- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Kronos Worldwide (KRO) Earnings & Sales Miss Estimates In Q4

Kronos Worldwide, Inc. (NYSE:KRO) logged a profit of $9.4 million or 8 cents per share in fourth-quarter 2019, down from $24 million or 21 cents in the year-ago quarter. Earnings missed the Zacks Consensus Estimate of 10 cents.

Results in the reported quarter were impacted by lower average selling prices and increased raw materials as well as other production costs, which were partly offset by higher sales volumes.

Net sales rose 6.7% year over year to $372.7 million on the back of higher sales volumes and reduced average titanium dioxide (TiO2) selling prices. However, the figure trailed the Zacks Consensus Estimate of $378 million.

2019 Highlights

In 2019, the company reported profit of $87.1 million or 75 cents per share, down from $205 million or $1.77 per share recorded in 2018.

Net sales in the year rose 4.2% year over year to $1,731.1 million.

Volumes and Pricing

Average TiO2 selling prices fell 3% year over year in the reported quarter.

The company’s TiO2 sales volume increased 14% year over year owing to increased sales in the European and export markets, which were partly offset by lower sales in the Latin American and North American markets. TiO2 production volumes rose 4% year over year in the fourth quarter.

Profit in the TiO2 segment plunged 56.3% year over year to $21.1 million in the fourth quarter.

Balance Sheet

Kronos Worldwide ended 2019 with cash and cash equivalents of $390.8 million, up 4.7% year over year. Long-term debt was $444 million, down 2.4% year over year.

Cash flows from operating activities were $160.3 million for 2019, down 15% year over year.

Outlook

For 2020, Kronos Worldwide expects production volumes to be modestly higher on a year-over-year basis. However, the company anticipates slightly lower sales volumes compared with 2019 based on expected production levels and assuming global economic conditions to remain stable (including the limited impact of coronavirus). The company stated that it will continue to examine current and expected customer demand levels in the near term as well as align its inventories and production accordingly.

Overall, the company expects sales to be slightly lower year over year in 2020, mainly resulting from lower expected sales volumes. Additionally, the company expects lower income from operations this year due to higher raw material costs (mainly feedstock) and lower expected sales volumes.

Price Performance

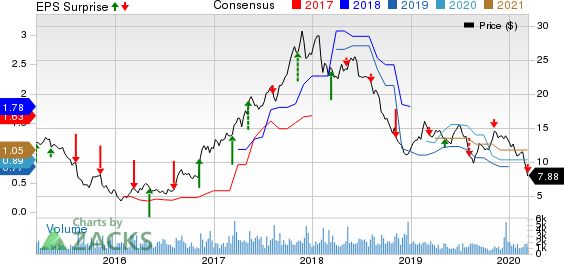

Shares of Kronos Worldwide have lost 44.8% in the past year compared with 45.8% decline of the industry.

Zacks Rank & Key Picks

Kronos Worldwide currently carries a Zacks Rank #3 (Hold).

Few better-ranked stocks in the basic materials space are Daqo New Energy Corp (NYSE:DQ) , Newmont Corporation (NYSE:NEM) and Impala Platinum Holdings Limited (OTC:IMPUY) , each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has an expected earnings growth rate of 353.7% for fiscal 2020. The company’s shares have surged 68.4% in the past year.

Newmont has an expected earnings growth rate of 69.7% for 2020. Its shares have returned 33.3% in the past year.

Impala Platinum has an expected earnings growth rate of 424.1% for fiscal 2020. The company’s shares have surged 82.8% in the past year.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Newmont Goldcorp Corporation (NEM): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Original post

Related Articles

New tariffs stoke inflation fears and rattle markets. With recession risks rising, defensive stocks look more appealing. InvestingPro spots three undervalued picks with...

The market for 3M (NYSE:MMM) stock is on fire, with shares rising by 7% in the final week of February and 65% in the preceding 12 months, and there is more upside ahead. The...

There are times when markets are driven by fear, keeping most investors away from what could be a life-changing trade or investment only because the rest of the media and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.