Shares of chemical maker

Kronos Worldwide, Inc. (NYSE:) touched a fresh 52-week high of $28.68 on Nov 20, before pulling back a bit to eventually close the day at $28.67.

Kronos Worldwide has a market cap of roughly $3.3 billion and average volume of shares traded in the last three months is around 430.4k. The company has expected long-term earnings per share growth of around 5%.

Kronos Worldwide’s shares have surged 135.2% over a year, significantly outperforming the

industry’s gain of 27%.

Driving Factors

Kronos Worldwide’s shares are heading higher following the company’s strong third-quarter earnings release. The company recorded net income of $73.8 million or 64 cents per share in third-quarter 2017, compared with net income of $22.2 million or 19 cents a year ago. Earnings surpassed the Zacks Consensus Estimate of 45 cents. Higher average selling prices and increased sales and production volumes drove the company’s third-quarter earnings.

Net revenues jumped around 30% year over year to $464.5 million, on the back of higher titanium dioxide selling prices and increased sales volumes. Sales beat the Zacks Consensus Estimate of $448 million.

Kronos expects production volumes to be higher in 2017 on a year-over-year basis, courtesy of the implementation of certain productivity-enhancing improvement projects at some facilities. Also, the company anticipates increased sales volume in 2017 compared to 2016.

The company also envisions income from operations in 2017 to be higher on a year-over-year basis, mainly due to an expected increase in average selling prices and the favorable impact of anticipated higher production and sales volumes.

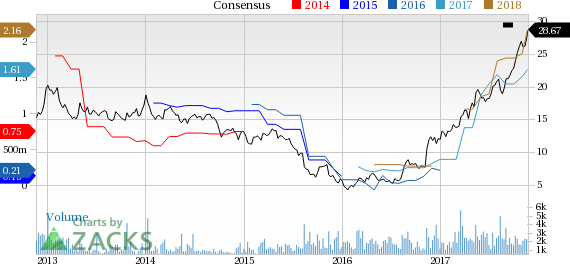

Kronos Worldwide Inc Price and Consensus

Kronos Worldwide Inc Price and Consensus | Kronos Worldwide Inc Quote

Zacks Rank & Other Stocks to Consider

Kronos Worldwide currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Ingevity Corporation (NYSE:) , ArcelorMittal (NYSE:) and Westlake Chemical Corporation (NYSE:) , all flaunting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has expected long-term earnings growth of 12%. Its shares have gained 35.6% year to date.

ArcelorMittal has expected long-term earnings growth of 11.3%. Its shares have rallied 29.2% year to date.

Westlake Chemical has expected long-term earnings growth of 10.4%. Its shares have moved up 68.4% year to date.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.