shorter average stage length. Load factor (% of seats filled by passengers) decreased 20 basis points to 82.9% as consolidated traffic growth (3%) was outpaced by capacity expansion (3.2%). Revenue per ASK improved 3.1%.

Meanwhile, expenses on wages and benefits decreased 5.7% owing to depreciation of local currencies. The carrier exited the fourth quarter with cash and cash equivalents of $1.07 billion compared with $1.08 billion at the end of 2018. LATAM Airlines had a total financial debt of $7.19 billion at the end of the fourth quarter compared with $7.26 billion at 2018 end.

LATAM Airlines expects to end 2020 with an operating fleet of 341. The same is expected to increase to 344 and 354 at the end of 2021 and 2022, respectively. For 2020, operating margin is anticipated in the range of 7-8.5%. Additionally, capacity is expected to increase 3-5% in the current year.

Zacks Rank & Other Key Picks

LATAM Airlines carries a Zacks Rank #1 (Strong Buy). Some other top-ranked stocks in the same space are Azul (NYSE:AZUL) , Ryanair Holdings (NASDAQ:RYAAY) and Spirit Airlines, Inc. (NYSE:SAVE) . While Azul and Ryanair sport a Zacks Rank #1, Spirit carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Azul has an impressive earnings history. It outperformed the Zacks Consensus Estimate in three of the preceding four quarters and missed estimates in remaining one quarter, the beat being 199%, on average. Ryanair surpassed estimates in three of the past four quarters and missed estimates in remaining one quarter, the beat being 56.3%, on average. Spirit trumped the Zacks Consensus Estimate in three of the trailing four quarters and matched estimates in remaining one quarter, the beat being 2.8%, on average.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Ryanair Holdings PLC (RYAAY): Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.