- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

MedTech Stocks (BAX, VAR, TMO, LH) Earnings Preview: What You Should Know

The third-quarter earnings season has commenced on an encouraging note for most sectors, with releases from 87 S&P 500 participants (24.7% of the total market cap) till October 20.

Per the latest Earnings Preview, total earnings for these members rose 9.4% on 7.3% higher revenues. With 180 S&P 500 members lined up for releasing their quarterly results this week, we are decidedly bullish on the equity market, which is gradually demonstrating a sequential improvement.

Medical, one of the broader sectors among the 16 Zacks sectors, is expected to put up an impressive show in the quarter. For Q3, the expected earnings growth rate for the sector is 2.2% on 4.8% revenue growth. In comparison, the reported earnings growth rate during the second-quarter of 2017 was quite impressive at 7% on 4.4% revenue growth.

Medical Products Amid Political Uncertainties

However, the Medical Product space, within the broader Medical universe, has been a precarious game for the Republicans since day one, courtesy of President Trump’s repeated failure to repeal and replace Obamacare.

However, major MedTech players have been pinning their hopes on the abolition of the infamous 2.3% medical device sales tax, though the elimination of this tax is far from being achieved.

Considering these tax issues, investors interested in the Medical Product space will likely keenly await earnings reports from MedTech bigwigs like Baxter International Inc. (NYSE:BAX) , Varian Medical (NYSE:VAR) , Thermo Fisher Scientific Inc., (NYSE:TMO) and Laboratory Corporation of America Holdings (NYSE:LH) . Notably, all the companies are expected to release their earnings results on Oct. 25.

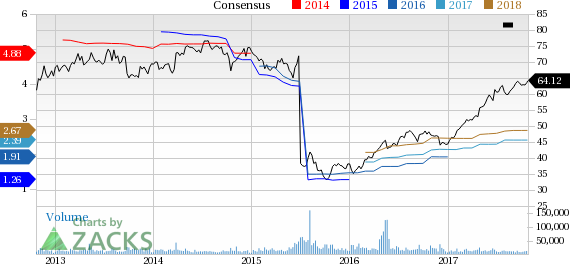

For the third quarter, Baxter anticipates sales growth of about 4% at constant currency (cc). Adjusted earnings per share are forecasted in the range of 58-60 cents versus the year-ago figure of 56 cents. We believe the company’s solid sales in the Medical Products segment will be a key driver in the third quarter. Notably, the Zacks Consensus Estimate for the segment stands at $1,648 million, up 4.2% on a year-over-year basis (read more: Baxter International Q3 Earnings: What's in Store?).

Despite the solid prospects, our quantitative model does not conclusively show a beat for the company, given the combination of a Zacks Rank #2 (Buy) and an Earnings ESP of -0.34%. That is because, as per our model, a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) to beat earnings.

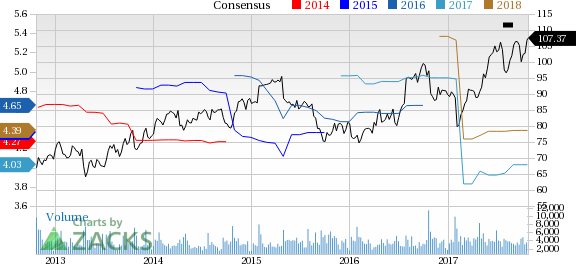

We are upbeat about Varian Medical’s oncology business, which is estimated to account for around 95% of the company’s total revenue in the fourth-quarter of fiscal 2017. The company has been addressing both the tier 1 and mid-tier markets through its Edge, Truebeam and VitalBeam products, and has also been winning international contracts in the oncology space. For the fourth quarter of fiscal 2017, Varian expects adjusted earnings per share in the range of $1.15-$1.23. Revenues are likely to increase about 3% on a year-over-year basis (read more: Varian Medical Q4 Earnings: Is a Surprise in Store?).

On the contrary, the Zacks Consensus Estimate for Varian Medical’s revenues stands at $741.7 million, down 18.7% year-over-year. The consensus estimate for earnings is pegged at $1.19, down 14% year-over-year. Our proven model does not predict an earnings beat for the company this season, thanks to its Earnings ESP of 0.00% and Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

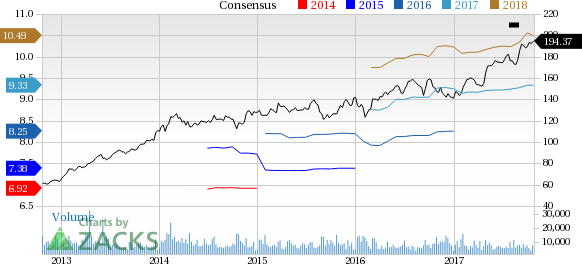

Laboratory Corporation, also known as LabCorp, will continue to face softness in its Covance Drug Development business in the third quarter of 2017. However, we are upbeat about the company’s expectations of an improvement in the Covance Drug Development arm starting the second half of 2017. This should be reflected in its third-quarter performance (read more: What's in the Cards for LabCorp This Earnings Season?). The Zacks Consensus Estimate for LabCorp’s third-quarter revenues stands at $2.56 billion, up 6.2% year-over-year.

LabCorp is concerned about the CMS (Centers for Medicare & Medicaid Services) proposal related to Protecting Access to Medicare Act (PAMA). We believe reimbursement pressure will affect the company’s performance in the third quarter as well. In fact, our proven model does not predict an earnings beat for the company this season. This is because LabCorp has a Zacks Rank #2 and an Earnings ESP of -1.57%. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

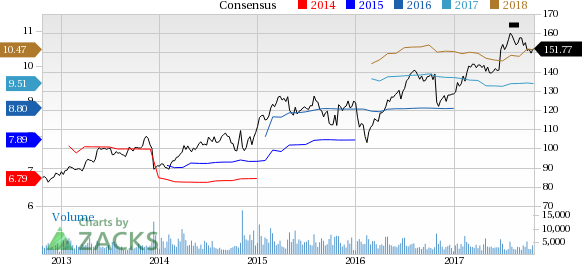

Thermo Fisher is gearing up for solid third-quarter results, primarily driven by analytical instruments segmental growth. In the third quarter, the company expects to see a positive impact from the electron microscopy business as well as strong volume leverage and productivity.

The Zacks Consensus Estimate for Analytical Instruments operating income is pegged at $233 million, in line with last quarter’s reported number. Total revenue estimate for this segment is at an impressive level of $1.11 billion (read more: What to Expect From Thermo Fisher in Q3 Earnings?).

Our quantitative model predicts an earnings beat for Thermo Fisher in Q3. The stock currently has a Zacks Rank #2 and an Earnings ESP of +0.19%. The Zacks Consensus Estimate for revenues is at $5.03 billion for the third quarter, up 12.1% on a year-over-year basis.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Baxter International Inc. (BAX): Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.